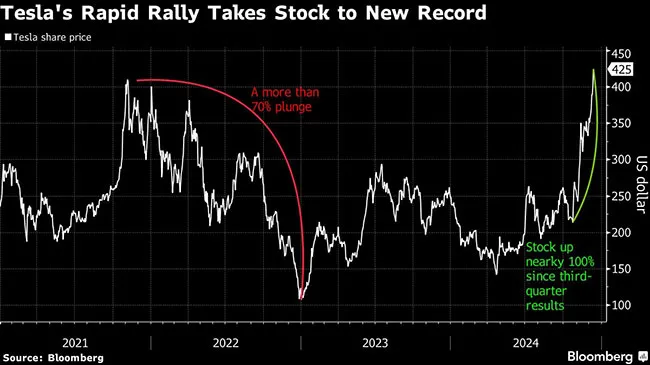

Tesla Shares Jump to Record Amid $515 Billion Rally

[Stay on top of transportation news: Get TTNews in your inbox.]

Tesla Inc. shares climbed to an all-time high for the first time since November 2021, buoyed by optimism the company’s self-driving ambitions can get a boost under President-elect Donald Trump’s next administration.

The stock jumped 5.9% to close at $424.77 on Dec. 11, helped by positive analyst commentary over the past week. The shares have now risen 69% since the Nov. 5 U.S. presidential election, adding over $556 billion to the company’s market capitalization.

Tesla CEO Elon Musk was a key figure in Trump’s election campaign and has been picked to co-lead a new Department of Government Efficiency along with entrepreneur Vivek Ramaswamy. Musk’s proximity to the president-elect as well as the Trump team’s plan to ease U.S. rules for self-driving vehicles have prompted a gravity-defying surge in Tesla’s shares.

Tesla was the only member of the so-called Magnificent Seven group that hadn’t posted a record in three years.

RELATED: Trump-Musk Alliance May Boost Tesla, Reshape Big Tech

“We are becoming more bullish on Tesla’s Robotaxi segment, following President-elect Trump’s plans to potentially develop a federal framework for self-driving vehicles in the United States,” Cantor Fitzgerald analyst Andres Sheppard wrote in a note to clients Dec. 10 as he raised his price target on the stock to $365 from $255.

Option sentiment was the most bullish this week in three years as traders snapped up contracts that profit from the post-election rally. On Dec. 11, implied volatility on three-month options reached the highest since February 2023, with the premium for calls over puts near the widest since early 2021.

The last time the company’s shares traded above $409 was in late 2021, when interest rates were pinned near zero and an investor mania for all things related to technology drove many mega-cap stocks to records.

Musk

The next year, however, delivered a rout as fears about inflation and higher interest rates spooked traders. Tesla shares dropped more than 70% in that period, closing at $108.10 on Jan. 3, 2023, down from the Nov. 4, 2021, record of $409.97.

As the wider concerns gradually abated, big-tech stocks recouped their losses and eventually surpassed their 2021 records. Tesla, however, struggled to scale those heights until just a month ago, as it faced a slowdown in demand for electric cars that sparked an industrywide price war and weighed on profits.

The tide had started to turn after the company’s third-quarter results released in October beat estimates and led to hopes that the worst of the EV weakness may be over. Still, the big rally came after Trump’s election win last month.

“Elon Musk’s entry into the political sphere has expanded investor thinking around Tesla’s fundamental outlook,” said Morgan Stanley analyst Adam Jonas, who also boosted his price target on the stock to $400 from $310 on Dec. 10.

Want more news? Listen to today's daily briefing below or go here for more info: