Tesla’s Shrinking Margins Put Pressure on Upcoming Earnings

[Stay on top of transportation news: Get TTNews in your inbox.]

With shares falling and profits shrinking, Tesla Inc. is increasingly looking like the odd one out among its mega-cap technology peers. Investors worry that quarterly results will make the electric-vehicle maker even more of an outlier.

The Elon Musk-led company is the only member of the so-called Magnificent Seven expected to see profits decline in its latest quarterly results — and the only one that has seen Wall Street estimates drop from a year ago. The shares have fallen 12% this year through Oct. 22, while all of its Big Tech peers have advanced. Despite that, it remains the most expensive stock in the group compared with profits, giving it a tough setup for earnings.

The results, due Oct. 23 after the close, might not have mattered as much if Tesla had impressed investors with its splashy reveal of a self-driving car earlier this month. But the robotaxi failed to meet high expectations, putting more pressure on the company’s core business of selling EVs.

“Investors are starting to lose patience with Tesla, especially after the robotaxi event that was long on idea, but short on execution, and as growth expectations from their core business remain low over the next two years,” said David Wagner, portfolio manager at Aptus Capital Advisors.

(Bloomberg)

Wall Street will watch for signs that slowing EV sales are near a trough and keep an eye on margins, which have been under pressure for the past year. Investors also are anxious to hear more about a cheaper EV model.

A better-than-expected set of numbers would help shore up confidence in the near term, though analysts warned that a significant share price increase may be difficult without more clarity about longer-term growth.

“Regardless of the third-quarter result, we think a sustainably bullish re-rating may not occur until investors have reasons to boost estimates,” Piper Sandler analyst Alexander Potter wrote in a note. Potter expects these reasons to emerge next year, including the unveiling of a new product and regulatory approval for the company’s advanced driver assistance software in a new region, such as China.

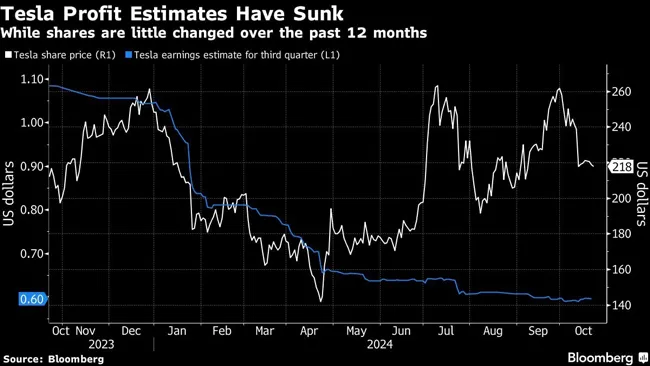

Analysts on average expect the company to report earnings per share of 60 cents for the three months ended Sept. 30, representing a 10% decline from the year-ago period. Revenue is estimated to be about $25.4 billion, up 8.9% from the previous year, according to data compiled by Bloomberg.

Want more news? Listen to today's daily briefing above or go here for more info

The third-quarter estimates represent a significant drop from a year ago, when analysts had forecast EPS of $1.09. Meanwhile, the main metric that traders watch — automotive gross margin excluding regulatory credits — is expected to be 14.9%, up slightly from the second-quarter figure of 14.6%.

“The most important factor for the stock in the short term is if demand trends come in above or below expectations and if gross margins are above or below,” said Cole Wilcox, portfolio manager at Longboard Asset Management. While Tesla’s position in the EV market remains strong compared with rivals, “EV demand is not the explosive high-growth category it once was,” Wilcox noted.

Tesla has been at the forefront of a slowdown in EV demand since late 2023, as consumers squeezed by inflation, high borrowing costs and nervousness about an economic slowdown held off on big-ticket purchases. The company responded by aggressively lowering prices to lure buyers and undercut emerging competition. While that helped them win some customers, it hasn’t fully offset weak demand, and both revenue and profit have suffered.

Lower profit expectations have also made Tesla’s stock valuation appear even more pricey. At 74 times forward earnings, it’s the most expensive of the mega-cap group, which consists of Amazon.com Inc., Microsoft Corp., Apple Inc., Alphabet Inc., Meta Platforms Inc. and Nvidia Corp.

McLeod Software CEO Tom McLeod explores the potential for artificial intelligence to boost efficiency and build resilience. Tune in above or by going to RoadSigns.ttnews.com.

Still, investors say the company’s position among the Magnificent Seven remains valid, given Tesla’s ability to innovate and potentially dominate the auto industry in a future where self-driving vehicles are the norm.

“Tesla’s upcoming earnings are crucial, but they’re part of a larger picture,” said Adam Sarhan, founder and CEO at 50 Park Investments. “For now, it’s too early to dismiss Tesla from the Mag 7, but the pressure is certainly on for the company to prove its worth.”