Trade War Leaves Pacific Northwest Port Growth at Risk

An industry that saw dramatic growth in the 10 years before Donald Trump became president is now concerned his administration’s trade tussle with China, and the lack of a deal with Japan, will cut future growth short.

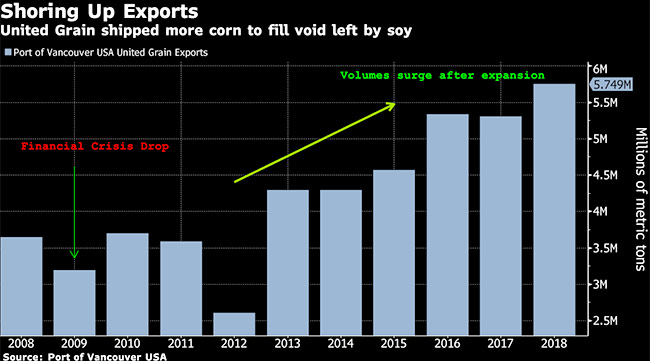

Ports in the Pacific Northwest have invested hundreds of millions of dollars to expand their ability to ship America’s agricultural riches east to an increasingly hungry Asia, with export capacity and rail unloading for grains and oilseeds more than doubling from 2008 to 2015.

Now, amid Trump’s trade war with China and no deal with Japan, port officials are concerned where growth will come from if Asia turns elsewhere for crops and U.S. farmers and exporters seeking diversification and stability ship more supplies through the Gulf Coast to Europe and Middle East.

“It is so hard to get business,’’ said Alex Strogen, chief commercial officer for the Port of Vancouver USA. “What’s even harder is to win back business.’’

Wheat shipments to Japan are a key concern, Strogen said. While the Trump administration has said negotiations with the island nation are a priority, there’s no deal yet. Meanwhile, Canada, Australia and the European Union have recently secured new or adjusted trade agreements with Japan, potentially giving them a pricing edge.

“As a country we have a 53% market share in Japan” for wheat, Strogen said. “We are at risk of seeing that market share erode.”

When trade is disrupted, buyers often will look for other suppliers while exporters search for other importers, especially if there’s a feel that the original relationship had become “too dependent,” said Jock O’Connell, a commentator for the Pacific Merchant Shipping Association newsletter and an international trade analyst.

During the second half of 2018, China sought soybeans from anywhere but the United States, with Brazil securing much of that business. Meanwhile, U.S. producers and exporters have pushed to expand markets in regions including the European Union and Middle East. Those shipments likely will go through Gulf of Mexico ports in Houston and New Orleans, O’Connell said.

“There’s a long-term implication the PNW will see their soy exports deteriorate,” O’Connell said.

Strogen said he has heard from agricultural companies and their bankers that they won’t be investing further in export infrastructure amid the ongoing uncertainties involving trade policies. That’s tough given the $250 million poured into developing an area known as the West Vancouver Freight Access at his port that could use new tenants.

“Had there been a better environment in term of trade, we would have had a more significant desire from those parties,’’ Strogen said. “There’s not the desire to take that financial risk until there’s that certainty.’’

Corn is prepared for export at the Port of Vancouver. (Moriah Ratner/Bloomberg News)

All the so-called ABCD’s of agriculture — heavyweights Archer-Daniels-Midland Co., Bunge Ltd., Cargill Inc. and Louis Dreyfus Co. — as well as U.S. farmer cooperatives and some Japanese firms with U.S. subsidiaries have assets in the Pacific Northwest. Collectively, they’ve invested hundreds of millions of dollars into the region. It wasn’t all for soybean exports but the crop was a significant driver, according to industry analysts.

Over the short term, the ports turned from soybeans to corn for other Asian countries, along with the flow of lumber, canola, wheat and steel shavings shipping out, and fertilizer and Subaru cars coming into the country.

“We did everything we could to mitigate the effect,’’ said John Todd, vice president for operations at United Grain Corp., whose Vancouver Export Terminal boasts the largest storage capacity on the West Coast. “Did that take a lot of blood, sweat and tears to find alternatives? Yeah.’’

On a recent afternoon in February, about 2,000 metric tons an hour of corn could be seen pouring into the cavernous red belly of the Zheng Zi bulk carrier along the Columbia River.

The corn, arriving by rail from Pillsbury, N,D., was shuttled onto the ship by a rapid system of overhead conveyor belts. Once full, the ship left United Grain Corp’s terminal at the Port of Vancouver USA in Washington on a two-week voyage to South Korea.

Until last year, China bought 97% of the soybeans shipped through Pacific Northwest ports, and the region had grown to comprise about a quarter of total U.S. soybean exports. United Grain, a unit of Japan’s Mitsui & Co., was expanded with $78 million in 2012 to handle more than just wheat. The project was part of several other expansions and construction of a new $200 million grain terminal in the region as demand from China for a variety of commodities especially soybeans surged.

Soybean exports through the Pacific Northwest plunged. In November, the Port of Vancouver USA shipped zero soybeans, down from about 147,000 metric tons a year earlier. For 2018, total soybean exports dropped 26% to about 1.1 million metric tons, according to port data.

“You look at all of the growth in demand from China, and if you graph that to soybean production increases in states like North Dakota and the amount of investment, there’s a clear relationship in all of those,” said Mike Steenhoek, executive director of the Soy Transportation Coalition in Ankeny, Iowa. “So much of that investment was based upon that forecast for the Chinese demand for soybeans.’’

U.S. farmers also invested, expanding acres north and west to send grain toward the Columbia River rather than just the Mississippi. In 2000, North Dakota produced 61 million bushels of soybeans. In 2017, the state produced 240 million bushels.

Now, in the wake of the trade war, “my concern is looking forward,” said Mark Wilson, executive director at the Port of Kalama, about a 40-minute drive northbound on Interstate 5 from Vancouver. “Long term, we have to worry about market share and position globally.”

Even though optimism has increased for a potential resolution in 2019 between the United States and China, United Grain still is preparing for the possibility that lower soybean shipments could continue, said Augusto Bassanini, the company’s chief operating officer. United Grain’s assets mainly are in the Northwest, and it buys most of its crops from the upper Midwest.

“We are going to be more focused on continuing to diversify our commodity portfolio,” Bassanini said.