Staff Reporter

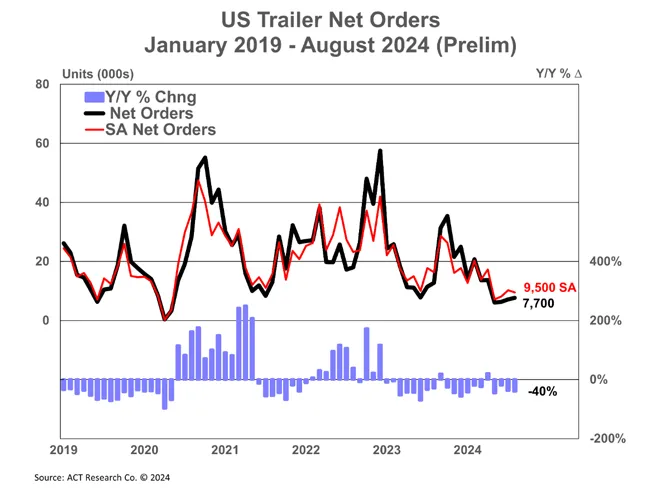

US Trailer Orders Drop 40% Year Over Year in August

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders declined year over year for the fourth consecutive month in August, ACT Research reported.

Preliminary net data showed orders fell 40% year over year to 7,700 units. However, the total increased by about 500 units from July. Seasonally adjusted results at this point in the annual order cycle boost the total for the month to 9,500 units. The only year-over-year increase this year was a 37% rise in April.

“Despite the sequential order improvement, August data continue to bear witness to our expectations of weaker demand against the backdrop of elevated order velocity the past few years, continuing weak for-hire truck market fundamentals, and already-filled dealer inventories,” said Jennifer McNealy, director of commercial vehicle market research at ACT Research. “That said, it is important to remember that for orders, we remain in the weakest months of the annual cycle, suggesting stronger orders weren’t expected in August.”

McNealy expects fleets to be in a better position to buy equipment later this year as their earnings improve. However, she warned that any improvement will be off a very low base given this year’s profits. She anticipates that the next few months will reveal more about whether there will be an uptick in trailer demand as order books open up for 2025.

“In general, we have not seen much change from July apart from increased quote activity signaling interest for 2025 equipment needs,” said Doug Coffing, senior director of less-than-truckload sales at Hyundai Translead. “We remain focused on investing in the business to better prepare ourselves to be ready as things return to what would be considered a more normal market. We have heard some sentiment reinforcing opinions of a better 2026 and beyond.”

US Trailer Net Orders - Prelim (ACT Research)

ACT Research also noted in its report that the year-to-date total has contracted 27% to 89,400 units.

“It definitely seems like recovery optimism has been fading,” said Brandon Lairsen, vice president of trailer leasing at Transport Enterprise Leasing. “We’re still seeing growth in our customer base and we’re still actively leasing quite a few trailers. But all of that is really, while its new business for TEL, it’s all replacement units for our customers. So, we’re displacing competitor equipment but it’s not really sustainable.”

Lairsen warned that all of these customers will eventually go through their replacement cycle. The current market has provided some opportunities for growth, but he noted it’s not sustainable. He also noted that most of his customers seem to be focused on pre-buys for trucks.

“There’s still a tremendous amount of excess capacity in the marketplace,” Lairsen said. “A lot of trailers sitting as you drive around in different markets. There’s a lot of idle equipment. I think that while there’s a lot of similarities to 2008 and 2009, it’s vastly different because it’s gone on so long and there’s so much more excess capacity in the market than there was then.”

TT's Seth Clevenger and Mike Senatore dive into the details behind the 2024 Top 100 Private Carriers list. Tune in above or by going to RoadSigns.ttnews.com.

Lairsen noted that his earliest timeline for when conditions turn around would be the second half of next year. But he suspects that is still a bit too optimistic. He anticipates that it’s going to take some time even after that for capacity to correct enough for trailer orders to go up.

“We have seen a slowdown, obviously, like everyone else,” said Dan Taylor, director of sales at Western Trailer Sales Co. “We’re working harder to get orders. We’re still holding our own. Orders aren’t as robust as they were earlier in the year.”

Taylor expressed guarded optimism about potential sales improvements if interest rates drop, potentially spurring hesitant buyers. The Federal Reserve on Sept. 18 announced it had cut its benchmark interest rate by 50 basis points — its first in more than four years.

Despite market challenges, Taylor’s company continues selling available inventory. He described the year as unpredictable, with significant market fragmentation allowing for strategic equipment redistribution to stronger areas. However, he expects challenging conditions to persist through 2025.

“We’re in a little bit of a freight recession, we’re coming off the COVID hangover in equipment,” Taylor said. “You look at the amount of new DOT numbers, and then look at the current DOT numbers today, and look at what has been put into the market in late model used equipment. I think [that] is a bigger problem than the election or the interest rates.”

Want more news? Listen to today's daily briefing below or go here for more info: