Staff Reporter

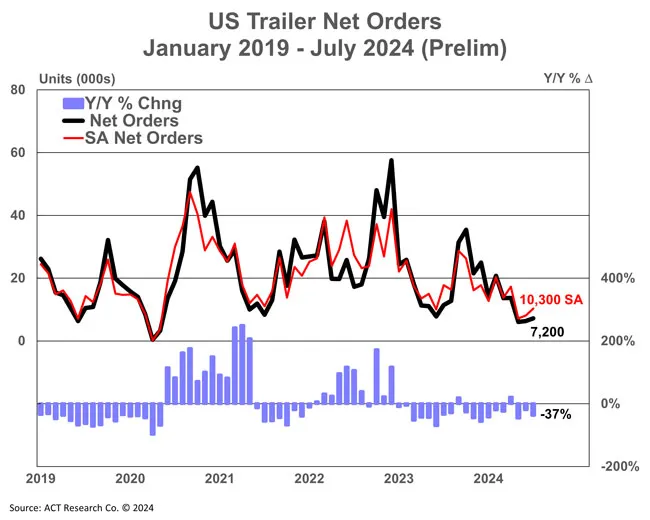

July Trailer Orders Drop 37% Amid Slower Market

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders fell 37% year over year in July to 7,200 units, ACT Research reported. The figure represented a 14.2% increase from June’s 6,300 units. The seasonally adjusted total was 10,300 units.

“Despite the sequential improvement in orders, July data continues to bear witness to our expectations of weaker demand against the backdrop of elevated order velocity the past few years, continuing weak for-hire truck market fundamentals, and already-filled dealer inventories,” said Jennifer McNealy, director of commercial vehicle market research at ACT. “That said, it is important to remember that for orders, we remain in the weakest months of the annual cycle.”

McNealy added that these soft conditions suggest no catalyst for stronger orders before the fall, when truck manufacturers start opening their order books for 2025. She anticipates fleets will be in a better position to purchase equipment when they start making more money later this year, though she notes those expected improvements are starting from a low base.

“We continue to see sluggish order activity across the larger trucking segments as tonnage remains flat to declining,” said Chris Hammond, executive vice president of sales at Great Dane. “Most order activity comes from fleets who need to upgrade aged equipment or those who have gained new lanes or dedicated contracts.”

Great Dane plans to monitor quoting activity over the next few weeks as it responds to customer needs and opens builds for 2025. Hammond noted the company continues to invest in itself despite softer market conditions to ensure it is ready to meet customer needs.

“We are seeing some of the smaller to midsize-type customers be a little more opportunistic, taking advantage of some of the falling prices in the market and so forth,” said Jeremy Sanders, chief commercial officer at Stoughton Trailers. “But it’s not really surprising to me that we’re on a multi-month trend of soft industry orders.”

RELATED: ATA Reports Another Truck Tonnage Decline for July

Sanders noted an uptick in activity for contract and spot freight. However, his customers remain cautious about spending due to uncertainty surrounding the presidential election, interest rates and peak shipping season. He also pointed out that this phase of the cycle is typically slow for trailer orders.

“It will be very intriguing to me to see what happens in the month of September and October, and August for that matter, as we start getting into the [request for quote] process for next year,” Sanders said. “However, I’ll tell you, not everyone is even initiating an RFQ at this point, which kind of leads me to believe that there’s still some widespread caution.”

Sanders views margin-challenged truckload carriers and caution as driving market conditions. Theresa Check, senior director of sales at Hyundai Translead, agreed, noting that orders are seasonally slow as a result of market uncertainty.

“The current market and looming election have resulted in some cancellations,” Check said. “Dealers remain extremely cautious during this time as they sell through current stock in anticipation of new model year product.”

RELATED: Class 8 Truck Orders Stumble Again in July

Check also noted that both for-hire and private fleets are generally still in the planning process for 2025. She pointed out that dry van quote activity is increasing, flatbeds and chassis continue to have diminishing demands, and refrigerated trailer order activity has remained steady.

“It’s exactly as we forecasted for the year,” said Steve Bennett, president and chief operating officer at Utility Trailer Manufacturing Co. “I would imagine that the activity is going to slow because, as our plants have filled up for the year, and we’re just opening up the 2025 calendar year, there’s hesitation. I don’t know if that’s across the market. The forecasting agencies, they pretty much forecast truck and trailer as an afterthought.”

Bennett pointed out the difficulty in conveying production plans to suppliers when industry forecasts show something different. He noted that summer being weak for trailer orders matched his prediction. However, he suspected it had more to do with carriers prioritizing other equipment types rather than market weakness.

“It’s just their capital is being used elsewhere,” Bennett said. “Fleets have definitely moved their truck-to-trailer ratio down.

“But we’ve seen that as a pretty strong trend. There’s a lot of really financially healthy trucking companies.”

Want more news? Listen to today's daily briefing below or go here for more info: