Staff Reporter

Truck Driver Pay Drops 7.4% in Q2 as Freight Keeps Slumping, Reports Say

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry continued to experience a decline in driver compensation during the second quarter, with much of that led by lackluster starting pay.

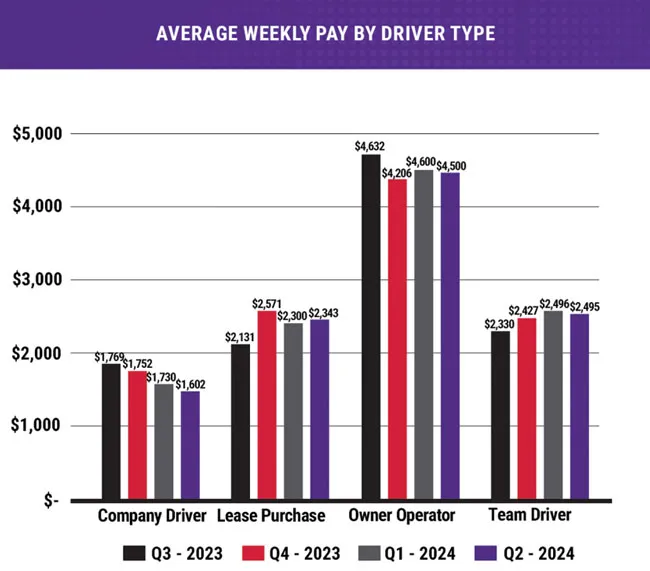

The Q2 2024 Driver Pay Trend Tracker Report found company drivers saw their average weekly pay decrease 7.4% to $1,602 from $1,730 in the first quarter. It also found owner-operator pay decreased 2.2% to $4,500 from $4,600. Conversion Interactive Agency, along with its division Fleet Intel, released the report to examine pay trends among drivers and diesel technicians.

“The big takeaway was definitely that we’re seeing the pay decreasing and it’s decreasing for a simple reason,” said Steve Sichterman, vice president of client services and Fleet Intel at Conversion Interactive Agency. “They just don’t need drivers right now. They don’t have the freight to sustain them.”

American Trucking Associations reported Aug. 20 that its for-hire truck tonnage index increased 0.3% month over month to 113.7 for July. But the index was still 0.9% lower than the prior year. May marks the only month that has shown a year-over-year increase since February 2023. Sichterman pointed to this pullback over the last year as leading to less demand for drivers. But he noted this has been primarily focused on starting pay.

(Fleet Intel)

“It makes sense,” Sichterman said. “I’m going to reduce the starting pay, I’m not going to reduce the pay that my current drivers have. That would go over terribly. But if they can make some of that up by reducing the starting pay, I think that’s where they’re headed. Until we see some sort of a freight balance come back, I don’t see that changing.”

The report did show that leased purchased transportation was an exception to this trend. Its average weekly pay increased 1.9% to $2,343 from $2,300 in Q1. The report also showed company drivers and owner-operators saw their average weekly pay decline from the third quarter of last year, the furthest this dataset goes back.

RELATED: Truck Driver Recruitment Refocused on Pay During Q1

“Driver wages during the protracted freight recession are likely stagnant on a per-mile basis, which has lowered their W-2s, because miles per truck day and revenue per truck day are down,” said Mark Schedler, senior editor of transport management at J.J. Keller & Associates. “Drivers are taking a hit due to lower miles or reduced hours. Financial results — operating earnings — have declined 30-50% at some well-run major carriers. They have to right-size the fleets, so driver bonuses are paused as a recruiting tool, I would have to guess.”

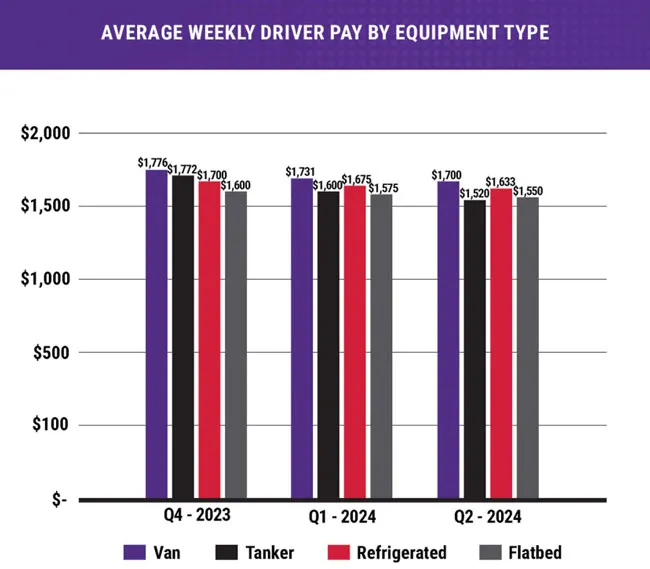

Schedler noted carriers aren’t likely to reduce per-mile or per-hourly pay with the declines primarily coming from the reduced operations. But he has seen reports of layoffs occurring among several carriers in the less-than-truckload, refrigerated, package and dry van truckload segments.

(Fleet Intel)

“We see a lot more focus on retention right now,” Sichterman said. “Our clients are maybe, for the first time, really seeing more value in how they can support their retention efforts. That’s a hard one to put a number to. It’s like a safety program, I’m spending money on a safety program to prove a negative. It’s the same thing in retention. I’m spending effort and money to retain drivers but it’s hard to show that ROI, particularly right away.”

Sichterman doesn’t expect to see any significant improvements in driver pay until market fundamentals improve. He warns there is still a lot of uncertainty with the upcoming presidential election.

Sichterman

“This is one of the longer cycles we’ve seen, as far as being down,” Sichterman said. “But when it comes back, it’s going to come back with a vengeance. And if you’re a company that’s forward thinking, you’re using this time to figure out how to, not just improve your offerings, but to improve your retention, to improve the fundamentals of your recruiting process.”

Sichterman added that these companies should be preparing to hit the ground running.

National carriers like Werner Enterprises have continued to offer additional incentives for drivers, and in some cases stand to benefit from a labor environment like this. At scale, trucking companies tend to enjoy larger cash reserves and a greater percentage of stable contract rates in their freight distribution. This can give an edge in driver retention during market downturns.

Transtex CEO Mathieu Boivin discusses the environmental sustainability of auxiliary power units. Tune in above or by going to RoadSigns.ttnews.com.

“Werner is proud to be one of the highest-paying transportation and logistics companies in North America,” said Chris Polenz, vice president of recruiting at Werner. “For professional drivers seeking additional pay, Werner offers a range of opportunities.”

Accounts that require drivers to unload the trailer can provide an additional $15,000 to $25,000 per year, Polenz said. He also pointed to specialty licensing to haul hazardous materials, since they are more likely to have dedicated routes, more time at home and higher pay.

Many carriers have done away with the eye-catching sign-on bonuses common during the COVID-19 freight boom, Polenz said. Instead, that money has shifted into cents per mile, which he believes is a more transparent model.

“[It] is driver-friendly, boosts company credibility and simplifies recruiting discussions,” Polenz said.

Werner ranks No. 16 on the Transport Topics Top 100 list of the largest for-hire carriers in North America, and No. 4 on the truckload/dedicated sector list. It also ranks No. 30 on the TT 100 list of the largest logistics companies.

Want more news? Listen to today's daily briefing below or go here for more info: