Staff Reporter

Trucking Costs Could Rise $93M Per Year During Bridge Repair

[Stay on top of transportation news: Get TTNews in your inbox.]

The closure of the Francis Scott Key Bridge in March is set to increase the mid-Atlantic trucking industry’s operating costs by $92.8 million in 2025 and each year after while the key regional thoroughfare is rebuilt, according to researchers.

A section of the Key Bridge collapsed March 26 after a containership, MV Dali 3, collided with a support pillar, diverting traffic onto alternate, longer routes, particularly for carriers and drayage companies serving the Port of Baltimore.

The port reopened in June, but the bridge is not scheduled to be ready for trucks until 2028, if work remains on schedule, which is likely to impose a total of $446 million in overall operating costs for carriers, a study by University of Maryland and Morgan State University researchers shows.

The study focused on medium-duty trucks and vans weighing between 14,001 and 26,000 pounds plus trucks weighing over 26,000 pounds, which it termed heavy-duty trucks.

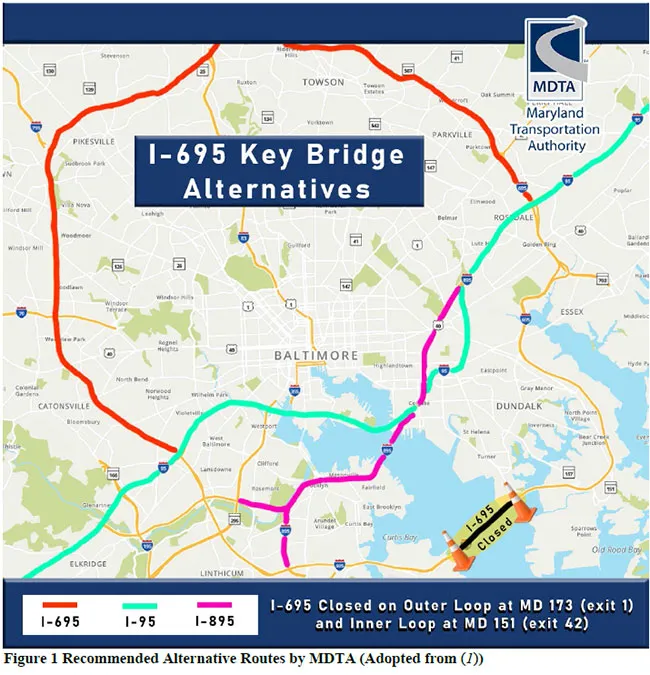

(Maryland Transportation Authority)

Assuming current conditions remain unchanged, a regionwide annual increase of around 1.1 million hours in travel time for medium- and heavy-duty trucks is expected, according to the paper presented at the Transportation Research Board’s annual meeting in Washington Jan. 6.

RELATED: Maryland CDL Program Puts More Truckers on the Road

As a result, the researchers say, operating costs for carriers are expected to jump $92.8 million in 2025, although additional traffic headed to the Port of Baltimore on the restricted options available may further exacerbate tunnel bottlenecks.

The study found that, depending on the type of truck and the alternative routes used, average travel times already increased by up to 58% for trucks traveling through Baltimore.

Heavy-duty trucks experienced more significant travel time increases due to restrictions in the Baltimore Harbor Tunnel and forced detours to Interstate 695 because of prohibitions on the transportation of hazardous materials through tunnels.

Class 7 and 8 trucks using the Fort McHenry Tunnel and I-95 saw a 19.18% jump in their travel time, while medium-duty vehicles faced a 14.18% increase, the study authors found. The share of trips using this route soared from 22.99% to 54.28% for larger trucks and from 6.46% to 24.73% for medium-duty vehicles after the bridge collapse.

Experts from Sailun Tires dive into strategies for managing tire expenses amid a challenging freight market. Tune in above or by going to RoadSigns.ttnews.com.

The two heaviest classifications of trucks traveling through the Baltimore Harbor Tunnel on I-895 saw a 6.28% rise in travel time, while their medium-duty counterparts encountered a 3.49% increase.

Trip volumes for this route also rose, from 1.32% to 3.53% for heavy-duty trucks and from 4.84% to 17.05% for medium-duty vehicles. Fewer trucks used this route because of restrictions on heavy-duty vehicles exceeding 13 feet, 6 inches in height, or 8 feet in width, and all double trailers, which are prohibited from using the Baltimore Harbor Tunnel, the study found.

If trucks detoured via the western sections of I-695, the travel time took an even bigger hit. Heavy-duty trucks saw a 36.46% jump in travel time, while medium-duty vehicles faced a 58% increase. The share of trips using the route rose from 8.63% to 16.46% for Class 7 and 8 trucks and from 4.07% to 5.90% for medium-duty vehicles.

The academics used more than 2 million truck trajectories from the Regional 3 Integrated Transportation Information System.

The study was carried out by Yaobang Gong, Kaitai Yang, Yi Zhang and Xianfeng Yang of the University of Maryland plus Di Yang of Morgan State University.

In addition to snarling regional arteries, the crash also cut the amount of freight passing through the Port of Baltimore. March saw 624,526 container tons pass through the port, while October saw only 526,700 container tons processed, state data show, also hurting the trucking industry.

Want more news? Listen to today's daily briefing below or go here for more info: