Staff Reporter

Truckload Rate Outlook for 2025 Softens, Remains Positive

[Stay on top of transportation news: Get TTNews in your inbox.]

The outlook for contract rates softened some over the past quarter, but analysts and carrier executives remain optimistic about the freight market’s prospects in 2025.

Contract truckload rates have yet to bottom out, and negative year-over-year comparisons are expected for several months in 2025, according to FTR Transportation Intelligence Vice President of Trucking Avery Vise. Part of the reason is the absence of a rebound in carrier volume, particularly with industrial production remaining stagnant.

However, FTR expects contract truckload rates to increase 2.2% on a full-year basis in 2025, Vise said during a Jan. 9 webinar, adding that by the end of 2025, contract rates will be rising 5% year on year.

That said, expectations are more subdued than a few months ago. In September, Vise said FTR expected truckload contract rates to rise 3% in 2025.

And as a precursor to the increase in contract rates, Vise said spot truckload rates have passed the bottom.

Vise

FTR expects spot rates to increase 5.5% to 6% in 2025, though this forecast is also down from a September prediction of 6.5% to 7.5%.

“The growth rate is not especially robust,” Vise said, but “it’s certainly welcome from a carrier perspective and certainly could be worse from a shipper perspective.”

Vise said fleets’ truck utilization levels are a key indicator of rate increases. FTR expects utilization levels will start to improve at the beginning of the second quarter of 2025, he said, adding that utilization improved in the first half of 2024 but has since stalled out.

At least one senior carrier executive welcomed the new year with a blog echoing Vise’s optimism.

Freeman

Old Dominion Freight Line CEO Marty Freeman wrote in a Jan. 6 blog: “We believe 2025 will be defined not just by growth but by prosperity. The foundation for success has been laid, and we’re here to move forward together.”

Freeman’s peers are also optimistic, according to Truckstop’s latest Carrier Insight Survey, released Jan. 8.

Some 94% of the respondents in a survey of nearly 500 carriers believe their professional life will improve in 2025, with 53% expecting it to be “significantly better,” Truckstop said. In addition, 77% of carriers plan to make rig upgrades in 2025.

In December, for-hire freight volume hit its lowest point since the early days of the pandemic, according to Cass Information Systems.

However, Vise expects a change come the second quarter. FTR expects truck freight volume to rise 1% in 2025, with Vise noting that while that doesn’t sound like much, volume only rose 0.2% in 2024.

Volume increases will vary significantly by segment, Vise said. Refrigerated and flatbed freight volumes will see strong growth in 2025, he said, though the latter’s strength also reflects how weak the segment was in 2024. Dry van volumes will be little changed and the shorthaul and heavy-haul segments will continue to be weak in 2025, he added.

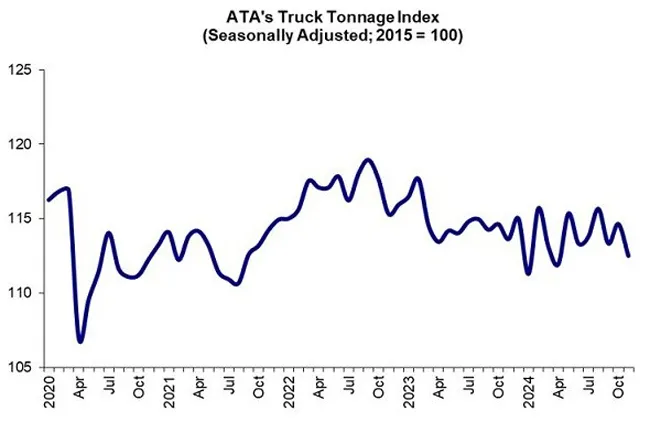

(American Trucking Associations)

American Trucking Associations’ For-Hire Truck Tonnage Index decreased 1.8% to 112.5 in November from 114.6 in October. The index is down 1% compared with November 2023.

Meanwhile, industrial production fell 0.1% in November after declining 0.4% in October, National Association of Manufacturers data shows.

But optimism is growing, with NAM’s Manufacturers’ Outlook Survey for the fourth quarter of 2024, released Dec. 17, seeing 70.9% of respondents positive about their company’s outlook, up from 62.9% in the third quarter.

Overall in 2024, industrial production is expected to fall 0.4%, FTR Senior Rail Analyst Joseph Towers said during the Jan. 9 webinar, then increase 0.1% in 2025 and 1.3% in 2026.

“We’re not seeing any type of robust growth or improvement in the overall industrial economy,” Towers said. “We are expecting to see some growth, but it is not at a high-level increase across the board that is really going to spur a lot of new freight demand.”

However, there are indicators that show a turnaround is on the way, both for industrial production and the freight sector, according to ODFL’s Freeman.

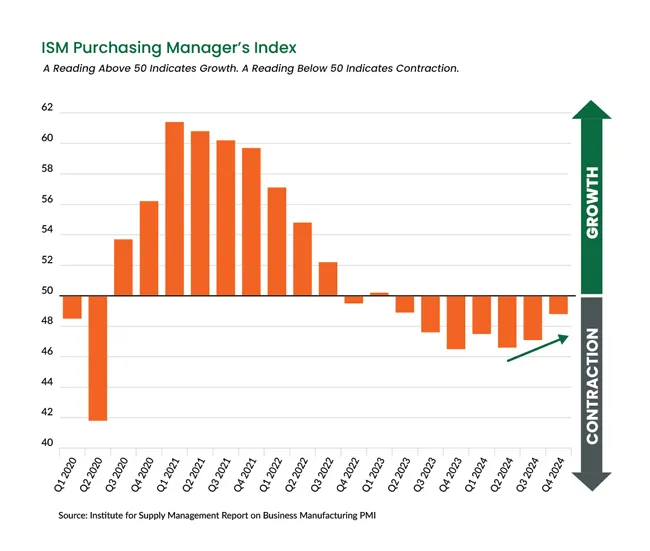

(Institute for Supply Management via Old Dominion Freight Line)

The Institute for Supply Management’s Producer Manufacturing Index is a reliable measure of manufacturing and economic expansion, he wrote, and December’s PMI indicated a shift in momentum.

ODFL ranks No. 8 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: