Bloomberg News

Trump to EU: Buy More US Gas or Prepare for Tariffs

[Stay on top of transportation news: Get TTNews in your inbox.]

President-elect Donald Trump warned the European Union that its exports will get hit with U.S. tariffs if its member states don’t buy more American oil and gas.

“I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!,” he said on Truth Social.

The U.S. is the world’s largest producer of crude oil and the biggest exporter of liquefied natural gas. LNG buyers — including the EU and Vietnam — have already talked about purchasing more fuel from the U.S., in part to deter the threat of tariffs.

The euro traded 0.3% stronger at $1.0398 Dec. 20 in a sign investors believe the bloc will be able to meet his demands and avoid punitive measures.

The U.S. goods and services trade deficit with the EU was $131.3 billion in 2022, according to the office of the U.S. Trade Representative, and the EU has been bracing for a trade offensive ever since Trump’s election victory last month.

(Bloomberg)

The bloc was largely caught off-guard in 2017 when Trump, citing national security concerns in his previous term as president, levied tariffs on European steel and aluminum. Since then, the EU has reinvented its trade doctrine and expanded its toolbox, giving it a range of options to counter coercive practices.

“We are well-prepared for the possibility that things will become different with a new U.S. administration,” German Foreign Minister Annalena Baerbock said after a Group of Seven meeting in Italy in late November. “If the new U.S. administration pursues an ‘America first’ policy in the sectors of climate or trade, then our response will be ‘Europe united.’”

Experts from Sailun Tires dive into strategies for managing tire expenses amid a challenging freight market. Tune in above or by going to RoadSigns.ttnews.com.

European Commission President Ursula von der Leyen floated the idea last month that imports from the U.S. could replace the bloc’s consumption of Russian LNG.

LNG “is one of the topics that we touched upon,” von der Leyen said after a phone call with Trump. “We still get a whole lot of LNG via Russia, from Russia. And why not replace it with American LNG, which is cheaper, and brings down our energy prices.”

The U.S. is already Europe’s biggest provider of LNG, but imports from Russia remain solidly in the second spot. EU officials are looking for ways to curb Moscow’s role as the war in Ukraine continues, even while Russian pipeline gas and LNG are largely outside of the scope of sanctions. The bloc will explore potential measures when they discuss a new sanctions package next month but stringent restrictions remain difficult, according to a person familiar with the matter, who spoke on the condition of anonymity.

In the short-term, the U.S. doesn’t have much more capacity to increase shipments. And since LNG is sold through long-term contracts, adding shipments to Europe would require original buyers of the gas to agree to divert its shipments to Europe — but that wouldn’t boost the amount being exported by the U.S. Over the longer term, more capacity will come on line with dozens of projects in the U.S. currently in the works.

(Bloomberg)

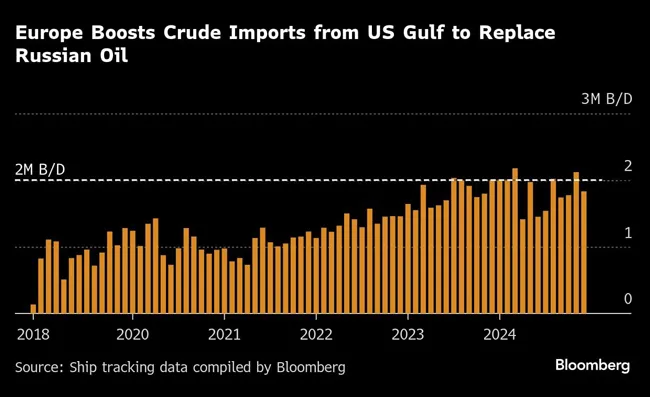

The U.S. has already assumed a critically important role as an oil supplier to Europe, especially in the wake of Russia’s invasion of Ukraine.

Shipments are now holding steadily up around the 2 million-barrels a day mark, exceeding flows from countries including Saudi Arabia, west Africa and elsewhere. U.S. barrels have also become increasingly important in setting Dated Brent, the world’s key price for determining physical market transactions.

Those flows have largely been a function of free-market trading and it’s hard to know what difference any kind of government-level intervention could make to them. Asia also competes for the barrels. Refineries are optimized to make the right fuels from the right crudes.

But the EU has still prepared for the possibility that it will end up in a trade war with Washington. The EU’s new anti-coercion instrument strengthens trade defenses and enables the commission, the bloc’s executive arm, to impose tariffs or other punitive measures in response to such politically motivated restrictions.

The EU also adopted a so-called foreign subsidies regulation, which allows the commission to prevent foreign companies that receive unfair state handouts from participating in public tenders or merger-and-acquisition deals in the bloc, among other measures.

Trump has multiple grievances against the EU and has criticized Europe for not spending enough on defense and for the U.S.-EU trade deficit. He once referred to Brussels, the seat of the EU institutions, as a hellhole, and more recently he said he’d once told a NATO member that he’d let Russia do “whatever the hell they want” to it if it didn’t hit defense spending targets.

Trump has threatened tariffs against countries from China to Canada, and is particularly focused on nations that have trade deficits with the U.S. Europe is already the top destination for American LNG, with more than half of the deliveries going to the continent last year.

Want more news? Listen to today's daily briefing below or go here for more info: