Staff Reporter

US Class 8 Sales Fall 18% in 10th Straight Month of Declines

[Stay on top of transportation news: Get TTNews in your inbox.]

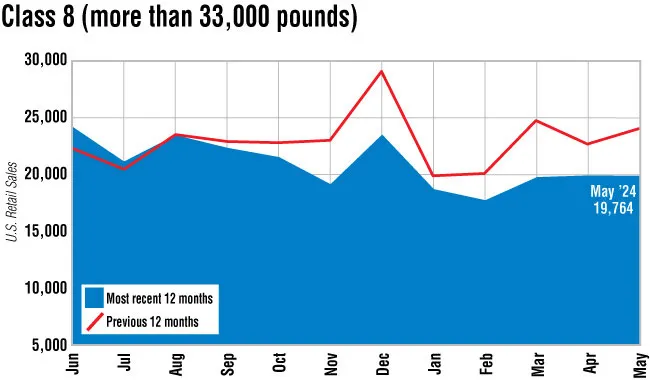

U.S. Class 8 retail sales hit their 10th consecutive month of year-over-year shortfalls in May, according to data from Wards Intelligence.

Sales decreased 18% to 19,764 units from 24,111 in May 2023. They also declined 0.2% from 19,798 units reported the previous month. Year-to-date sales are down 14.6% to 95,401 units from 111,723.

“I think for the most part things are playing out pretty much according to the script that we have in our heads,” ACT Research Vice President Steve Tam said. “You’ve got conflicting forces at work. For example, we’re seeing relatively robust production, and with the kind of mediocre retail sales number, we’re actually seeing a pretty decent run-up on inventory.”

The U.S. Environmental Protection Agency introduced stricter emissions standards for heavy-duty vehicles starting with model year 2027. Tam suspects manufacturers are making the choice to keep production up as a hedge against the disruption those changes could cause.

Tam

“On the production side, we’ve adapted or altered our thoughts about where inventory levels are going to be,” Tam said. “We had a small increase in sales. Our U.S. Class 8 [annual projection] number is 230,000 units right now. Pretty much in the neighborhood of where we’re thinking things are going.”

Freightliner, a brand of Daimler Truck North America, claimed the largest market share with 6,800 trucks, accounting for 34.4% of all sales for the month. That was still a 27.4% decrease from 9,368 the prior year. Western Star, also a DTNA brand, experienced the largest year-over-year percentage increase in truck sales of the major brands at 26.9% to 935 units from 737.

Mack Trucks sales increased 2.6% to 1,613 from the 1,572 units reported during the year-ago period. Volvo Trucks North America sales decreased 5.5% to 2,334 units from 2,471. Mack and VTNA are brands of Volvo Group.

“May retails were lower compared with last year as a result of market corrections among some segments, leading to lower demand and an economy more in line with long-term trend growth,” said Jonathan Randall, president of Mack Trucks North America. “The freight market continues to face headwinds and has affected truckload carriers and demand for tractor sleepers. Vocational sales remain robust with a solid order board.”

“The North American industry’s retails have now been flat the last three months,” said Magnus Koeck, vice president of strategy, marketing and brand management at VTNA. “The lower industry retails versus a year ago reflect the anticipated downturn, but we’re confident the market will soon bounce back as the fleets are gearing up for their pre-buys for 2025 and 2026, which will boost the market demand.”

Navistar’s International brand recorded a 40.9% drop in sales to 1,911 units from 3,232.

Peterbilt Motors Co. sales declined 6.7% to 3,266 units from 3,501. Kenworth Truck Co. saw sales decrease 10.1% to 2,876 from 3,200. Peterbilt and Kenworth are Paccar Inc. brands.

“New Class 8 sales have been very consistent for three months now at just under the 20,000 mark, which is about 3,000 units higher than the long-term, pre-pandemic average,” said Chris Visser, director of specialty vehicles at J.D. Power. “This figure represents nearly maxed-out two-shift production, which is where OEMs want to be. Year-over-year comparisons are unfavorable partly because this time last year there was still some catch-up from the pandemic.”

Visser added that model year 2025 deliveries are still roughly 54,000 units behind orders. This may suggest stability for sales in the short term. He also noted that an uptick in orders in May was encouraging for the remainder of that model year after the disappointing prior few months.

“The results in 2024 continue to match our expectations,” said David Kriete, president of Kriete Truck Centers. “Freight is tight, rates are low, equipment prices remain at all-time highs although finally stabilizing, interest rates are high and credit is tight. These continue to compress the longhaul segment’s results. When sleeper sales are down, the whole market gets dragged down dramatically. Vocational demand remains hot, however, and supply continues to be tight.”

Corey Cox of the Tandet Group of companies discusses how early AI adopters are beginning to harvest the latest wave. Tune in above or by going to RoadSigns.ttnews.com.

Commercial Truck Trader reported that buyer interest in its online truck listings has been improving. The online marketplace for new and used commercial vehicles found vehicle detail page views increased month-to-month for new sleepers and new day cabs.

“We’re seeing much higher inventory levels than we have in six years as production is outpacing demand,” said Charles Bowles, director of strategic initiatives for Commercial Truck Trader. “The number of trucks for sale on Commercial Truck Trader has grown 37.2% in just the last year. For the first four months of 2024, we observed that unit searches were below what they were in 2023, which would align with Ward’s sales data. However, we saw that the search numbers for May 2024 were about 2% higher than May 2023.”

Want more news? Listen to today's daily briefing below or go here for more info: