US Industrial Output Surges by Most Since 1959 on Reopening

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

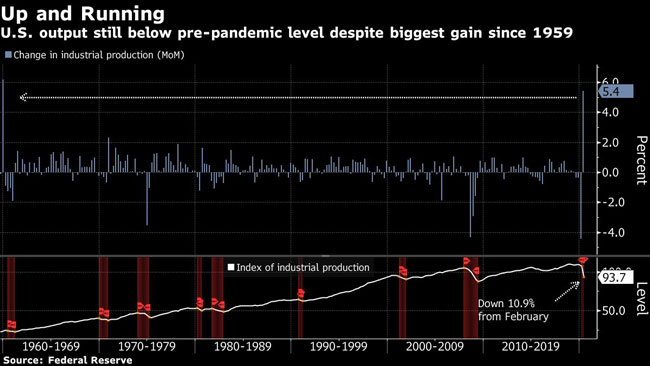

U.S. industrial production in June posted the largest monthly gain since 1959, indicating manufacturing is stirring to life after coronavirus-related shutdowns.

Total output at factories, mines and utilities increased 5.4% from the prior month after climbing 1.4% in May, Federal Reserve data showed July 15. The median projection in a Bloomberg survey of economists called for a 4.3% advance. Factory output jumped 7.2%, the biggest gain since 1946.

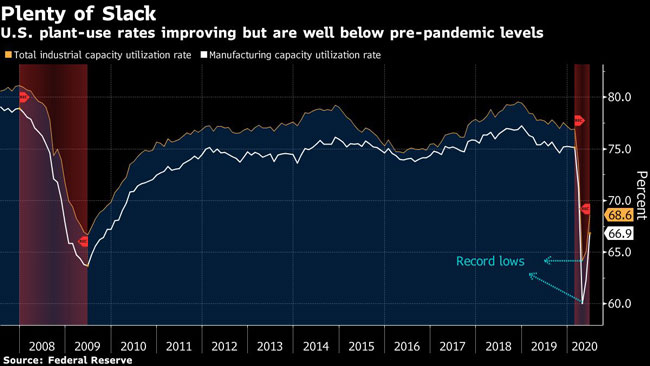

The outsize rebound in production still leaves the Fed’s index of industrial output 10.9% below pre-pandemic levels and the capacity utilization rate shows plenty of slack as demand builds only gradually. What’s more, sales may be tempered in coming months as reopenings have entered a more uncertain phase, with states like California imposing renewed lockdown measures.

Total production was boosted by a robust upturn in “manufacturing output as producers, particularly in the auto sector, reopened factories to catch up with the surprisingly strong initial rebound in consumption,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note. “With high-frequency indicators suggesting the latter is now losing pace, future gains in production look set to be more muted too.”

In the second quarter, industrial production fell an annualized 42.6%, the biggest setback in the post World War II era.

Capacity utilization, which measures the amount of a plant in use, increased to 68.6% from a revised 65.1% in May; it was 76.8% in February. Extra capacity can weigh on corporate profits because business capital is underutilized, and it also signals a sluggish capital spending outlook.

The increase in factory output was led largely by vehicle and parts output, which surged 105%. Excluding auto production, factory output rose 3.9% as all major industries registered gains for the month.

The Fed’s report showed utility output increased 4.2%, while mining dropped 2.9%, the fifth straight monthly decrease. Oil and gas well drilling declined 18% after a 36.9% slide a month earlier. Drilling is down a whopping 70% from a year earlier after a slump in oil prices several months ago prompted cutbacks in exploration.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More