Bloomberg News

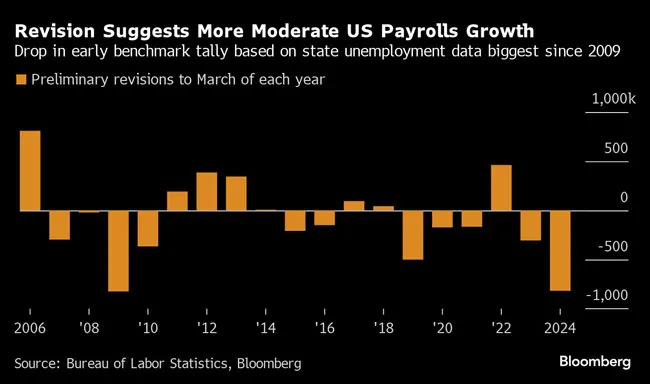

US Payroll Data Likely to See Largest Revision Since 2009

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. job growth was probably far less robust in the year through March than previously reported, according to government data out Aug. 21.

The number of workers on payrolls will likely be revised down by 818,000 for the 12 months through March — or around 68,000 less each month — according to the Bureau of Labor Statistics’ preliminary benchmark revision. It was the largest downward revision since 2009.

While economists largely anticipated a decline, some predicted a loss of up to 1 million jobs. The final figures are due early 2025.

Before the report, the BLS’s initial payrolls figures indicated employers added 2.9 million total jobs in the period, or an average of 242,000 per month. Now the monthly pace is more likely to be around 174,000 assuming the change is distributed proportionately, still a healthy rate of hiring but a moderation from the post-pandemic peak.

RELATED: US Labor Cooldown May Have Started Earlier Than Thought

Benchmark revisions are conducted every year, but they were particularly scrutinized this year by markets and Federal Reserve watchers for any signs that the labor market may be cooling faster than originally reported.

Several economists said the initial payrolls data may have been impacted by a number of factors, including adjustments for the creation and closure of businesses and how unauthorized immigrant workers are counted.

The revisions may reignite angst among markets and economists that the labor market is deteriorating much faster than originally thought. The July jobs report set off alarm bells with a weak pace of hiring and a fourth month of rising unemployment, but other metrics like jobless claims and vacancies suggest a more moderate slowdown.

The figures are likely to fuel concerns that the Federal Reserve is behind the curve in lowering interest rates.

The Aug. 21 data will help shape Fed Chair Jerome Powell’s latest assessment of the labor market ahead of a speech Aug. 23 at the central bank’s annual symposium in Jackson Hole, Wyo. Policymakers have recently turned their attention to the labor side of their dual mandate now that inflation has come down from its pandemic peak.

Want more news? Listen to today's daily briefing below or go here for more info: