US Ports Gear Up for Strike as Deadline Nears

[Stay on top of transportation news: Get TTNews in your inbox.]

Just as U.S. policymakers shift focus from curbing inflation to shoring up the job market, the economy faces a jolt that threatens the kind of supply chain disruption and consumer discontent rife during the pandemic.

This time, the shock looms just weeks before a knife-edged election.

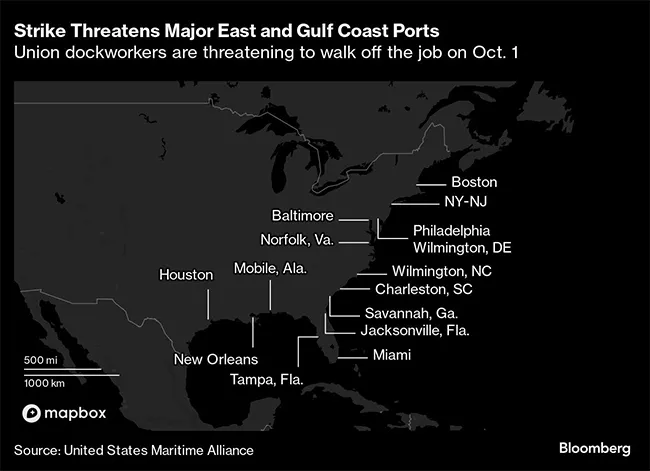

Some 45,000 dockworkers at every major eastern and Gulf coast port are threatening to strike Oct. 1. With talks at a stalemate since June, industry officials now believe a strike is inevitable, and ocean carriers and port operators have started sending out customer advisories and making contingency plans.

The trade gateways involved handle more than half of all goods shipped in containers to and from the U.S. A weeklong strike could cost the economy as much as $7.5 billion, according to one estimate. Millions of boxes of specialized cargo like bananas, plywood and autos could be hit, though energy terminals wouldn’t be affected.

If a strike does proceed, the flow of consumer goods, components for factories and certain vehicles would seize up, disrupting auto supply chains and other manufacturing networks in election battleground states. Refrigerated fruit imports and fresh meat exports would face spoilage and diversions, leading to shortages and higher prices.

Port officials brace for potential strike by dockworkers along the East Coast https://t.co/lvl8zkwreF — The ILA App (@TheILAmobileApp) September 21, 2024

The ripple effects would spread globally as port congestion bogs down shipping capacity and drives up freight rates, analysts warn.

The two sides remain far apart. The union is demanding a near-80% raise over six years, arguing workers deserve a share of profits won by foreign-owned container carriers during the pandemic. Reluctant to set such a precedent — and with some reserves in the bank — companies could wait it out longer than usual.

“A sleeping giant is ready to roar on Tuesday, October 1, 2024, if a new Master Contract Agreement is not in place,” Harold Daggett, the tough-talking leader of the International Longshoremen’s Association, said in a Sept. 17 statement.

Terminal operators and ocean carriers, represented by the United States Maritime Alliance, or USMX, said in August their offer contains an “industry leading” wage increase — closer to the 32% won by West Coast dockworkers last summer.

But there’s another, even more intractable issue at stake. Daggett is demanding more restrictive language on automation, alleging certain companies are using technology in violation of the current contract.

USMX’s offer preserves language on technology that’s in the current contract, which its members view as a concession against a global backdrop where automation is widely used at the world’s largest facilities, including in China, the Netherlands and UAE.

“It is disappointing that we have reached this point where the ILA is unwilling to reopen dialogue unless all of its demands are met,” the USMX said in a statement last week.

With just over a week before the deadline, the deadlock risks turning into a game of chicken that threatens an economy that’s weathering a sharp slowdown in job growth with lingering inflation concerns.

It would also test the White House’s willingness to get involved in the final month of a campaign geared toward winning union votes. Retailers, trade groups and House lawmakers are calling on the administration to help with negotiations — and intervene should a strike occur.

The union has warned the White House against getting involved. It has withheld endorsing a presidential candidate, though, according to Daggett, former President Donald Trump “promised to support the ILA in its opposition to automated terminals” during a Mar-a-Lago meeting last fall. Neither Trump nor Vice President Kamala Harris has drawn public attention to the strike threat.

Jason Miller, an expert on supply chains at Michigan State University, assessed the goods most reliant on the affected ports, and found auto parts would be particularly hard hit. That could put carmakers in swing states like Michigan and Georgia in a bind.

Stellantis NV, which is facing its own strike threat, has an inventory buildup thanks to slow sales, though supply chain issues could still hamper production of particular models. The company didn’t respond to a request for comment.

Foreign automakers would also be affected, Miller says. South Korean parts imports enter primarily through the East and Gulf Coasts, feeding Hyundai Motor Co. and Kia Corp. plants in Alabama, Georgia and, to a lesser extent, Michigan.

BMW AG, the top US auto exporter, ships about 60% of its production out of South Carolina. The German company also imports all of the engines and transmissions it uses in U.S.-made gas-powered vehicles, plus some high-end models.

TT's Seth Clevenger and Mike Senatore dive into the details behind the 2024 Top 100 Private Carriers list. Tune in above or by going to RoadSigns.ttnews.com.

The impact on everyday staples would appear soonest in items that cannot be stockpiled. Americans consume more bananas per capita than any other fresh fruit, and, according to Miller, two-thirds of them are unloaded at East and Gulf Coast ports.

As a key distribution hub for Dole Fresh Fruit Co. and Chiquita Fresh North America, Port Wilmington in Delaware is the nation’s No. 1 gateway for bananas and an entryway for a range of other fruit — grapes from Chile, clementines from Morocco, pears from Argentina and kiwifruit from New Zealand.

They’d spoil if left on the docks too long, or face higher costs given the delays and extra refrigeration needs.

“Any fruit that arrives after Oct. 1 will be condemned to the trash can” if dockworkers walk out, said produce importer Peter Kopke Sr. “And all of the people who have invested in that business will lose a fortune.”

Kopke’s imports — mainly citrus and grapes at the moment — mostly enter through Wilmington and Philadelphia, ending up at stores like those of Walmart Inc., Costco Wholesale Corp. and Target Corp. nationwide. For consumers, the price of fruit would go up within a week or two and “many small firms, privately owned, may be forced out of business,” he said.

Gabriela D’Arrigo, a marketing executive at produce distributor D’Arrigo New York, said if imports stopped “we would go out of the West Coast/LA, and then truck it” if needed — showcasing the kind of disruptions a strike would entail.

The union is set to meet Sept. 24 to discuss details on how certain goods would be treated during a strike, including whether some shipments would continue to be unloaded, according to an ILA spokesperson, who declined to comment on whether bananas or other fresh fruit are at risk.

Affected grocery items go beyond fruit. Chilled beef and pork exports — among the most profitable food items — are particularly vulnerable.

“The protein supply chain cannot be stopped: the calves, hogs keep growing,” said Peter Friedmann, executive director of the Agriculture Transportation Coalition. “The frozen products can be stored, in cold storage facilities, but those will be quickly filled to capacity.”

When that happens, farmers are forced to push products onto the domestic market, causing prices to plummet. “As we saw during the prior COVID crisis, some farmers will simply cease production,” Friedmann said. “They go out of business.”

Want more news? Listen to today's daily briefing above or go here for more info

President Joe Biden could ultimately invoke the Taft-Hartley Act, which would force workers back to work during a “cooling off period” — though that could jeopardize union support for Harris heading into Election Day.

The Biden-Harris administration has never invoked Taft-Hartley to break a strike and isn’t considering doing so now, a White House official said last week.

As for the broader economic impact, the backlog from a weeklong strike would take at least four weeks to clear and impose a $4.5 billion to $7.5 billion hit, according to Grace Zwemmer at Oxford Economics. She expects that the drag would be made up once the strike is resolved and ports process any backlogs.

But by then the election will be over.