Staff Reporter

August Used Truck Sales Show Little Change

[Stay on top of transportation news: Get TTNews in your inbox.]

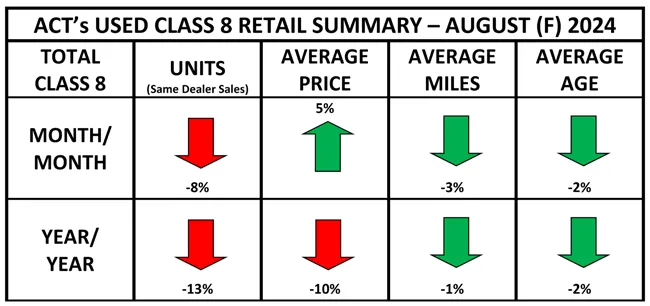

Used Class 8 truck sales demonstrated a slight year-over-year increase and no sequential change during the month of August, ACT Research reported.

Sales rose 1.3% to 22,800 units from 22,500 in August 2023. But the figure was unchanged from July. The average retail sale price dropped 9.5% year over year to $58,358 from $64,499 but increased 4.6% from $55,789 in July. Mileage decreased 0.7% to 418,000 from 421,000 a year ago and 2.6% from 429,000 the prior month.

“Same dealer Class 8 retail truck sales faltered in August, returning to a pattern of slowing,” said Steve Tam, vice president of ACT Research. “The 7.7% decrease was counter to the 10 percentage point seasonal improvement indicated by history. August is typically the second-best sales month of the year, running almost 9% above average.”

Tam noted that both auction and wholesale segments saw volume increases sequentially. He expects used truck prices to remain stable around current levels through 2024, potentially transitioning to year-over-year growth in early 2025.

(ACT's Used Class 8 Retail Summary)

“August was good for us as well,” said Trey Golden, vice president of used truck sales at Rush Enterprises. “There’s a bunch of different dynamics that kind of play out through August and the rest of the year. But July was crummy. I’m just going through the calendar as one thing. But the Fourth of July was in the middle of the week, and so some people act like that’s a whole week off. So, then July was crummy.”

Golden pointed out that a positive consequence was a buildup of demand heading into August. Another positive aspect was the lack of holidays disrupting the workweek. September wasn’t as clear with Labor Day. Golden is optimistic that the used truck market is slowly starting to see the necessary conditions for a recovery.

Golden

“I’m not saying there’s a recovery yet,” Golden said. “But you can see capacity coming out. You can see ACT lowering builds. They’ve lowered 2025 estimates multiple times in the last couple months. Not huge numbers, but if you read carrier earnings, you see people trying to defleet. They’re trying to match the supply and demand on the freight side. And so we’re still obviously in a freight recession.”

J.D. Power’s monthly market report found that auction volume increased in August, while pricing dipped. The report noted that retail volumes were typical and depreciation was normal, with day cabs continuing to depreciate at a rate greater than sleepers. Prices for 4- to 6-year-old auctioned sleepers were 5.6% lower than in July. The report noted that depreciation this year is substantially lower than the historical average at 1.3% per month.

“It’s interesting to note that while inventory levels continue to rise, there exists some growth in demand,” said Charles Bowles, director of strategic initiatives at Commercial Truck Trader. “When that occurs, one expects to see prices rise to meet the demand. We weren’t surprised by the bump in retail prices in August, but I wouldn’t say that it will be a trend in the short term. There’s simply too much inventory in the system right now.”

Bowles expects the resulting pricing volatility to continue but depend on the specs and ages of trucks. In the more immediate term, he said he saw conditions in the used truck market decline somewhat in September. The new truck market was hit much harder.

Bowles

“We saw a very slight decline in September demand versus August for both used day cabs and used sleepers, which may be a harbinger of a lower sales volume and a downward adjustment in average retail prices in the coming weeks,” Bowles said. “We’re seeing a much larger drop in demand in September for new day cabs and sleepers.”

Bowles has not yet seen the beginning of the pre-buy bump ahead of the emission rules changes coming in 2027. He isn’t expecting to see much of that as those pre-ordered units are rarely listed online. He is also seeing dealers market their units more aggressively with the continuing buildup of inventory on heavy-duty lots.

“Used trucks are going to mirror the freight market for the next year or so,” Golden said. “Seems like freight rates have been bouncing along the bottom for a long time. I don’t think we’re going to get a noticeable decrease in freight rates from here. I just think that now the problem is the longer we stay down here, the more carriers get stressed and exit.”

Want more news? Listen to today's daily briefing below or go here for more info: