Bloomberg News

Walmart Stock Soars 82% in 2024, Leading Retail Industry

[Stay on top of transportation news: Get TTNews in your inbox.]

At a time when the American consumer’s resiliency has been questioned amid signs of a slowing economy, Walmart Inc. has thrived. The world’s largest retailer, famed for its discount prices but increasingly known for its pursuits in advertising and an online marketplace, is headed for its best year since 1998.

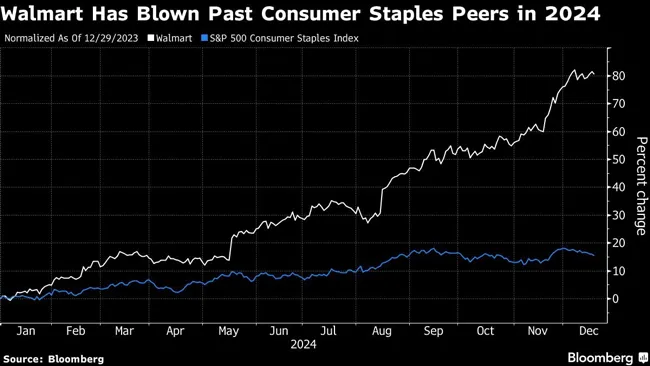

Its shares have surged 82%, adding roughly $340 billion to Walmart’s market value this year. Compare that to many of its peers. Shares in Dollar Tree Inc. and Dollar General Corp., which should have also benefited as the economy cooled and shoppers hunted for bargains, have slumped more than 40%. Walmart has outperformed rival Target Corp. and other retail heavyweights like Amazon.com Inc. and Costco Wholesale Corp. too.

Walmart ranks No. 1 on the Transport Topics Top 100 list of the largest private carriers in North America. Dollar General ranks No. 18 on that list and Costco No. 47. Amazon ranks No. 1 on the TT100 list of the largest logistics companies in North America and No. 1 on the global freight carriers TT50 list.

Looking ahead to 2025, analysts and investors anticipate that Walmart will continue to set itself apart from its retail peers. They’re betting that further market-share gains and increased profit contributions from Walmart’s higher-margin ancillary businesses will extend the stock’s rally.

At Laffer Tengler Investments, senior analyst Jamie Meyers expects Walmart to once again outperform consumer staples stocks next year. The firm boosted its Walmart position earlier in 2024.

“Walmart is deserving of this premium valuation, and frankly, it could go higher,” said Meyers. “The company’s in a good position. Certainly with the valuation it has now, they’re going to have to keep up the work.”

(Bloomberg)

A number of retail stocks struggled this year as Americans continued to focus their spending on necessities and shied away from discretionary purchases, pressured by years of elevated inflation and interest rates.

But for the Bentonville, Ark.-based retailer, which sells mostly household essentials, those trends worked in its favor. As this year’s top performer on the S&P 500 Consumer Staples Index, Walmart has fueled nearly half of the index’s 15% advance.

Its stock chart “looks more like something that’s technologically oriented,” said Keith Buchanan, senior portfolio manager at GLOBALT Investments. “It has the growth and margin expansion that some names in the tech sector envy.”

Lori Heino-Royer of Waabi discusses the latest developments, breakthroughs and key industry partnerships in autonomous trucking. Tune in above or by going to RoadSigns.ttnews.com.

Higher-income consumers have turned to Walmart in recent years as they searched for bargains, and the company’s convenient delivery options, revamped stores and wider product assortment have helped it gain traction with wealthier shoppers. Households earning $100,000 or more per year made up roughly 75% of Walmart’s market-share gains in the third quarter, the company said in a November call with analysts.

“Walmart is just in the sweet spot right now,” Buchanan said.

While GLOBALT has trimmed its position in Walmart this year given its rally, Buchanan said he still expects shares to outperform the broader market in 2025.

Disappointing earnings reports from the dollar stores and Target in recent months have already demonstrated Walmart’s success is disrupting the retail industry.

Citigroup Inc. analyst Paul Lejuez anticipates Walmart will continue to take share from dollar stores as it builds awareness of its delivery options and its Walmart+ Assist program, which allows consumers who qualify for government assistance to join Walmart+ at a discounted rate. Meanwhile, Walmart’s store remodels, which offer an improved shopping experience for apparel, home goods and beauty products, and enhanced pet departments, could hurt Target and pet suppliers, he said.

“Walmart’s been our top pick for almost three years now, and we have not moved it out of that number one spot,” said Lejuez, who has a buy rating on shares. A further acceleration in general-merchandise sales could fuel “the next leg of excitement” for the stock, he added.

Redburn Atlantic analyst Daniela Nedialkova anticipates the gap between retail winners and laggards will widen further in 2025 as macroeconomic pressures persist. While she’s bullish on Walmart, she doesn’t expect 2025 to replicate the stock gains seen this year.

Competitive Advantage

Walmart bulls tout the company’s potential for gross margin expansion as newer businesses like advertising, its third-party marketplace and fulfillment services, grow after years of investment. Market pundits will look for updates on these areas at the retailer’s investment community meeting in April.

Roughly one-third of Walmart’s operating income is now generated from advertising and membership income, which RBC Capital Markets analyst Steven Shemesh said allows the company to keep prices low while still expanding margins. Shemesh has an outperform rating on Walmart shares and calls the stock a top pick heading into 2025.

The retailer is at a “significant competitive advantage,” according to Shemesh, as peers that don’t have well-established capabilities in these areas are forced to choose between maintaining product price gaps and pressuring margins, or letting price gaps widen and potentially losing market share.

Analysts and investors are also keeping an eye on trends for Walmart’s e-commerce business. In June, the company said its US e-commerce unit would generate profits within the next two years.

Walmart has generally been a well-loved stock, and its fan base has only grown in 2024. The retailer entered the year with a buy recommendation from nearly 80% of analysts tracked by Bloomberg. That share has steadily increased to more than 90%, near the highest on record.

(Bloomberg)

However, the stock’s valuation is a point of contention. Walmart shares trade around 35 times forward earnings, well above its 10-year average of about 21 times and the multiple for the overall S&P 500 Index. Even Amazon is less expensive by this measure, trading at 33 times projected earnings.

But Walmart is difficult to compare to anything else, according to analysts and investors. It’s a very large retailer that also has younger, higher-margin businesses that have some characteristics of an “Amazon in the first inning,” said Citi’s Lejuez.

“Walmart has earned its way into a quality tier that has separated it from garden variety retail,” said John San Marco, portfolio manager of the Neuberger Berman Next Generation Connected Consumer ETF, which invests in the company. “The likelihood of a year from now talking about Walmart’s competitive superiority, I think is very high.”