World Demand for Diesel Likely to Fall

[Stay on top of transportation news: Get TTNews in your inbox.]

The world’s demand for diesel is forecast to fall this year, a rare event for the fuel that powers swaths of the global economy.

The Paris-based International Energy Agency has for months been chipping away at its forecast for the year, and now expects annual consumption of gas oil — a catchall term for diesel-type fuels — to fall by 258,000 barrels a day. Outside the pandemic, it’s set to be the biggest drop since 2016, with demand only falling a handful of times in the past 15 years.

While that’s a small decline in the context of the global diesel market’s more than 28 million barrels a day of consumption, the rare reversal is notable for those keeping tabs on the world’s economic activity: Diesel is the single biggest chunk of oil demand, powering trucks, cars and ships, and used in industries from farming to construction.

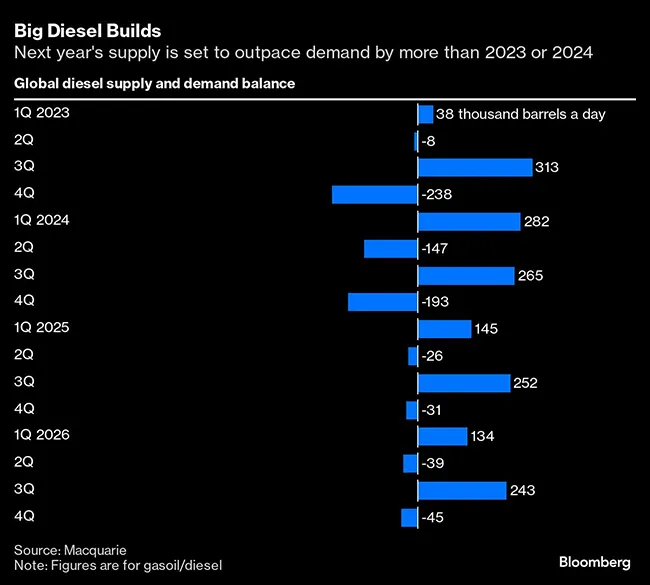

“The days of diesel being the leading fuel for oil demand growth are over,” said Vikas Dwivedi, global energy strategist at Macquarie Group. While demand should pick up next year, it won’t keep up with an expansion in supply, resulting in “big balance builds,” he said.

In China, demand has come under pressure from a slowdown in building and housing construction, as well as the rapid spread of trucks powered by liquefied natural gas. In India, diesel sales rose by just 1.8% during the January-October period, the slowest pace since 2020 when pandemic lockdowns had led to a sharp slump.

In the U.S., data show inventories are at a two-year seasonal high and futures contracts are in a bearish contango structure — a sign of oversupply — for the first time since the pandemic for this time of year.

And in northwest Europe, stockpiles of diesel are forecast to stay above the seasonal norm. ICE Futures Europe data meanwhile show money managers’ bets on diesel, usually net-long, have been net-short since late summer — although there has been an uptick in benchmark futures’ premium to crude oil since late last month.

It’s worth noting that there are different types of diesel for different sectors. Marine gas oil, for instance, is for powering ships; ultra-low-sulfur diesel is often consumed by road vehicles; heating oil does what it says on the tin.

McLeod Software CEO Tom McLeod explores the potential for artificial intelligence to boost efficiency and build resilience. Tune in above or by going to RoadSigns.ttnews.com.

Demand in 2024 has been undermined by comparatively weak industrial activity in several key regions and lower consumption in China, said Ciaran Healy, an oil market analyst at IEA. Heating oil use was also “considerably reduced during 1Q '24 because of mild winter temperatures in Europe and Japan,” he added.

Almost 1.5 million barrels a day of crude distillation unit capacity is also expected to be added — on a net basis — to the global refining system this year, according to consultancy Wood Mackenzie.

And there’s little sign of a letup, with growth expected to continue in 2025 and 2026.

To be sure, it’s worth bearing in mind that IEA expects global gas oil demand to return to growth in 2025 — though at just 176,000 barrels a day, that’s still smaller than this year’s drop.

Wood Mackenzie and Rapidan Energy Group both expect stronger U.S. diesel demand in 2025, even if that’s contingent on interest rates continuing to decline.

Want more news? Listen to today's daily briefing above or go here for more info

Europe’s consumption will also get a shot in the arm from an environmental rule coming into force next May that will push ships toward using diesel-type fuel — though it won’t be enough to stop an overall annual demand drop, according to consultancy FGE.

Macquarie anticipates diesel supply outpacing demand at a faster rate next year than this, having also done so in 2023.

“The end of diesel demand growth isn’t already here, it’s just gonna be slower,” Dwivedi said. “Instead of growing at 400-600k [barrels per day], we think going forward it’ll be 200-300k b/d.”

Written by Jack Wittels, Maggie Eastland and Rakesh Sharma