[This overview of self-driving trucks was created and is maintained by Managing Editor, Features Seth Clevenger, who can be reached at sclevenger@ttnews.com]

Autonomous trucking, once regarded as the stuff of science fiction, is gradually moving closer to viability in real-world freight operations after years of investment, development work and on-road testing and validation.

A host of technology developers, truck manufacturers and industry suppliers have been working to overcome the significant technical challenges and tackle myriad operational considerations to make unmanned truck delivery a reality on interstate highways — at least on certain freight lanes and under certain operating conditions.

Proponents of this emerging technology say autonomous driving trucks could unlock significant efficiency and productivity gains while improving highway safety.

To pave the way for that vision, several technology developers already have been using autonomous driving trucks to haul freight on public roads through partnerships with shippers, carriers and logistics providers. In these early deployments, self-driving trucks still travel with safety drivers behind the wheel and typically an operations specialist in the passenger seat, but the goal for most of these developers is to enable unmanned operation in the coming years.

To enable autonomous operation, autonomous trucking companies are equipping commercial trucks with onboard computing to support automated driving software along with sensor arrays that incorporate cameras, radar and lidar to monitor the vehicle’s surroundings as it travels down the highway.

Although most autonomous truck developers are targeting unmanned operation, these companies are pursuing business models that would complement the trucking industry’s workforce rather than displacing it.

More Q1 iTECH

►Who's Still In Autonomous Trucking?

►Clevenger: Autonomous Trucking: A Rapidly Shifting Landscape

►Company snapshots: Aurora | Kodiak | Torc | Waabi | Stack AV | Gatik | Plus | Einride | Forterra | Outrider

►From November 2022: Who's Who in Self-Driving Truck Development

►Q and A: Chris DeMillo, Leonard's Express

►Dysart: New SEC Rules

Explore the Issue!

These developers are not attempting to produce unmanned vehicles that can go everywhere or haul every type of freight that a human driver can cover. Instead, they are reducing the complexity of the problem by constraining autonomous driving trucks to a more limited operational design domain, or ODD — which refers to a set of operating conditions that the autonomous driving system is designed to handle. Typically, this means that autonomous driving trucks would operate only on specific, repeatable routes that are well suited to automation, leaving more complex routes and driving situations to trucks piloted by human drivers.

Some developers envision unmanned truck delivery as a new mode of transportation for shippers, carriers and logistics providers to consider when planning freight movements.

Since autonomous trucks will only travel on certain routes and under specific conditions, the trucking industry, and by extension the nation’s supply chain and economy, will continue to depend on professional truck drivers for the foreseeable future. In fact, the industry will need to recruit more drivers, not fewer, as freight volumes increase over time. But autonomous driving trucks could ease the industry’s struggles to recruit drivers and help mitigate high driver turnover rates, especially in longhaul trucking.

While the rollout of this technology has been slower than many predicted several years ago, developers have made tangible progress toward deployment and commercialization.

A crucial component of the development work is designing autonomous driving systems to respond to innumerable edge cases — the very rare or unexpected events that the autonomous vehicles might encounter, such as a fallen tree blocking the roadway.

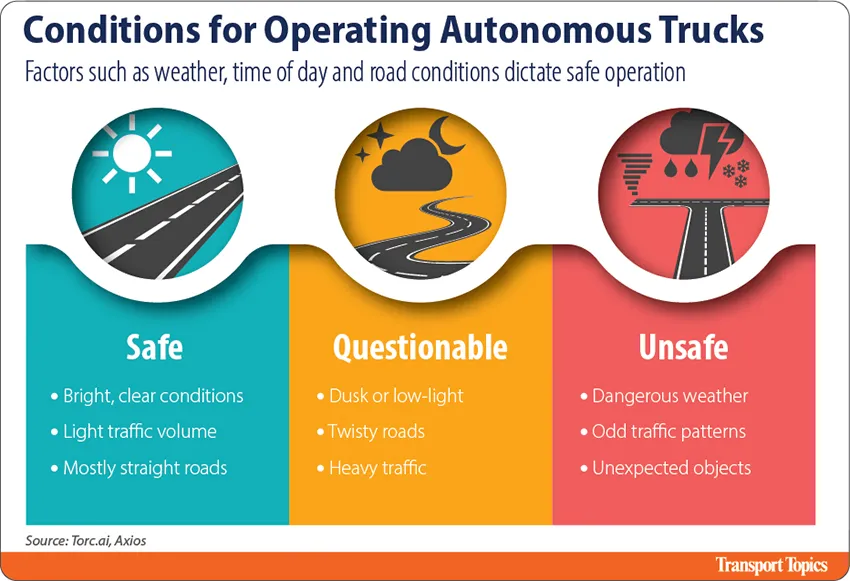

Today, autonomous truck companies are operating primarily in the U.S. Sunbelt, especially in Southwestern states such as Texas, Arizona and New Mexico that have ideal weather conditions and a favorable regulatory environment for testing and eventual deployment. However, some have mapped out nationwide networks for autonomous truck lanes as part of their longer-term ambitions.

In February of 2022, self-driving truck developer TuSimple announced it would conduct driverless freight runs for Union Pacific Railroad between Tuscon and Phoenix in Arizona. (TuSimple)

The autonomous trucking industry could hold the potential to unlock numerous safety and efficiency benefits for the freight transportation industry.

Increased Efficiency and Productivity

Fully autonomous trucks would no longer be constrained by drivers’ limited driving time under hours-of-service regulations, thus opening the way for much greater vehicle utilization and higher productivity.

Improved Safety on the Roads

Autonomous vehicles also promise potential safety benefits. Although automated driving software is not as flexible or adaptable as the human mind, it also can perceive hazards sooner and react faster. Unlike humans, computers do not get tired or become distracted or angry behind the wheel.

Reduced Labor Costs

And perhaps most significantly, autonomous trucking companies could help ease the trucking industry’s longstanding struggle to attract and retain professional drivers.

By automating some longhaul truck routes in hub-to-hub freight operations, autonomous trucking companies could shift some driver jobs from longhaul truckload operations — where driver turnover rates can exceed 100% for some carriers — to shorthaul and regional jobs that provide more home time and better match the preferences of many younger drivers.

Potential for Reduced Carbon Emissions

Some autonomous vehicle developers also say their technology will yield significant fuel savings because autonomous trucks will operate more efficiently than human-driven trucks and may travel at lower average speeds that consume less fuel.

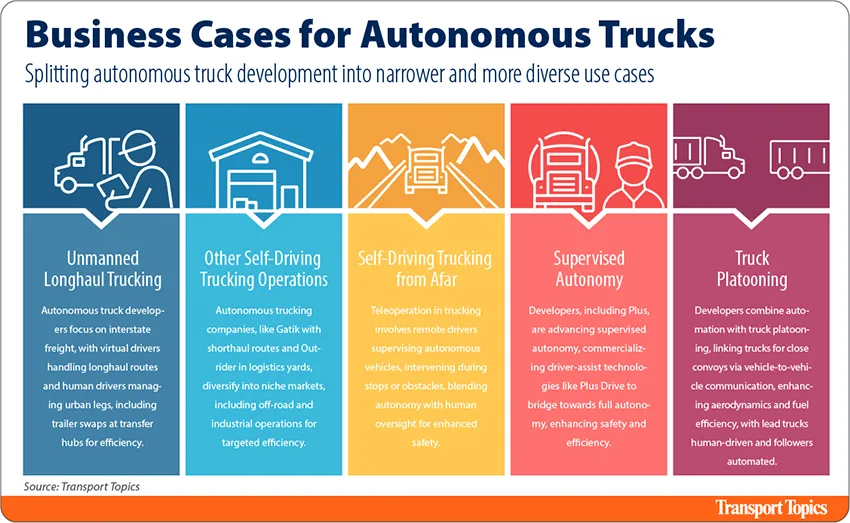

Over time, the development of autonomous trucks has split into narrower and more diverse use cases.

Unmanned Longhaul Trucking

Today, the majority of autonomous truck developers are designing their virtual drivers to haul freight in regular hub-to-hub routes on interstate highways, thus avoiding the more complex urban driving associated with the first and final mile.

In this business model, autonomous driving trucks would cover the longhaul portion of a shipment while trucks driven manually by human drivers would continue to handle the first and final legs of the journey, with human-piloted and autonomous trucks swapping trailers at designated transfer hubs.

Other Self-Driving Trucking Operations

Other autonomous trucking companies are pursuing very different but still limited use cases.

Gatik, for instance, is using self-driving, medium-duty box trucks to move freight on shorthaul delivery routes on public roads between logistics sites and store locations.

Other developers are focusing on off-road applications. Outrider, for one, is working to enable unmanned operations in logistics yards, while others such as Pronto are targeting industrial sites such as mining operations.

Self-Driving Trucking from Afar

Another concept for autonomous truck deployment involves teleoperation, where autonomous vehicles are supervised from afar by remote drivers in offices. The trucks would drive autonomously but remote drivers could intervene if the vehicle is stopped or encounters an unexpected obstacle.

Supervised Autonomy

Furthermore, some developers have pursued various forms of “supervised autonomy.”

Plus, for example, has begun commercializing its Plus Drive self-driving technology as a driver-assist system to help pave the way for full autonomy in the future.

Truck Platooning

Other technology developers have sought to combine automated driving technology with truck platooning, where two or more trucks form a convoy connected via vehicle-to-vehicle communications. Synchronized braking enables reduced following distances to provide enhanced aerodynamics and fuel savings. Typically, the lead truck is piloted by a human driver while the following trucks are either partially automated with driver-assist capabilities or potentially “drone” trucks with no driver onboard.

Developers of autonomous driving systems are not alone in their quest to make unmanned trucks a reality.

These companies have formed partnerships with global truck manufacturers, industry suppliers and a range of other transportation industry stakeholders.

Autonomous Truck Driving Technology

One key element of this development work is integrating autonomous driving software and sensors with mass-produced commercial vehicles in a way that ensures safety and reliability.

While some early developers in the autonomous trucking industry saw potential for aftermarket installations of self-driving systems, nearly all of today’s autonomous truck developers say their technology will need to be installed on commercial trucks at the factory level.

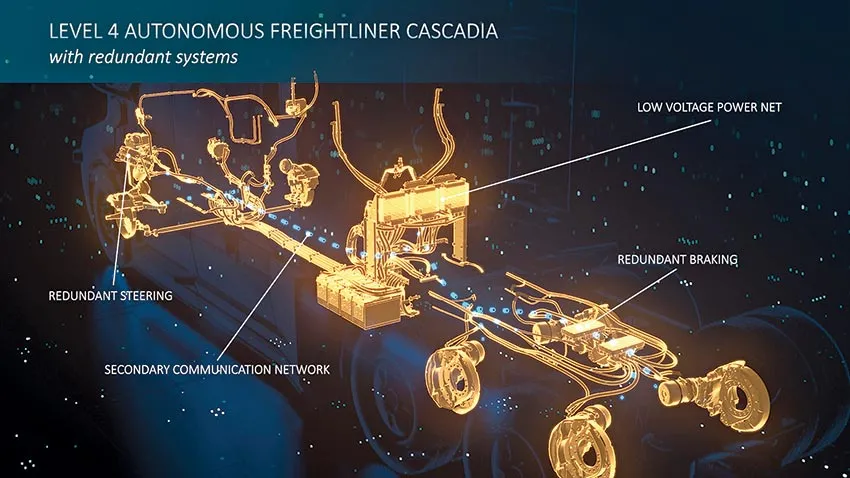

Redundant Systems for Safety

Without a driver behind the wheel as a backup, autonomous driving trucks will require additional components and redundant systems to ensure safety in the event of a technical failure.

Autonomous truck platforms developed by truck makers and technology suppliers feature secondary braking and steering systems, redundant powertrain controls and cybersecurity safeguards.

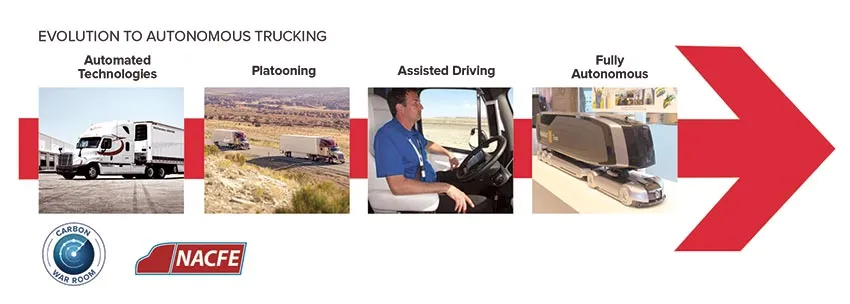

As development work on autonomous trucks continues, efforts to enhance and expand the capabilities of driver-assist technologies also are advancing.

Driver-Assist Technologies

Truck manufacturers and industry suppliers have been introducing advanced driver assist systems, or ADAS, that build upon the safety technologies that have been on the market for years, such as automatic emergency braking, lane departure warnings, electronic stability control and adaptive cruise control.

More recently, truck makers have begun offering driver-assist features that partially automate steering functions. These automated steering capabilities include lane keep assist and lane departure protection.

These driver-assist functions and the components and sensors that support them can be viewed as building blocks for fully autonomous vehicles.

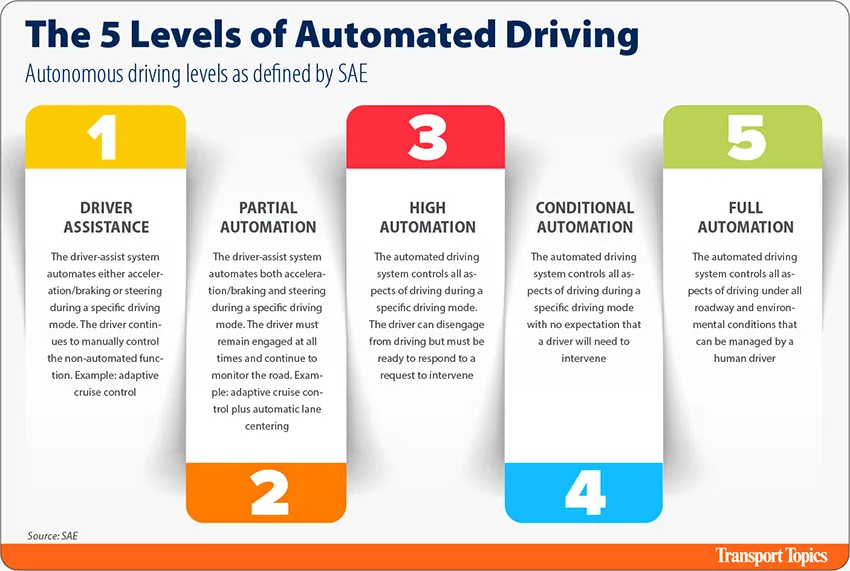

Self-Driving Automation Levels

Nonetheless, the development of autonomous driving trucks is largely distinct from ADAS because the technical requirements and business cases for fully autonomous vehicles differ significantly from driver-assist systems that depend on a driver to operate the vehicle.

Daimler Truck North America

To more clearly define the capabilities of various driver-assist and automated driving systems, SAE International has designated the following levels of vehicle automation:

- Level 0, No Automation: The driver performs all aspects of driving.

- Level 1, Driver Assistance: The driver-assist system automates either acceleration/braking or steering during a specific driving mode. The driver continues to manually control the non-automated function. Example: adaptive cruise control

- Level 2, Partial Automation: The driver-assist system automates both acceleration/braking and steering during a specific driving mode. The driver must remain engaged at all times and continue to monitor the road. Example: adaptive cruise control plus automatic lane centering

- Level 3, High Automation: The automated driving system controls all aspects of driving during a specific driving mode. The driver can disengage from driving but must be ready to respond to a request to intervene.

- Level 4, Conditional Automation: The automated driving system controls all aspects of driving during a specific driving mode with no expectation that a driver will need to intervene.

- Level 5, Full Automation: The automated driving system controls all aspects of driving under all roadway and environmental conditions that can be managed by a human driver.

SAE Level 3 and below represent driver-assist systems that by definition require the presence of a driver.

SAE Levels 4 and 5 are autonomous driving systems that do not require any driver input or fallback performance while active and are agnostic on the presence of a driver in the vehicle.

Trucks With No Driver

Autonomous truck developers generally are targeting Level 4 automated driving with no driver onboard. Although these trucks would not require a driver, these vehicles would only be able to operate on routes and under conditions that fit into the technology’s operational design domain.

SAE Level 5 autonomy, where an unmanned vehicle can handle all routes and driving conditions that a human driver could negotiate, is a much greater technical challenge and therefore highly unlikely to be realized for decades to come.

Industry stakeholders from truck manufacturers to industry suppliers and technology developers increasingly see the rollout of autonomous trucks not as a question of if, but of when.

Deploying Autonomous Trucks at Scale

However, the precise timing for meaningful commercial deployment of autonomous trucks at scale remains elusive.

In the trucking industry, the prospect of highly automated vehicles became a more prominent topic in 2014 and 2015 with the introduction of the Mercedes-Benz Future Truck 2025 and Freightliner Inspiration concept trucks.

Since then, numerous technology companies and startup firms have joined the push to develop various forms of highly automated driving capabilities for commercial vehicles.

In addition, the transition to a 5G wireless network is likely to open up new opportunities in terms of autonomous trucking technology.

Self-Driving Passenger Cars

Autonomous driving technology for the freight transportation industry is developing in parallel with the deployment of autonomous passenger cars in ride-hailing operations.

A Waymo robotaxi in San Francisco in August 2023. (David Paul Morris/Bloomberg News)

Google sister company Waymo and General Motors subsidiary Cruise are now operating fully driverless robotaxis in select geographies such as Phoenix, San Francisco and Austin, Texas.

Much like autonomous trucks, the development and rollout of driverless passenger cars was many years in the making. Waymo, for example, began in 2009 as the Google self-driving car project but did not begin offering its fully autonomous ride-hailing service to the public until 2020.

In the mid-2000s, autonomous vehicle challenges held by the Defense Advanced Research Projects Agency, or DARPA, helped kick start and inspire further development of self-driving vehicles.

The road to unmanned trucking delivery has been long and winding.

Many technology developers and startups have set out to solve the technical and operational challenges of deploying autonomous trucks. Some of those autonomous trucking companies have come and gone, been acquired, exited the industry or pivoted to different business cases. Others continue to make progress toward their goal of large-scale commercial deployments of autonomous trucks.

Along the way, developers have been working to address the many operational details of effectively integrating autonomous driving trucks into real-world freight networks, including vehicle and system maintenance and interactions with law enforcement.

Deployments also will hinge on public acceptance. Developers will need to build trust with government regulators, elected officials and the motoring public.

Regulatory and Safety Concerns

Regulatory and legislative frameworks for autonomous trucks will continue to evolve at the state and federal levels.

Although the autonomous trucking industry appears poised to become an increasingly important part of the freight transportation system at some point in the coming years and decades, the timing and pace of these deployments remain fluid and subject to many variables. But the development work, on-road testing and industry collaboration of the past several years have brought this future into much clearer focus.

Most of the initial efforts on autonomous trucks are devoted to automating specific longhaul routes on interstate highways between designated hubs or distribution centers. In this hub-to-hub model, autonomous heavy-duty trucks would exchange freight at these hubs with human-driven trucks that would continue to handle the local and regional runs at the beginning and end of the shipment’s journey. Other use cases for autonomous trucks include designated shorthaul routes and off-road operations.

It will be a gradual phase-in, but one company, Aurora, sees 2024 as a “pivotal year” for the company, which plans to commercially launch its technology with about 20 fully autonomous trucks with no driver by the end of the year. Kodiak Robotics also aims to begin operating autonomous trucks on public roads without a driver on board in 2024. Most developers envision autonomous trucks as a new mode of transportation that will be appropriate for certain routes and freight types, but not for others.

Nearly a dozen different companies are developing self-driving trucks as of the start of 2024, but the nature of startups results in some companies failing while new ones arrive on the scene. Waymo, TuSimple, Embark and Locomation are examples of companies that have suspended efforts.

As with any technology there are risks of failure but developers make safety their first priority as they know reputation is key to industry adoption and acceptance. Developers of autonomous driving technology have partnered with truck manufacturers to design trucks with redundant braking, steering and other crucial systems to ensure safety in the event of a system failure while no driver is present. Vehicles must not only operate safely, but be protected from potential hacking.

Upfront costs for autonomous trucks will be higher but will be designed to offer cost savings through more efficient freight networks, reduced labor costs, improved driver retention and potential fuel efficiency gains.

Texas, Arizona, New Mexico, Nevada and California have become common testing grounds for autonomous trucks where the highway environment is favorable to long stretches of open road and less challenging climate conditions. Aurora and Kodiak both are planning to roll out their first fully autonomous trucks on Interstate 45 between Dallas and Houston. Torc Robotics also plans to begin fully autonomous operations in Texas on an initial lane between Laredo and Dallas. Developers generally plan to establish national networks of autonomous freight lanes over time, but early deployments have focused predominantly on the U.S. Sun Belt.

The trucking industry will continue to depend on professional truck drivers for the foreseeable future and will need to recruit more drivers, not fewer, as freight volumes increase over time. But autonomous driving trucks could ease the industry’s struggles to recruit drivers and help mitigate high driver turnover rates, especially in longhaul trucking. Hub-to-hub autonomous trucks could shift some driver jobs from longhaul routes to regional and local driving jobs that provide more driver home time and generally see higher retention rates.

Autonomous trucks are currently hauling freight on select routes with safety drivers behind the wheel to monitor the vehicles as they operate on public roads. Companies such as Aurora and Kodiak Robotics plan to deploy trucks without drivers on public roads by the end of 2024. Gatik already has removed the driver in some early deployments of its autonomous medium-duty box trucks. Autonomous truck testing and deployment has been limited to specific freight lanes and operating conditions. It is highly unlikely that autonomous trucks will be able to handle all routes and driving conditions that a human driver could negotiate for decades to come.

To this point autonomous trucking has been largely regulated by individual states. Ohio and Indiana, for example, agreed in July 2023 to test partially automated trucks on a 166-mile stretch of I-70 between Columbus, Ohio, and Indianapolis. In 2023, California legislators passed a bill that would have banned autonomous trucks from being tested on state roads without a driver in the cab, but Gov. Gavin Newsom vetoed the bill in September.

While there are nearly a dozen startups building autonomous trucks or developing self-driving software, some original equipment manufacturers that dominate the traditional human-powered truck market are involved as well, many via partnerships. Daimler Truck is developing autonomous trucks via its independent subsidiary, Torc Robotics. Volvo Trucks North America and Paccar Inc. are partnering with Aurora to integrate and eventually deploy Aurora’s technology on their Class 8 truck models.

Advocates say there are many benefits to autonomous trucks from a safety standpoint. The computers that power them are not subject to potential human driver failings such as becoming tired, distracted or angry. And automated driving software can perceive hazards sooner and react faster than humans can. Autonomous truck platforms also feature secondary braking and steering systems, redundant powertrain controls and cybersecurity safeguards.

While it is uncommon, and certainly less common than with human-powered vehicles, autonomous vehicles do fail. When they do, as has happened with self-driving passenger vehicles from Cruise and with self-driving software available in Teslas, coverage from news outlets and on social media can make it seem like autonomous vehicles fail more often than they actually do. California pulled Cruise vehicles off the road in October 2023 following some safety incidents.

The business case for self-driving trucks from a company standpoint is that since there’s no driver who needs to rest, and the vehicle wouldn't be subject to federal hours-of-service regulations, trucks can remain on the road nearly nonstop, getting goods to their destination and ultimately the customer sooner. This creates money-saving efficiencies.

Autonomous trucks are still refueled by a human.