Staff Reporter

ATA Reports More Tonnage Declines for April

[Stay on top of transportation news: Get TTNews in your inbox.]

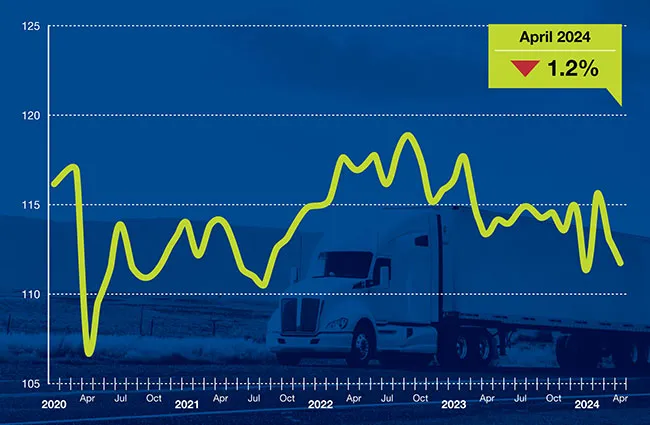

Truck tonnage continued to experience year-over-year declines in April, American Trucking Associations reported May 21.

The ATA For-Hire Truck Tonnage Index dipped 1.5% year-over-year to 111.7. This marked the 14th consecutive month the index declined from the year-ago period. The result also marked a 1.2% decrease from the 113.1 reported for March.

“The truck freight market remained soft in April as seasonally adjusted volumes fell for the second straight month,” ATA Chief Economist Bob Costello said. “With a rebound in freight remaining elusive, it is likely that additional capacity will leave the industry in the face of continued softness in the market.”

Costello

ATA calculates its monthly tonnage index by surveying its membership. The feedback primarily comes from contract freight rather than spot market freight. In calculating the index, 100 represents the year 2015.

“The market is still quite soft,” said Jason Miller, interim chairman of the Department of Supply Chain Management at Michigan State University. “It seems that we’re moving along the bottom of the trough. January was a particularly soft month because of the polar vortex in terms of freight demand. Now, obviously, spot rates went up because supply also gets hit.”

Miller pointed to single-family housing starts coupled with existing single-family home sales as being a possible driver of freight demand. He noted interest rate cuts may trigger pent-up demand for home buying but also sees some potential headwinds, such as decreasing demand for farming equipment and food manufacturing.

Dhawan

“It was a certain type of consumer behavior that is holding steady and better, which is the service-based economy related to travel,” said Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University. “So, whether it’s lodging, whether it’s restaurants, whether it’s air flying, spending on air tickets, that component is doing much better than overall consumption or the overall economy.”

Dhawan noted there is still demand for travel with the economy only being a couple of years removed from the coronavirus pandemic. He pointed out how that includes work travel, such as conferences, but he also has seen people spending less on goods.

Robby Hamby of Bridgestone Americas and Ken Eggen of Wolf River Express share how fleets should acquire the right tire monitoring tools for data collection. Tune in above or by going to RoadSigns.ttnews.com.

“The economy has been decelerating for the last 18 months for multiple reasons,” Dhawan said. “But the rate of deceleration was very slow in the last six months of last year, and one of the main reasons was the pent-up demand for travel. Now, this year, the pent-up demand for travel is still there, even though the economy is decelerating.”

The Logistics Managers’ Index registered at 52.9 for the month compared with 58.3 in March. This breaks what had been four consecutive months of increasing rates of expansion and is the slowest rate of growth observed so far in 2024. The report noted that lower levels of inventory led to a loosening of warehousing and transportation demand.

Rogers

“The first two weeks in April were way down,” said Dale Rogers, an author on the report and a business professor at Arizona State University. “Then in the last two weeks in April, we went back to the growth we saw in the first three months of 2024. And so, we don’t know if the beginning of April was just a weird aberration, or if it was a signal that something was going to happen. But it was way different than at the end of the month.”

The index is compiled by researchers at ASU, Colorado State University, Florida Atlantic University, Rutgers University, the University of Nevada-Reno and the Council of Supply Chain Management Professionals.

“It seems like we’re kind of back to the pre-pandemic levels of 2018 and 2019, where the consumer has been pretty hot and has really supported the healing of a lot of things following the pandemic,” Rogers said. “Business-to-business is not as strong, it doesn’t seem like, as the consumer pull. And that was similar to how things were in ’18 and ’19.”

American Trucking Associations

The Cass Freight Index reported that its shipments reading decreased 4% year-over-year to 1.098 from 1.144. It also found that underlying volumes showed improvement in the first quarter, but volumes are at risk of giving up those gains in the second quarter.

Want more news? Listen to today's daily briefing above or go here for more info

“I’d say we see signs of a broad recovery in freight starting to take shape in the big-picture data, including imports, intermodal volumes and our GDP-based ACT Freight Composite Index,” said Tim Denoyer, the author of the report and senior analyst at ACT Research. “In our view, it just hasn’t started to benefit for-hire fleets.”

Denoyer pointed out that a lot of that activity came from the large private fleet capacity additions over the past couple of years. He believes new truck sales are still at high levels because of private fleets expanding their capacity.

“So the recovery probably won’t be quick, but equipment backlogs are shortening,” Denoyer said. “Lower supply and the limited productivity and higher costs of private fleets should eventually drive demand back to for-hire fleets, but it will take time.”