Staff Reporter

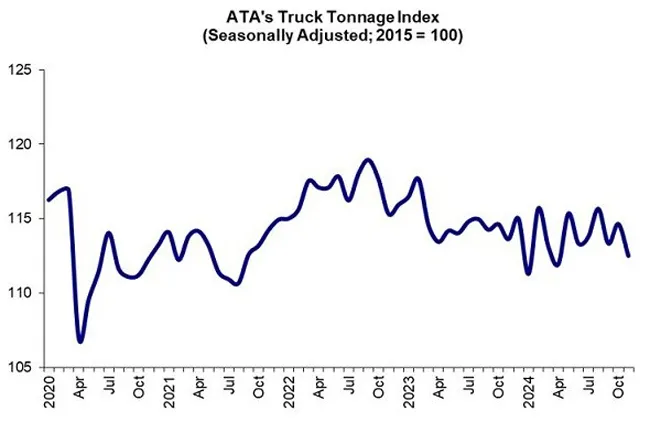

Truck Tonnage Retreats in November After October Gain

[Stay on top of transportation news: Get TTNews in your inbox.]

Trucking activity contracted in November after an October increase, as the freight market continues to show instability, American Trucking Associations reported.

The ATA For-Hire Truck Tonnage Index decreased 1.8% to 112.5 in November from 114.6 in October. The index is down 1% compared with November 2023.

“The frustratingly choppy freight environment continued in November,” ATA Chief Economist Bob Costello said. “Since hitting a low in January of this year, tonnage is up a total of 1.1%, but the path has been fraught with nice gains one month only to come back down the next. The good news is that the overall trend this year is up, albeit at a slow rate.”

Before seasonal adjustments, the raw tonnage index dropped 9.6% to 109.6 in November compared with October.

The November decrease follows a revised 1.2% gain in October.

(American Trucking Associations)

Fear over bottlenecks among shippers was a significant reason for the regression in November, DAT Freight & Analytics Chief of Analytics Ken Adamo said Dec. 20.

“Shippers moved so much freight into the U.S. earlier this year, ahead of potential tariffs and port strikes, that we didn’t see the volumes we might expect in November,” said Adamo. “The exception was [refrigerated] freight. The late Thanksgiving gave grocers a few extra shipping days for fresh and frozen goods.”

Another reason for the ongoing volatility is continued manufacturing weakness, although optimism among segment executives is growing.

Industrial production fell 0.1% in November after declining 0.4% in October, National Association of Manufacturers data shows.

Capacity utilization declined to 76.8% in November, 2.9 percentage points below its long-term average from 1972 through 2023, but increased 1.2% year over year, NAM said Dec. 22.

Manufacturing sector economic activity decreased in November for an eighth consecutive month and the 24th time in the last 25 months, according to a survey by the Institute for Supply Management.

Fiore

“U.S. manufacturing activity contracted again in November, but at a slower rate compared to last month. Demand continues to be weak but may be moderating, output declined again and inputs stayed accommodative,” said ISM Manufacturing Business Survey Committee Chair Timothy Fiore.

Optimism is growing, however, with NAM’s Manufacturers’ Outlook Survey for Q4 2024, released Dec. 17, seeing 70.9% of respondents positive about their company’s outlook, up from 62.9% in Q3.

Meanwhile, ISM data shows its New Orders Index returning to expansion territory and New Export Orders Index increasing moderately, although still in contraction territory.

Further data supporting the perspective that positive momentum is building includes a November Logistics Manager’s Index of 58.4, where a reading above 50 exhibits an expanding economy and a figure below 50 a contracting market. The index has risen for 12 consecutive months.

ATA calculates the tonnage index based on surveys from its membership, with the data primarily reflecting contract freight rather than spot market freight. The index uses 2015 as a base year of 100.

Contract freight rates weakened slightly in November, but are starting to show signs of strength, according to DAT.

The average contract dry van rate in November was $2.40 per mile, DAT data shows, down 1 cent, but 11 cents lower year over year. The contract reefer rate in November was $2.74 a mile, unchanged month on month, but down 18 cents year over year, it added.

But DAT’s iQ New Rate Differential for dry van freight was above zero for the third month in a row for the first time since spring 2022, it said. The NRD measures changes in the contract market by comparing rates entering the market to those exiting it; a positive NRD signals a tightening market and higher rates for shippers.

Adamo

“The NRD suggests that truckload pricing for contract freight is moving higher,” Adamo said. “We don’t expect bold changes quickly, but all indications point to steady rate growth into the first half of 2025.”

Industry analysts expect gradual improvement in freight conditions through 2025, as the market works to correct the current mismatch between demand and capacity.

While uncertainty remains around various economic factors, including potential trade policy changes, experts anticipate the freight environment will strengthen modestly, particularly after the first quarter of the new year.

FTR Transportation Intelligence said Dec. 20 it expects the research and analysis group’s Trucking Conditions Index to be consistently positive by the second quarter of next year and remain that way through at least 2026.

ACT Research, meanwhile, is eyeing a recovery that could be slower than expected. Demand is set to decelerate further as retail inventory adjustments stabilize and replenishment cycles slow and overcapacity, particularly in the truckload market, remains a challenge, it warned Dec. 16.

Want more news? Listen to today's daily briefing below or go here for more info: