Staff Reporter

ATA Reports Sequential Freight Tonnage Rise for July

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry in July saw a sequential rise in freight tonnage but a decrease from the year-ago period, American Trucking Associations reported Aug. 20.

The ATA For-Hire Truck Tonnage Index increased 0.3% from June to 113.7 but was 0.9% lower than July 2023. May marks the only month that has shown a year-over-year increase since February 2023.

“While July wasn’t a strong month, we see continued evidence that the truck freight market is likely turning a corner, albeit slowly,” ATA Chief Economist Bob Costello said. “Some of July’s small gain was likely due to strong import activity, especially at West Coast seaports. Decent retail sales and factory output growing slightly from a year earlier also helped truck tonnage last month.”

ATA calculates its monthly tonnage index by surveying its membership. The feedback primarily comes from contract freight rather than spot market freight. In calculating the index, 100 represents the year 2015.

Dhawan

Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University, said he’s seen an uptick in tonnage coming into U.S. ports, particularly at the ports of Los Angeles and Long Beach. Most likely, this is due to companies trying to get ahead of a potential dockworker strike in September.

The timing is particularly important as much of the holiday season shipping occurs in September. Dhawan pointed out that getting shipments in early can increase inventory costs, but many companies take that on knowing the importance of meeting customer demand.

The increase in port activity is leading to more demand for rail and trucking services. He added that this uptick could last a few months. But he also noted that the underlying economy still appears to be slowing.

Cox Automotive's Kevin Clark discusses how dynamic parts management can transform your fleet services. Tune in above or by going to RoadSigns.ttnews.com.

“But it’s about the shipments,” Dhawan said. “You need to get the stuff in by September, at the latest in October. But if there’s a threat of a strike in September, you would like to get your stuff earlier. Because everybody knows what happens when the ports get clogged.”

The Cass Freight Index reported that its shipments reading decreased 1.1% year over year to 1.110 from 1.122. But the figure did increase 3% sequentially from 1.078 in June. The index highlighted that the year-over-year decline in shipments moderated from 6% in June.

“Goods demand continues to grow slowly, but private fleet capacity additions are slowing, which appears to be reducing the pressure on for-hire shipments,” the report noted. “After rising 0.6% in 2022, the index declined 5.5% in 2023. With normal seasonality, the index will fall about 3% y/y in August and about 4% for the full year.”

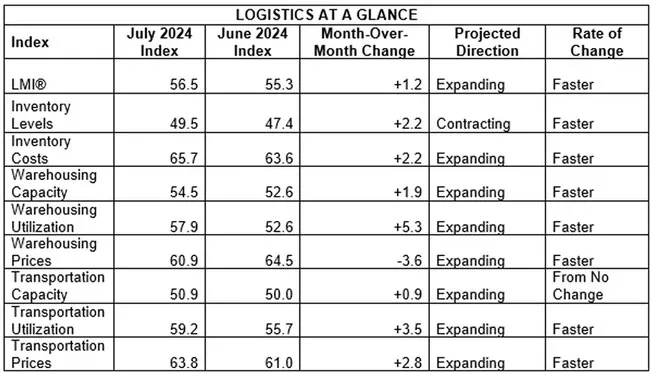

The Logistics Managers’ Index, a monthly survey of logistics professionals that measures the health of the industry over time, registered an aggregate reading of 56.5 for July, compared with 55.3 in June. The index measures the rate of change in components like inventory levels and transportation prices on a scale to 100, where a reading above 50 indicates expansion, and a reading below 50 indicates contraction.

Want more news? Listen to today's daily briefing above or go here for more info

The latest reading is a significant improvement from logistics professionals’ sentiment a year ago, when the index was logging its lowest scores on record. Still, it is below the all-time average (since the index was established in 2016) of 61.9. The report attributed this subdued level of growth to a third consecutive month of inventory-level contraction.

“Achieving a ‘soft landing’ for the economy is kind of like trying to land an airplane on a very small aircraft carrier in rough seas in the middle of war,” said Zac Rogers, associate professor of supply chain management at Colorado State University and author of the LMI report. “It can be done, but it is really hard. For July, the LMI is in its eighth month of expansion. This seems like a good sign, but the events of today going into the 2024 U.S. election are a little concerning.”