Senior Reporter

Class 8 Sales Slide Lower in August

[Stay on top of transportation news: Get TTNews in your inbox.]

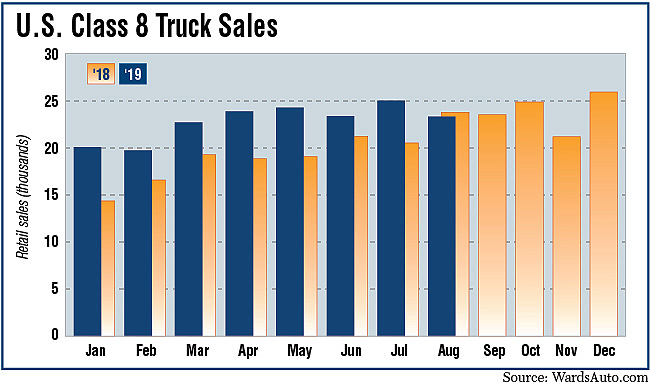

U.S. Class 8 retail sales in August slipped to 23,466, WardsAuto.com reported, and posted the first year-over-year decline in a little more than two years.

Sales fell 1.9% compared with 23,913 a year earlier, according to Wards. The last such decline was in June 2017, when sales fell to 17,310 compared with 18,354 in the 2016 period.

“Maybe we are seeing the earliest signs of weakening,” ACT Research President Kenny Vieth said.

ACT has forecast the publicly traded truckload carriers’ net profits in 2020 will drop to $1.5 billion compared with $2.2 billion this year.

But it could be worse.

“The best year this group of carriers ever had was in 2015, and they made $1.5 billion,” Vieth said. “So that’s one of the it’s-different-this-time metrics that we have to consider in looking for worse expectations for next year.”

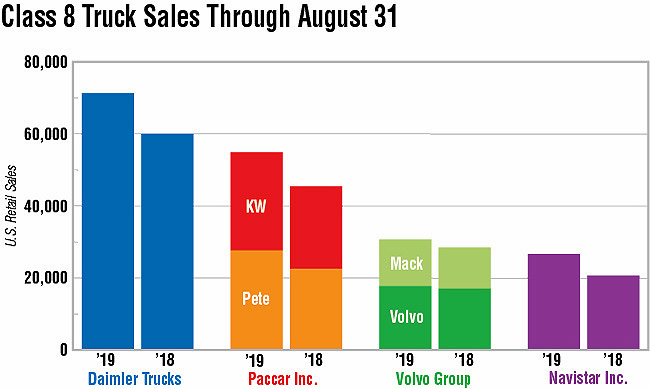

Total sales in August were held back by declines at Freightliner, down 21.2%, and at International, down 7.2%. All other truck makers posted double-digit gains.

Freightliner is a unit of Daimler Trucks North America.

International is the brand of Navistar Inc.

Freightliner remained the market leader and sold 7,535 heavy-duty trucks compared with 9,564 a year earlier.

“We understood it was coming. In a way, the whole industry is just taking a breath,” Scott Williamson, sales manager for Fyda Freightliner Youngstown Inc., told Transport Topics.

“The industry had a couple of great years as far as overall truck sales go,” he said. “I think what we see now is the need for additional new equipment has been satisfied, for the most part. Now we are getting back into kind of a normal replacement level.”

Some Freightliner dealers recently surveyed by Neil Frohnapple, an analyst at The Buckingham Research Group, noted the truck maker has been more aggressive on pricing concessions in the third quarter as the number of build slots rose after increased cancellations. At the same time, the dealers said Navistar and Paccar Inc. continue to be aggressive with pricing on certain deals.

International’s sales in August were 3,402 compared with 3,667 a year earlier — the vocational segment remains a bright spot for the truck maker.

“We have some real momentum building on the vocational side of the business,” Navistar International Corp. Chairman and CEO Troy Clarke said during the latest earnings call. “Obviously, lower volume and share impact, but pretty good business for us and quite profitable, and a lot of those units are still working their way through the truck equipment manufacturers [body builders, upfitters].”

In related news, three truck makers recently announced either outright production cuts of 15%, in the case of Navistar, or down weeks in the case of Mack Trucks and Volvo Trucks North America. Together, these three truck makers accounted for 33% of U.S. Class 8 retail sales in August, according to Wards.

Freightliner is not reducing headcount or production, a spokesman told TT.

“While we don’t typically comment on production, we can say that after two years of very strong demand, it’s become clear that the North American market is softening to a more normalized level, and we need to align our production with demand,” Mack spokesman Christopher Heffner said. “To do so, Mack’s Lehigh Valley operations will take two down weeks in the fourth quarter.”

VTNA also will be taking two down weeks in the fourth quarter at its New River Valley plant “to align with a market that’s normalizing after two extraordinarily strong years,” spokesman Jon Mies said.

Mack and VTNA are units of Volvo Group.

Mack posted sales of 1,773 in August, up 20.2% compared with a year earlier. VTNA had sales of 2,563, up 10.7%.

Paccar Inc.’s two truck brands did not respond to a request for comment.

Peterbilt Motors Co. sales jumped 24.2% to 3,684 compared with a year earlier. Kenworth Truck Co. improved sales by 13.4% to 3,889.

Bob Dieli, chief economist at the research firm MacKay & Co., was asked if all the trucks in service are needed.

WANT MORE NEWS? Listen to today's Daily Briefing

“I would say ‘yes,’ if we stop the nonsense about supply chains. The problem with the trade war is what we call second- and third-order effects,” he said. “These cascade effects are spreading from what I hear from my contacts in trucking and other parts of the economy — agriculture and manufacturing. The supply chains are starting to be rearranged.”

If a tariff lands on Chinese steel, and then someone here doesn’t buy that more expensive steel, two things happen: They don’t hire a truck to move the steel they didn’t buy. Then comes the third-order effect, the trucker doesn’t buy any fuel, or any parts, he said.

Dieli said of supply chains: “It takes time to disrupt them, and it takes time to put them back in place.”