Diesel Average Drops 6.7¢ to $2.866

By Michael G. Malloy, Staff Reporter

By Michael G. Malloy, Staff ReporterThis story appears in the Feb. 2 print edition of Transport Topics.

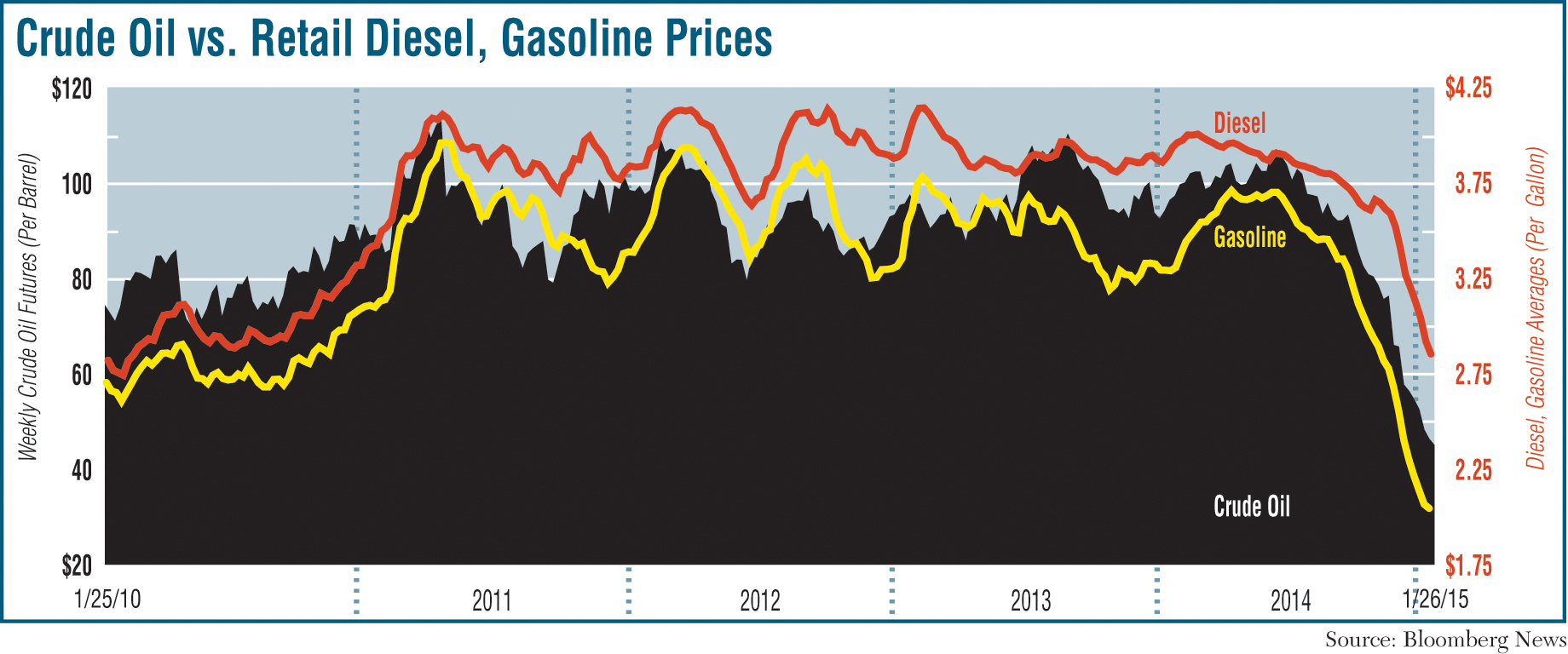

Diesel’s average pump price fell 6.7 cents to $2.866 a gallon, continuing its seven-month downward trend and the lowest price in almost five years, the Department of Energy reported.

The price was the lowest since it was $2.861 on March 1, 2010, and the drop left it $1.038 below the same week a year ago, DOE said Jan. 26 after its weekly survey of fueling stations.

Last week marked the first time since October 2009 that trucking’s primary fuel has been more than a $1 below its year-ago level.

Diesel has declined every week for the past seven months, except one in November, and has dropped more than $1 since June.

DOE also reported that the average retail price for regular gasoline also continued to decline, falling 2.2 cents to $2.044. That was the smallest of its 17 straight declines and left it $1.25 below a year ago.

That was the lowest price since April 2009, and the motor fuel is averaging below $2 in the Midwest, Rocky Mountain and Gulf Coast regions.

“I don’t think we’ll see $3 a gallon diesel again this year,” said Tom Kloza, chief analyst at the Oil Price Information Service,

He added that the declines have helped small fleets in particular.

“Pump prices have moved lower and narrowed the gap between what the big fleets are paying and what the smaller operators are forking over,” he told Transport Topics.

Kloza said many medium and large trucking fleets do not pay full retail price for diesel; instead, they pay cost-plus based on wholesale numbers plus a small markup and taxes.

“The average price that these fleets may be paying for diesel these days is probably closer to $2.25 than it is the $2.86 [national] average,” he said.

An official with an Ohio-based trucking and logistics firm said low prices were not affecting its regular trucking routes, and it’s planning as much as on its brokerage side, where low fuel prices have led to some fuel surcharge challenges.

“It’s always a tough position, when capacity remains tight, to have to backwards-negotiate your pricing,” said Neil Hersh, general manager of Keller Freight Solutions in Defiance, Ohio.

“Sometimes, we have some very dedicated runs, where fuel surcharges are just a straight pass-through,” he told TT. “But when we don’t — and are on the spot market and trying to justify to carriers why we have to pay less when capacity remains tight — is a bit of a challenge.”

In high-supply markets with plenty of trucks, there is generally more ability to be able to decrease fuel-surcharge payments, Hersh said.

“But if you’ve got lanes that are not popular in the trucking industry — tougher lanes — then you’ve got to have good relationships with consistent carriers to get them to take rate concessions [when fuel prices are down], which can be tough,” he said.

Keller Freight Solutions is part of Keller Logistics Group, which also includes Thomas E. Keller Trucking, a regional truckload carrier with about 115 trucks.

Truckload carrier Swift Transportation reported last week that its fourth-quarter fuel expenses fell 11.6% from a year earlier to $133.1 million, due to lower fuel prices and greater fleet fuel efficiency.

Diesel averaged $3.57 in the fourth-quarter — down 30 cents, or 7.8%, from a year earlier, according to DOE. Swift, based in Phoenix, ranks No. 6 on Transport Topics’ Top 100 list of the largest U.S. and Canadian for-hire carriers.

The retail prices dropped as oil continued to tumble with crude futures falling to below $45 a barrel for the first time in almost six years.

Despite the declining prices, still-strong U.S. crude production rose by 27,000 barrels a day in the week ended Jan. 23 to 9.21 million, the highest level since January 1983, DOE’s Energy Information Administration reported Jan. 28.

After that report — which also showed that weekly oil inventories rose 8.9 million barrels — crude futures fell almost $2 to finish at $44.45 a barrel on the New York Mercantile Exchange, the lowest closing price since March 2009.

DOE said in the same report that distillate and gasoline inventories declined by 3.9 million and 2.6 million barrels, respectively, for the week ended Jan. 23. Distillates include diesel and heating oil.

Also last week, analyst Trilby Lundberg said that retail gasoline prices may have landed near a bottom.

“Retail prices will most likely be bottoming soon, if they haven’t already,” she told Bloomberg News after she released the Lundberg Survey of fuel stations on Jan. 25. “In the past 10 days, the wholesale prices that gasoline marketers and retailers pay are up,” she said.