Senior Reporter

Diesel Falls to $2.379; Gas Dips to $2.053; Crude Prices Slide Amid Worldwide Glut

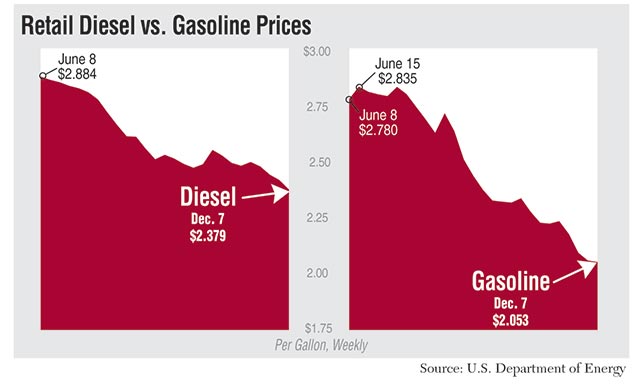

The U.S. average retail price of diesel fell 4.2 cents a gallon to $2.379, marking the fourth consecutive weekly drop, the Department of Energy reported Dec. 7.

The latest decline left diesel just 2.5 cents above the lowest average retail price in nearly 6½ years — $2.354, set on June 1, 2009.

Trucking’s main fuel is now $1.156 a gallon cheaper than the corresponding week a year ago, when the price was $3.535.

Crude oil futures closed below $40 a barrel, settling at $37.68 on Dec. 7, or $24.35 less than $62.03 a year earlier. That was also $2.29, or 5.73%, less than the previous close. U.S. refineries produce diesel and gasoline from crude oil.

Further, key global suppliers voted earlier this month to continue oil production at volumes that have helped keep prices low.

“In past years at this time of year, you might be able to sell diesel as a refiner for $20 or more over the price of crude oil. But for now, there is a glut of crude, there’s not really a glut of gasoline, but there is a glut of diesel,” Tom Kloza, global head of energy analysis with the Oil Price Information Service, in Gaithersburg, Maryland, told Transport Topics.

Diesel prices fell in all regions. It was lowest along the Gulf Coast at $2.232. Although down from the week before, California had the highest price at $2.704.

DOE’s Energy Information Administration also said the national average price of gasoline fell six-tenths of a cent to $2.053 a gallon, as prices dropped in all regions except the Midwest, where it rose 1.3 cents to $1.890.

In its latest short-term energy outlook, EIA forecast the diesel fuel retail price to average $2.71 a gallon in 2015 and $2.67 a gallon in 2016. It averaged $3.83 a gallon in 2014.

Also, EIA forecast U.S. regular gasoline retail prices would average $2.04 a gallon in December 2015 and then climb to $2.36 a gallon for 2016.

“I can’t imagine any trajectory but lower for this month, and I mean sharply lower,” Kloza added.

Oakley Transport, a food-grade liquid bulk carrier buys bulk fuel and equips its trucks with fuel-saving technology as well as arranges for its over-the-road trucks to purchase fuel from a single vendor to help lower fuel costs.

Its over-the-road trucks purchase a little more than 7 million gallons of diesel a year from Love’s Travel Stops, through an economical and long-standing arrangement, Oakley executives said.

Also, the carrier purchases 750,000 gallons a year of bulk fuel for its Lake Wales, Florida, headquarters.

“When [our trucks] come here, it is cheaper for us to have in-house fuel storage than buying from truck stops,” said Peter Nativo, Oakley’s maintenance director.

Also, all of the fleet’s 450 trucks are equipped with auxiliary units that power driver amenities in the cab when the engine is shut off to help reduce fuel consumption.

“We try to keep our idle time below double digits, and it is somewhere around 6% to 8%, where most companies without APUs are in the 30% to 40% range,” Nativo said.

“What we are probably going to see, basically, is flatter pricing” for diesel fuel and oil, said Joel Pivacco, Oakley’s procurement manager, now that oil is so plentiful.

New oil-drilling “technology has come along to help create this [abundance of oil], so hopefully, it will help drive it,” he said.

With prices as low as they are, fuel surcharges “have about tailed off,” Pivacco added.

Key producers said they remain committed to current production levels.

The Organization of Petroleum Exporting Countries last week agreed not to reduce production until possibly the second half of 2016. OPEC produces 60% of the oil traded internationally and 40% of total production, EIA said.

OPEC “will keep pumping about 31.5 million barrels a day,” its president, Emmanuel Ibe Kachikwu, said Dec. 4 after a meeting of ministers in Vienna, according to Bloomberg News. Members set aside their previous daily output target of 30 million barrels, a ceiling breached for 18 months. OPEC will wait until June to decide on a new limit, Secretary General Abdalla El-Badri said.

“Why should OPEC alone sacrifice its part in the market?” Iraq’s Oil Minister Adel Abdul Mahdi asked Bloomberg after the meeting. “Americans don’t have any ceiling, Russians don’t have any ceiling, why should OPEC have a ceiling?”

Oil has slumped about 40% since Saudi Arabia led OPEC’s decision in November 2014 to maintain output, Bloomberg said.