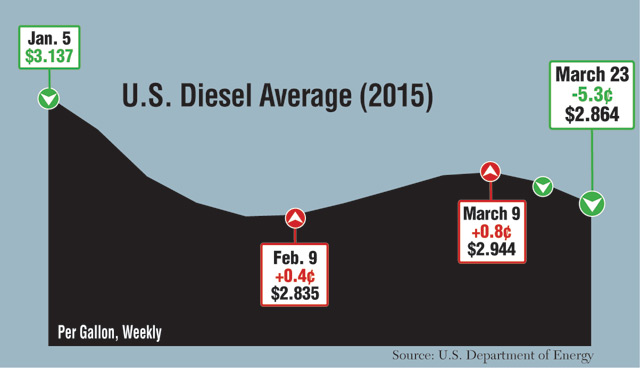

Diesel Falls 5.3¢ to $2.864 in Second Weekly Price Drop

By Michael G. Malloy, Staff Reporter

This story appears in the March 30 print edition of Transport Topics.

Diesel’s national average price dropped 5.3 cents to $2.864 a gallon, the second consecutive weekly decline after five straight increases, the Department of Energy reported March 23.

The downturn, which followed the previous week’s dip of 2.7 cents, left the price of trucking’s main fuel $1.124 below the same week last year, DOE said after its weekly survey of filling stations.

Gasoline, meanwhile, edged up 0.4 cent to $2.457 a gallon, marking the seventh gain in eight weeks, during which the motor fuel has jumped 41.3 cents.

Gas, which had dropped 3.4 cents the previous week, was $1.092 below the corresponding week last year, DOE reported.

The gasoline uptick was primarily the result of seasonal factors, with refineries performing spring maintenance as they prepare to produce summer-blend fuels, one analyst said last week.

“We’re past the heating oil season,” which was the main factor for the diesel drop, said Phil Flynn, senior analyst with the Price Futures Group in Chicago. “Diesel inventories are also doing better. We’re getting closer to the summertime blends of gasoline, which is going to make [gas] a little more expensive,” he told Transport Topics.

Flynn predicted oil prices would rise along with the seasonal gasoline demand heading into the summer driving season, and while that primarily would affect gasoline, it could pull diesel prices higher, too.

“I wouldn’t say diesel is going to take off, but I do think there is going to be some upward [price] pressure on diesel, though most of it will be on the gasoline side,” he said.

Last week’s changes contrasted gasoline’s decline from late June through late January, when it fell $1.66 while diesel fell about $1.09.

“Before, we had gasoline going down [more rapidly], and diesel wasn’t falling as quickly,” Flynn said.

Flynn added that he expects increased trucking demand to put pressure on diesel prices as an improving world economy boosts U.S. export demand, which in turn would drive trucking, and diesel demand, as well as U.S. diesel exports.

“It’s going to tighten supplies of diesel a little bit,” he said. “I do think that we’re close to a low on diesel prices, and we’ll probably start to edge higher.”

Diesel declined most sharply in the Northeast last week, falling 7 cents in New England to $3.20 a gallon and 8 cents in the Central Atlantic to $3.231. Both are subsets of DOE’s East Coast region.

One New England-based carrier executive said the lower prices were welcome relief compared with the previous week and the year-ago level.

“We took advantage of the 7 cents that it came down this week, which brought our surcharge down and helped our customers,” said Sean Bowie, general manager for Chapman Trucking in Auburn, Maine.

And diesel prices are a “lot lower than they have been in the last year or two,” he noted.

Chapman runs 70 big rigs nationwide, a mix of vans and flatbeds, with the flatbeds operated primarily in New England.

The truckload carrier has outfitted its trucks with auxiliary power units to help cut fuel idling, uses low-rolling-resistance tires and caps its trucks’ speeds at 67 mph, Bowie said.

“That’s not as low [a speed] as some, but it’s good enough to show savings,” he told TT. The APUs have provided the “the best bang for the buck” since Chapman added them about four years ago, Bowie said.

Oil supplies jumped 8.2 million barrels for the week, while gasoline fell by 2 million barrels, DOE reported March 25.

Nine days after closing at a six-year low of $43.46 a barrel on the New York Mercantile Exchange on March 17, crude oil prices rose almost $8 on March 26 to finish at $51.43 per barrel on the Nymex.