Diesel Price Bumps Up a Half-Cent to $3.544 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

The national average price of diesel experienced a modest increase of a half-cent per gallon during the week ending Sept. 30, climbing to $3.544, according to U.S. Energy Information Administration data. This marks the second consecutive week of small gains after the previous week’s 1.3-cent rise.

Year Over Year

The national average is $1.049 lower than the same period last year, continuing a long trend of price reductions compared with 2023.

Gasoline Update

The national average price for a gallon of gasoline dipped six-tenths of a cent to $3.179. That's 61.9 cents less than it cost at this time a year ago.

Regional Analysis

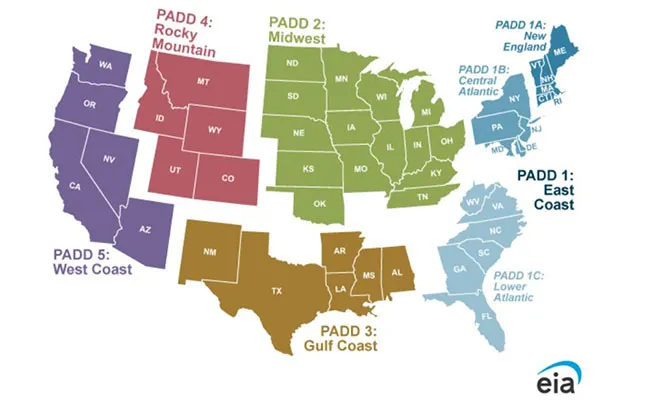

The Gulf Coast region saw the largest increase this week, rising 2.1 cents to $3.212 per gallon, while the West Coast recorded the most substantial decline, dropping by 1.3 cents to $4.226 per gallon.

East Coast (PADD 1): Diesel prices in the East Coast region declined by 0.6 cent, bringing the average to $3.571 per gallon. Each of the subregions within the East Coast showed marginal decreases:

- New England (PADD 1A) prices dropped by 0.9 cent to $3.788 per gallon, driven by a stable supply chain and reduced heating oil demand.

- Central Atlantic (PADD 1B) recorded a 0.11-cent decline, ending the week at $3.802 per gallon. This subregion is 95.7 cents below last year’s levels, one of the most substantial annual declines on the East Coast.

- Lower Atlantic (PADD 1C) posted a minor 0.4-cent decrease, with the price standing at $3.463 per gallon. Year over year, prices in this subregion are down 99.2 cents, reflecting the impact of improved distribution efficiency and consistent import levels.

U.S. On-Highway Diesel Fuel Prices

U.S. Energy Information Administration

Midwest (PADD 2): The region saw a 0.9-cent increase in diesel prices, ending the week at $3.520 per gallon. This marked the second-highest regional gain after the Gulf Coast. While the rise may indicate stronger agricultural demand during the harvest season, prices are still 92.9 cents lower than the same week last year. This year-over-year decline is consistent with broader national trends, highlighting a balanced supply outlook for the region.

Gulf Coast (PADD 3): The Gulf Coast experienced the largest increase this week, with diesel prices rising 2.1 cents to $3.212 per gallon. The region’s low prices continue to reflect its proximity to major refining centers and robust regional supply. Year over year, Gulf Coast prices are down $1.067, the second-largest decline among all regions, offering sustained relief for carriers operating along this corridor.

PADD — Petroleum Administration for Defense Districts. U.S. Energy Information Administration

Rocky Mountain (PADD 4): The Rocky Mountain region saw a modest increase of 0.4 cent, bringing prices to $3.612 per gallon. The region has experienced limited price fluctuations over recent weeks, and the latest data shows a $1.166 decline compared with the same period in 2023. The ongoing trend of stable prices is largely attributed to the region’s isolation from the broader U.S. diesel distribution network, leading to less volatility.

West Coast (PADD 5): The West Coast recorded the most significant decline this week, with prices dropping by 1.3 cents to $4.226 per gallon. Within the region:

- West Coast less California prices fell 1.8 cents, ending the week at $3.797 per gallon. Year over year, prices are down $1.393.

- California, which continues to report the highest diesel prices in the nation, saw a slight decrease of 0.8 cent to $4.719 per gallon. This marks a significant $1.55 decline compared with the same week last year, underscoring improved supply conditions and reduced refining costs.

Looking Ahead

The broader market outlook suggests that while recent weeks have shown a slight upward trend, the long-term trajectory still leans towards stable or slightly declining prices, especially as demand softens heading into the fall and winter seasons.

Want more news? Listen to today's daily briefing below or go here for more info: