East Coast Ports Scramble to Absorb Cargo

[Stay on top of transportation news: Get TTNews in your inbox.]

East Coast ports are modifying their operations to absorb cargo diverted from Baltimore harbor, where salvage specialists are starting to clear debris from the destroyed Francis Scott Key Bridge and authorities are racing to establish a temporary channel to reopen traffic.

The Port of Virginia, with terminals at the mouth of the Chesapeake Bay near Norfolk, opened a gate April 1 at 5 a.m. — an hour earlier than usual — to help accommodate more truckers. The Port of New York and New Jersey, which is expecting additional cargo including autos, is working to allow quick access for transport companies that usually go through Baltimore. A major railroad is expanding its services, too.

Those efforts underscore the adjustments underway after last week’s deadly bridge collapse, which indefinitely closed the nation’s 17th-largest port by total cargo tonnage and the busiest gateway for vehicles. Snarls, delays and added costs are more likely to appear outside ports as tens of thousands of shipments require longer routes on already-crowded roadways and rail lines.

“The ports on the East Coast can easily absorb the immediate aftermath on containerized trade,” said Sanne Manders, president of international operations at Flexport Inc., a digital freight platform. “The longer-term aftermath will probably be more severe, because even if you take away the debris from the port, that is an extremely important bridge as a feeder into the port, and traffic will have to reroute a long, long way.”

While there’s no timeline yet for reopening the Baltimore channel, giant cranes are being put in place to begin dismantling wreckage from the bridge, U.S. Transportation Secretary Pete Buttigieg said March 31. It’s important “to our national supply chains to get that port back up and running as quickly as possible,” he said on CBS’ Face the Nation.

The temporary channel will be marked with government lighted aids for navigation and have a controlling depth of 11 feet, a 264-foot horizontal clearance and vertical clearance of 96 feet. The current 2,000-yard safety zone around the Key Bridge remains in effect.

“This will mark an important first step along the road to reopening the port of Baltimore,” said Capt. David O’Connell, Federal On-Scene Coordinator for the response. “By opening this alternate route, we will support the flow of marine traffic into Baltimore.”

As of March 31, there were 29 bulk cargo, container and vehicle carriers anchored outside 10 ports between Boston and Jacksonville, compared with 18 on March 30, according to satellite tracking data compiled by Bloomberg.

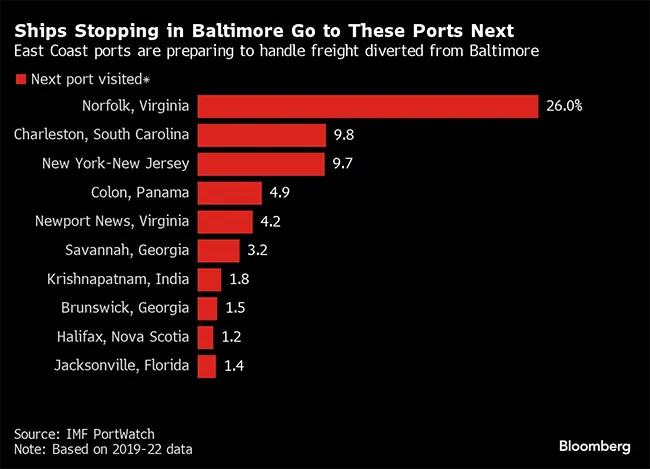

Norfolk, New York and Charleston, S.C., are most often the next destinations for cargo ships leaving Baltimore on scheduled routes, according to an analysis from the International Monetary Fund’s PortWatch platform. That makes them the likeliest to absorb more imports in the short term.

CSX is taking proactive steps to help mitigate freight shipment disruptions in the transportation industry by launching a dedicated service solution between Baltimore and New York, in response to the devastating March 26 incident in which a cargo ship collided with the Francis… pic.twitter.com/n2VTC8R48j — CSX (@CSX) March 30, 2024

CSX Corp., the Jacksonville, Fla.-based railroad, said it’s starting to offer a rail service designed to move diverted Baltimore freight from New York.

Gateways including New York’s and Virginia’s are handling about 20% less volume than they were during their pandemic peaks, leaving officials confident they have the extra capacity to avoid extended bottlenecks.

If all goes to plan, truck drivers who normally book pickup and dropoff appointments in Baltimore should be able to do so this week at terminals elsewhere in the region.

“The Port of New York and New Jersey is proactively working with our industry partners to respond as needed and ensure supply chain continuity along the East Coast,” port director Bethann Rooney said in an emailed statement.

According to data released by FourKites Inc., a supply chain visibility platform, the diversions are adding five days to the delivery times on ground modes of transportation.

“Even once they remove the rubble from the water, traffic in the area will be impacted as truck drivers become reluctant to take loads in and out of the region without a price increase,” said Jason Eversole, vice president of professional services at FourKites.

The local devastation wrought by the crumbled bridge and the closure of Baltimore’s port will linger in the region for a few months, several economists said.

Though relatively small in economic impact, it’s another stark example of the kinds of supply chain shocks to a globally connected hub that have sent shudders through corporate boardrooms and political circles about the need for more resilience and self-sufficiency.

Those kinds of jolts have been felt across the world, including by ships sailing around Africa to avoid Houthi attacks in the Red Sea, or delays transiting the drought-stricken Panama Canal.

And other shocks just damage local economies — including a port strike in Finland; South Africa’s unreliable logistics infrastructure; and a containership that crashed into dockside cranes in a Turkish port earlier this month.

Want more news? Listen to today's daily briefing above or go here for more info

“Trade is actually holding up pretty well — trade flows are still moving, companies are finding workarounds, and most of this disruption seems to be rather temporary,” said Shanella Rajanayagam, a trade economist with HSBC Holdings Plc in London.

HSBC economists recently boosted their forecast for world trade growth this year to 2.5% and maintained their outlook for a 3.4% expansion in 2025. That would be a marked improvement from 2023, which many observers expect will show little to no growth once final figures are compiled.

Rajanayagam said that although container shipping rates from Asia to the U.S. East Coast might spike temporarily in the aftermath of the Baltimore disaster, the bigger risks to global commerce are those involving geopolitics, protectionism, election-year uncertainty and climate change.

“It all seems to be pointing to the downside rather than to the upside, so it makes sense to brace for those shocks,” she said.