The Detroit News

Unsteady EV Demand Drives Automaker-Supplier Tension

[Stay on top of transportation news: Get TTNews in your inbox.]

Rising costs and unsteady demand for electric vehicles remain major sources of friction between automakers and their suppliers, according to a new Plante Moran survey examining supplier-automaker relationships.

“The No. 1 tension right now is around the electric vehicle product plans and product cycles,” said Dave Andrea, principal in Plante Moran’s automotive and mobility consulting practice. “And that’s a combination of both timing of those [EV] programs, as well as the anticipated volumes of the programs. And that’s because that drives what the suppliers’ investment requirements are.”

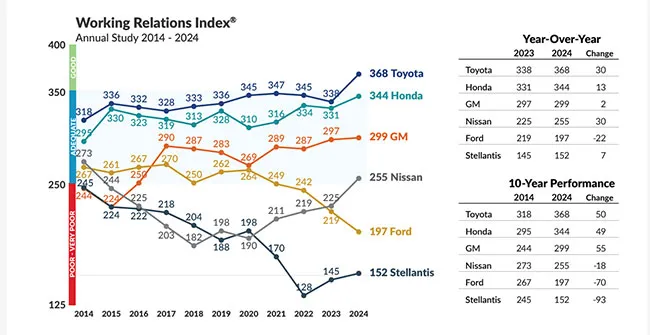

The 2024 North American Automotive OEM-Supplier Working Relations Index Study collected surveys from 696 tier-one supplier executives from February to April. In its 24th year, the survey asks suppliers about their relationships with six major North American automakers across eight major purchasing areas.

Toyota Motor Co. once again got the highest marks from suppliers. Of the Detroit Three, General Motors Co. achieved the best supplier approval, slotting in at third overall, below Honda Motor Co. Ltd.

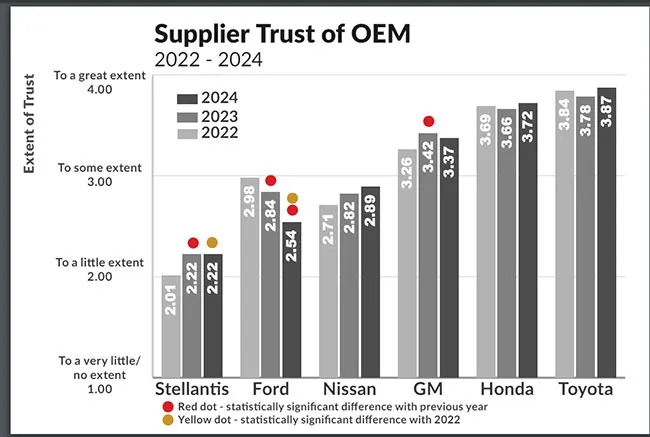

(Plante Moran/PR Newswire)

Ford Motor Co.’s overall score dropped, and it remained in fifth place, behind Nissan Motor Corp. but above Stellantis NV, which has ranked at the bottom of the Plante Moran study’s results for several years.

All six automakers except Ford saw at least some improvement in their supplier relationships in this year’s index. Ford dropped 22 points, and was down 70 points and two spots since 2016. A Ford spokesperson didn’t respond to a request for comment.

Andrea noted Ford, which separated its electric vehicle business from its traditional operations two years ago, appeared especially stung in the survey by its recent EV challenges, and how those challenges have trickled down to affect suppliers. Both Ford’s buyer metrics dropped, as did its business practice ratings.

“This is one of the things that the whole industry has to deal with: If we have that type of volatility in the marketplace [with EVs], and we’re making this major transition that comes with its own set of major investments, the industry has to be flexible to deal with that uncertainty,” Andrea said.

GM, unlike Ford, has seen a “continual increase” in its supplier scores, he said, even despite three recent changes of leadership for its purchasing and supply chain division. That shows that “the organization is putting supplier relations at the top of their list as a priority,” he said, and also demonstrates how the company’s engineering and manufacturing divisions are well-aligned with the purchasing and supplier side.

“We’re proud of the results GM achieved in the Supplier Working Relations Index and value our suppliers and the role they play in enabling us to deliver world-class vehicles,” Jeff Morrison, GM vice president of global purchasing and supply chain, said in a statement. “We will continue to collaborate and strengthen our supplier relations by enhancing communication, transparency and accountability, while rewarding high-performing suppliers.”

(Plante Moran/PR Newswire)

Stellantis has been at the bottom of the six-company pack since 2021, though it gained seven points in the most recent survey. Key metrics on supplier trust of the automaker, as well as communication, were flat from last year.

Stellantis has taken a “harder line” than other automakers with suppliers, Andrea said, including on part price negotiations and productivity. New leadership for North America purchasing has helped the company’s supplier relations somewhat, including as Stellantis bounced back from stringent supplier contract terms that it imposed two years ago and was forced to rescind, he said.

“But in terms of the relationship, and the trust, and all of those elements — the qualitative elements that we measure — those have not bounced back,” Andrea said.

Stellantis is currently embroiled in several financial disputes with suppliers, as well as at least three lawsuits involving suppliers. In at least two instances, plant shutdowns have occurred this year as suppliers have sought more compensation due to rising costs, and withheld, or threatened to withhold, deliveries if Stellantis did not pay up.

“Over the last few years, Stellantis has implemented multiple strategic initiatives working with our Supplier Advisory Council to enhance our communications, collaboration, and support with our supply base,” Stellantis said in a statement sent by spokesperson Jodi Tinson. “We’re encouraged that our performance in the Supplier Working Relations Index study continues to improve and are committed to working with our suppliers to deliver the products and technology that ensures affordability for our customers.”

Want more news? Listen to today's daily briefing above or go here for more info

The Plante Moran study noted that among the top priorities for automakers should be overhauling outdated contract terms and purchasing practices to make them better suited to fluctuating EV demand. There must be additional flexibility built into contracts, it said.

Instead of suppliers having major capital investments like new plants or production lines paid for over time by each part that is shipped, automakers should consider funding some of those major supplier investments upfront, to make them less risky if demand for a particular component doesn’t pan out.

“You can capture those estimated costs, and write a separate contract to the customer for those investments,” Andrea said. “And that gets paid, so that keeps the supplier whole, and no matter if it’s 50,000 units that’s shipped, or 100,000 units that ship, the supplier can adjust, because they’ve been paid for those fixed costs.”

Distributed by Tribune Content Agency, LLC