February Truck Sales Up 28%

This story appears in the March 16 print edition of Transport Topics.

Demand for new heavy-duty trucks showed no sign of slowing in February, as sales climbed 28% compared with the same month last year, WardsAuto.com reported.

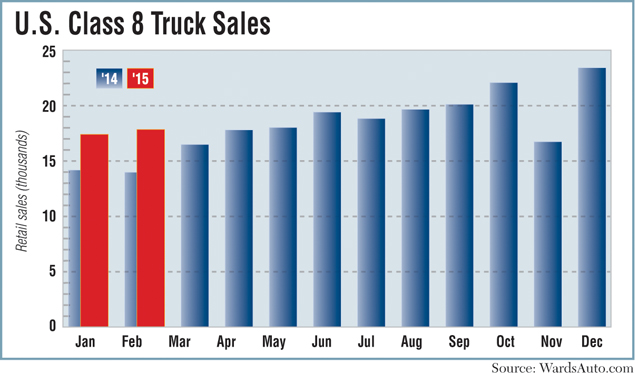

U.S. retail Class 8 sales increased to 17,811 last month, up from 13,949 a year earlier and a 3% gain from 17,373 in January.

Through two months, cumulative 2015 sales have totaled 35,184, a 25% increase from the same timeframe last year. Sales have exceeded 16,000 for 12 consecutive months.

“We’re seeing some of the replacement and expansion that we’ve been waiting for,” said Lawrence De Maria, an industry analyst at William Blair & Co. “The orders that we saw last year are turning into sales.”

The sustained growth in January and February lends strength to predictions by manufacturers and analysts that the Class 8 market will be even stronger this year than in 2014, which was the industry’s best year for retail sales since 2006.

De Maria said he expects “solid growth” to continue in 2015, although the year-over-year sales gains may decelerate from their current pace.

Elevated levels of replacement purchases continue to be the main driver of the sales growth, he said.

“Fleets are getting more comfortable with replacing their old trucks with newer, more efficient trucks, but you’re seeing some elements of expansion too,” De Maria said.

Original equipment manufacturers provided similar assessments.

Magnus Koeck, vice president of marketing and brand management for Volvo Trucks in North America, said the strong February sales “reflect a host of positive economic indicators in manufacturing, employment, freight demand and energy costs.”

Volvo’s Class 8 sales jumped to 2,211 heavy trucks in February, up 49% from a year earlier, according to Ward’s. That growth boosted the brand’s market share to 12.4% from 10.6% a year ago.

John Walsh, vice president of marketing at Mack Trucks, said, “Key drivers of the strength in Class 8 truck sales include continuing replacement demand, as well as some fleet expansion as manufacturing and overall freight levels remain strong.”

Sales at Mack climbed 35% to 1,206 vehicles, representing 6.8% of the total market, up from 6.4%.

Volvo and Mack are part of Volvo Group.

Sales at Kenworth Truck Co. leaped 57% to 2,686 trucks, representing 15.1% market share, up from 12.3% a year ago.

Peterbilt Motors Co. sold 2,470 trucks last month, a 19% gain from a year earlier. It captured 13.9% of the market, down from 14.9% in February 2014.

Kenworth and Peterbilt are operating companies of Paccar Inc.

Fleets are continuing to replenish their equipment after delaying replacement purchases during the recession years, said Will Bruser, president of Truckworx, a Kenworth dealer operating eight locations in Alabama and Mississippi.

He predicted that the replacement purchases among over-the-road fleets could taper off in 18 to 24 months. That could be offset, Bruser said, by the vocational sector, where demand for day cabs and dump and mixer trucks has been picking up.

At least for now, though, business is strong in the longhaul and vocational segments.

“I think this is going to be a banner year because you’re going to have both hitting on all cylinders,” Bruser said.

Market-leading Daimler Trucks North America sold 7,002 Freightliner trucks last month, a 29% increase from a year ago. The Freightliner brand accounted for 39.3% of all Class 8 sales in February, up from 39% in the same month last year.

“We are excited that DTNA continues to have year-over-year increases both in volume and in share,” said Diane Hames, general manager of marketing and strategy. “We believe this success is being driven by our industry-leading Cascadia Evolution and our continued strength in the growing heavy-duty vocational segments.”

DTNA’s Western Star brand posted 6% sales growth to 333 trucks, for 1.9% of the market.

Meanwhile, Class 8 sales volumes at Navistar Inc. slipped 6% to 1,902 units. Market share for its International brand trucks fell to 10.7% compared with 14.5% a year earlier.

Navistar has been working to rebuild its market share after its previous engine strategy failed to meet tighter federal emissions standards. The manufacturer has since adopted the selective catalytic reduction technology used by all of its competitors.

During the company’s March 3 earnings call, CEO Troy Clarke said Navistar expects sales volumes in all of its business segments to rise in 2015 but added that there will be “some fits and starts” based on the way customers place orders and when they’re in a “buying mood.”

The company is taking its efforts to rebuild its market position “one inning at a time,” he said.