Ford’s Commercial Business Is Defying the EV Slump

[Stay on top of transportation news: Get TTNews in your inbox.]

While malaise sets in across much of the electric vehicle market, there’s a corner that’s still going strong, where buyers like Chris Russo show little concern about high prices or range anxiety or spotty charging infrastructure.

The co-founder of Elite Home Care, a South Carolina-based company, bought his first EV more than two years ago — a Ford E-Transit van that his business uses every day to transport senior citizens. Since then, he has added dozens more battery-powered models, electrifying nearly his entire 100-vehicle fleet. Russo figures he saves $6,500 a year on each EV compared with similar-sized gas-powered vehicles because of lower fuel and maintenance costs. And with 100 chargers at his company’s vehicle depot, the fleet can operate with clockwork-like efficiency.

“Our drivers go out, do the job, come back to our site, charge it overnight, come back the next day and do it again,” he said. “It’s just like charging a phone.”

Demand from fleet-based vehicle operators is a lone bright spot for the EV industry as global sales sputter. While retail buyers balk at high sticker prices and worry about where they will charge up on a road trip, business owners say EVs are ideal for routine, relatively short-distance routes.

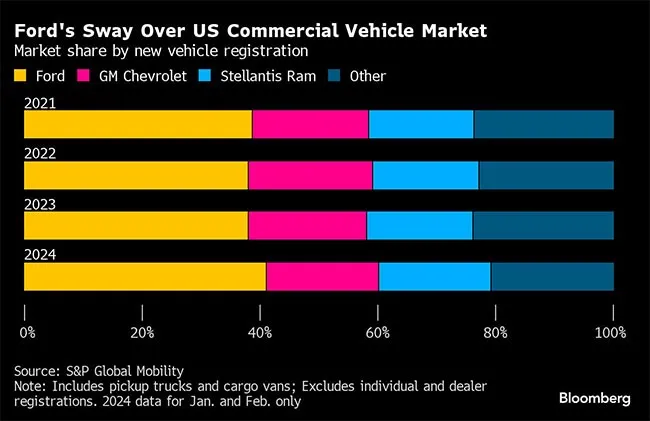

The trend is especially pronounced at Ford Motor Co., which sells more work trucks and vans in the U.S. than any other carmaker. Ford Pro, the company’s commercial division, has become its biggest and most profitable growth engine.

“EV adoption on Pro is actually going much better than we thought,” CEO Jim Farley told analysts at a conference in February. “They use the vehicles more intensely, so the operating costs on the energy side are much better than they thought. We can’t make enough E-Transits.”

All of this has made Ted Cannis, CEO of Ford Pro, something of a rising star. The 35-year company veteran has served as head of the unglamorous commercial business for the past four years. Previously, he headed Ford’s global electrification push, something he has worked to integrate as part of Pro’s seamless suite of hardware and software products.

“You can find it all in one place,” Cannis said in an interview. “That premise is working beyond my wildest dreams.”

Long before EVs entered the lineup in 2022, the company enjoyed a leading position in fleet sales. But rivals have taken notice and are beefing up their own offerings.

General Motors Co. introduced its Envolve commercial service a year ago, which includes electric BrightDrop vans. Rivian Automotive Inc. has a big contract with Amazon.com Inc., its largest investor, to supply it with 100,000 electric delivery vans by 2030.

A Ram ProMaster. Stellantis recently introduced the Ram Professional division. (Stellantis via Tribune Content Agency)

Stellantis NV recently introduced the Ram Professional division and is aiming to have commercial vehicles account for half of the automaker’s revenue by 2030. The new head of sales for Ram Professional recently told fleet buyers at a work truck trade show in Indianapolis that his “mission” is to “crush Ford,” according to trade publication Fleet Owner.

That may not be so easy, given Ford’s head start, says Olivier Blanchard, an analyst at Futurum Research.

“I don’t think you’re going to see huge market share shifts with other companies entering the arena,” Blanchard said. “What you will see, though, is more adoption of EVs in commercial fleets.”

It will be hard to pry away customers like Ecolab Inc., a water purification company with $15 billion in annual revenue that’s been doing business with Ford since the days of the Model T. In January, the St. Paul, Minn., company signed a deal with Ford to purchase 1,000 EVs over the next 18 months. Ecolab expects to see a 50% savings on fuel and a 20% increase in the time the vehicles are on the road in service.

But what really sealed the deal were the deep price cuts that Ford, like other EV makers, have been making to stimulate demand. Ecolab is looking forward to prices dropping even further as it seeks to electrify its entire 11,000-vehicle fleet by 2030.

Amazon expects to have 100,000 electric delivery vehicles by 2030, part of its commitment to achieve net-zero carbon emissions by 2040. (Amazon.com Inc.)

“We haven’t hit the bottom yet, there’s still pressure on some of the EV pricing,” said Mike Hauge, Ecolab’s fleet electrification manager.

Even for the work truck business, EVs are a loss leader because battery costs remain high and sales volumes are still relatively low. While Ford doesn’t expect to make money on sales of commercial EVs until its second-generation vehicles debut in 2026, the automaker is countering some of those losses by upselling buyers on connected-car logistics and servicing contracts.

Ford already has a half-million commercial customers signed up for business software subscriptions and telematics services to manage and maintain their fleets more efficiently. Farley predicts software and services will make up 20% of Ford Pro’s profits by 2026, bringing to reality a much-deferred vision to make money from smartphones on wheels entertained a decade ago by industry leaders.

Growth in those areas, along with strong sales of traditional internal-combustion engine vehicles, helped boost Ford Pro’s earnings before interest and taxes by 80% last year. Ford is projecting its commercial unit will become its most profitable division in 2024, earning between $8 billion and $9 billion on that basis.

Ford doesn’t have that kind of software revenue stream yet to sop up red ink flowing from its retail EV sales, which stand to lose as much as $5.5 billion this year. Investors will get an update when the company reports first-quarter earnings on April 24.

The automaker is working to maximize business-to-business division profits to help offset those losses, and to play up its success in the commercial segment. When the carmaker announced in early April the postponement of a pair of mass-market EVs — a three-row SUV and a full-size pickup — it noted a new EV for Ford Pro is still on track to start production mid-decade in Ohio.

EV transition among fleet buyers — which includes government clients, public utilities and small businesses — has been aided by Ford’s efforts to market them to its large commercial customer base. Commercial EV sales are eligible for the full $7,500 federal tax credit to stimulate zero-emission vehicles. Ford is further sweetening the offer with 0% financing on some E-Transit van models. It even created a step-by-step “eGuide.”

Want more news? Listen to today's daily briefing above or go here for more info

For now, the bulk of Ford Pro’s profit comes from selling old-school gas- and diesel-fueled pickup trucks and vans. That helped give Ford Pro an earnings before interest and taxes margin of 12.7% last year — the best in the company and higher than Tesla Inc. on that basis.

This year, Ford sees that margin reaching the mid-teens as it realizes the full benefit of a redesigned Super Duty pickup that rolled out slowly last year due to the United Auto Workers’ six-week strike.

Ford Pro’s performance seems to be flying under investors’ radar, as the company’s shares are flat so far this year. But Morgan Stanley analyst Adam Jonas compared the unit to Ferrari, the value of which was largely overlooked until it was spun off from parent Fiat. “Ford has a Ferrari, it’s called Ford Pro,” Jonas said during Ford’s latest earnings call. “People are ignoring the cash cow.”