Staff Reporter

How the Freight Market Trough Defined 2024

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry continued to be defined by a market trough this year, but one that has shown some minor signs of improvement.

The pandemic brought with it a surge in freight demand amid the resulting changes in consumer behavior. But the freight cycle eventually caught up with the boom as pandemic restrictions phased out. The resulting decline in freight demand also meant the industry had too much capacity. It has struggled to regain traction in the roughly two years since.

“Trucking is now in the longest and deepest freight down cycle since the 2007 global financial crisis,” said Michael Castagnetto, president of the North American surface transportation division at C.H. Robinson Worldwide. “A typical freight recession lasts 10 months. The previous record was 24 months. We’re now in Month 34 of this one. A multitude of dynamics will influence how long this trough continues, including capacity trends, the economy and trade policy.”

C.H. Robinson ranks No. 2 on the Transport Topics Top 100 list of the largest logistics companies in North America.

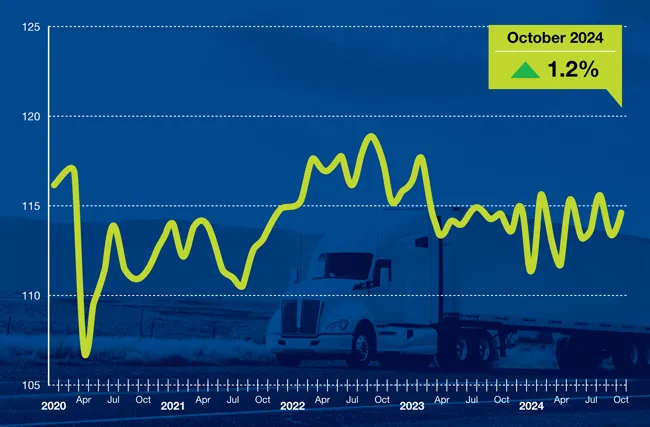

(American Trucking Associations)

American Trucking Associations showed that tonnage has been slowly climbing since hitting a low of 111.0 points in January 2024. The latest data from its tonnage index shows it even gained 3% since that point, reaching 114.6 in October. But that still is well below where the cycle peaked at 118.8 in September 2022.

Vise

“It was a very stable year in terms of freight volume, and frankly, capacity also,” said Avery Vise, vice president of trucking at FTR Transportation Intelligence. “While it’s easing very gradually, it did not really change very much at all either. We have seen, especially at the beginning of the year, a lot more carrier failures. But that has really stabilized at this point.”

Vise noted that the past four months averaged about 400 carrier failures. But that’s compared with an average of 1,700 monthly failures throughout 2023. He stressed that doesn’t necessarily translate to capacity, but payroll data suggests larger carriers are not adding capacity.

“In fact, it probably whittled away a little bit, while the small carriers have stayed the same,” Vise said. “You have a freight environment that is slightly improved, and you have capacity that is very slightly lower. That has produced the makings of a recovery next year when we look at rates, which is really how I think most people view a recovery.”

Castagnetto echoed the point by noting the explosion of trucking firms during the pandemic has continued to ease. He anticipates carriers will continue to leave the market until capacity returns to normal levels, which could be by June. He also stressed it likely won’t be just one factor that changes the trajectory of the industry.

Castagnetto

“Growth in freight volumes could help correct the capacity imbalance, depending on how the economy performs in the coming months,” Castagnetto said. “We’re particularly watching three key areas that drive the most freight: manufacturing, construction and retail. Industrial production has been flat for nearly two years. Housing starts are down but increasing sequentially, and we know that every home built generates about eight truckloads of freight. Consumer spending is the one bright spot for the 7,500 retailers we serve.”

C.H. Robinson is projecting that cost per mile this year will be 5% below 2023. The third-party logistics company has tracked truckload rates bouncing along the bottom of the market for most of this year but also forecasts a 9% improvement next year. Much of that growth is expected to occur in the second quarter.

“I agree with labeling it as a trough,” said Mazen Danaf, staff applied scientist and economist at Uber Freight. “I think what we saw is just seasonality being the main driver of a market with stability otherwise. So we saw the market tightening in the beginning of the year with the winter weather and all of that.”

Danaf added that the market tightening lasted through the first two fiscal quarters but then underwent some softening that continued until recently. He believes that this indicates that seasonality is back and has been the primary driver of the current market. Uber Freight ranks No. 13 on the logistics TT100.

Danaf

“What we saw in the first half of the year was just seasonality with a slow downward trend, and in the second half of the year it was seasonality with a slow upward trend,” Danaf said. “I think we’re past that trough. At least that’s what the different indicators we were looking at are showing.”

Danaf expects that the market will continue to move slowly with there being no foreseeable shocks to the supply-and-demand landscape. He compared the current market to the upswing that occurred during the pandemic when there were numerous shocks. He noted those were sudden and major enough to impact the market, but now that isn’t the case.

“In the overall economy, it’s been not bad,” said Lee Clair, a managing partner at Transportation and Logistics Advisors. “However, it’s a tale of two cities, because within that number, there are services and there are goods. The services numbers have done well, the goods numbers have done terrible.”

Inflation is a potential factor for why drivers have been slow to retire, even in a down market. As inflation rises, it becomes more difficult to determine how much savings will be needed for retirement. (shaunl/Getty Images)

Unfortunately, strong demand for services does little to nothing for freight, Clair explained. So trucking and logistics companies have experienced low demand for about two years now.

Clair noted that freight demand decreasing traditionally would have led to drivers looking for jobs elsewhere because of the lower miles and pay. He pointed out that much of the workforce is older, too, so there also would be retirements expected to add to that number. However, he hasn’t seen that happen as much as would be expected for the current downturn.

Lee Clair

“I was amazed at the fact that has not happened,” Clair said. “The reason is that during COVID and the recent run-up, the pay rates went up significantly. So even when demand falls and miles fall, and their income falls, it’s still a lot higher than what it was before, and it’s still a good income. It’s still better than most of the other things they can go do.”

Clair also pointed to inflation as a potential factor for why drivers have been slow to retire. As inflation rises, it becomes more difficult to determine how much savings will be needed for retirement. He also noted that carriers going bankrupt doesn’t necessarily impact capacity, but it does mean drivers may have to find new jobs at possibly lower rates.

“If you’re on the asset side or the provider side, it’s been a tough year,” AFS Logistics CEO Andy Dyer said. “If you’re on the buyer side, it’s been a really good year. The pricing power has still rested on the buy side of the transaction for almost the entire year. There might be bits and bobs here and there you could point to, but in general there’s still ample capacity, which is forcing rates down. There’s no tangible, imminent demand curve.”

Dyer stressed that the industry still is relatively oversupplied and that there doesn’t appear to be anything coming that could drive a sustained and elevated demand. He does anticipate increased opportunities for panic buying given the proposed trade policies, but that would mean moving cargo earlier than planned so any resulting increase would be borrowing from the future.

Dyer

“It’s going to take a true demand spark to change it, and panic buying is not that,” Dyer said. “I think a lot of small and midsize brokers will continue to exit the industry, particularly those that don’t have any other complementary revenue services.”

Dyer expects the upturn to primarily be a supply-side correction that will largely start with brokerage before impacting the asset side. He also anticipates continued reduction in interest rates, which he noted could help free up some capital in a way that bolsters demand.

Perrone

“It’s been a very challenging year in the business overall,” said Tom Perrone, senior vice president of global professional services at Project44. “Pressure from consumers to be more environmentally friendly, carbon neutral, pressures from shippers to make the movement of goods cheaper, and then combine that with governments who are continually still looking at ways to regulate either sustainability initiatives, driver hours, consolidation in the industry.”

Perrone has seen companies leveraging technologies such as artificial intelligence to meet these pressures. He highlighted route optimization, pre-emptive maintenance and predicting market swings as some of the ways technology has helped. He also noted that companies have been leveraging other transportation modes such as rail more. But he also suspects the volatility this year helped to somewhat counter the negative effects that mode shifting has on trucking.

Faghri

“Through our disciplined focus on service and quality, XPO has delivered industry-leading results in 2024,” said Ali Faghri, chief strategy officer at XPO. “Over the first nine months of the year, we grew revenue in our North American LTL business by 7% and adjusted operating income by 37% compared to the same period in 2023.”

Faghri credited the performance to above-market yield growth and variable cost management. He also highlighted the importance of quality customer service. The result was year-over-year improvement in margins and operating ratio through the first three quarters. Its damage claims ratio even reached a company record in the third quarter at 0.2%.

“We’re achieving this improvement in a historically soft freight market,” Faghri said. “We’ve been able to grow our business in the trough of the freight cycle by executing on our strategy and focusing on initiatives that are within our control.”

XPO ranks No. 5 on the TT100 list of the largest for-hire carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: