Bloomberg News

Fuel Groups Warn of Price Hikes Without Tax Credit Certainty

[Stay on top of transportation news: Get TTNews in your inbox.]

More than 30 trade groups across the energy, farming and transport sectors say a lack of U.S. government guidance on tax credits is putting Americans at risk of higher fuel prices.

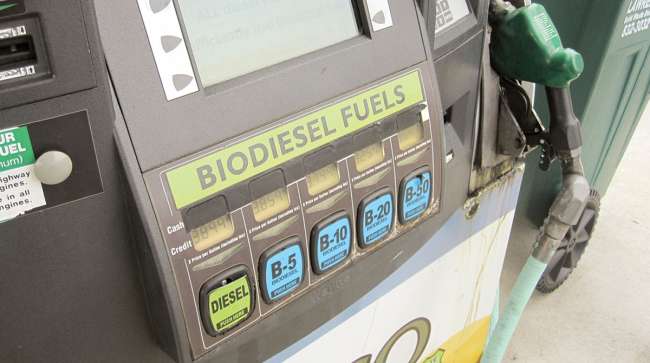

The current U.S. Congress should extend credits set to expire next month, including a $1 a gallon biodiesel tax incentive that’s been in place since 2005, they say, to ensure market stability as fuelmakers, airlines and crop processors wait for details on how new credits that take effect in January will work.

“Absent the certainty provided by a bridge package, American consumers would face rising energy and fuel prices, and our organizations and the members we represent would face regulatory, legal, and tax filing uncertainty,” the groups including those representing fuel retailers and truck stops wrote in a letter to congressional leaders on Nov. 13.

The transition to a new administration under President-elect Donald Trump, along with a lack of guidance under President Joe Biden, has the energy and agriculture industries in a quandary on how to proceed. The new incentives under Biden’s signature climate change law are meant to encourage lower-emitting energy sources and help jump-start developing industries like green jet fuel.

Tell Congress To Extend The Alternative Fuel Tax Credithttps://t.co/1WIFfJAAlZ — Virginia Propane Gas Association (@VAPropaneGas) November 12, 2024

“We don’t know whether or not the credit will be there for us on Jan. 1 of next year nor how long it would take for it to be there,” Tom Michels, head of government affairs for United Airlines Holdings Inc., said in an interview.

Another issue that needs to be addressed is extending the upcoming credits for at least 10 years so investors can see the government is serious about the transition to clean energy and companies can get new fuel plants up and running, Michels said.

Want more news? Listen to today's daily briefing below or go here for more info: