Hershey Could Be More Open to Mondelez Takeover

[Stay on top of transportation news: Get TTNews in your inbox.]

Mondelez International Inc.’s latest overture to Hershey Co. underscores the challenges posed by sky-high cocoa prices and penny-pinching consumers, which could make the chocolate company more open to a deal than it was eight years ago.

Bloomberg reported this week that Mondelez made a preliminary approach about a possible combination. A deal would create a food group with combined sales of almost $50 billion and present a bigger challenge to Mars Inc., the world’s leading confectionery maker. The matter is largely up to the Hershey Trust, which controls roughly 80% of the company’s voting shares.

Mondelez ranks No. 65 on the Transport Topics Top 100 list of the largest private carriers in North America and No. 9 among agriculture and food processing carriers.

A lot has changed since 2016, when Chicago-based Mondelez, which makes Ritz crackers and Oreo cookies, made a previous $23 billion bid that Hershey rejected.

Mondelez is exploring an acquisition of iconic US chocolate maker Hershey in a potential deal that would create a food giant with combined sales of almost $50 billion https://t.co/gqeI7Cd6Ij pic.twitter.com/bdbZM72jDm — Bloomberg TV (@BloombergTV) December 9, 2024

Mondelez, Hershey and the family trust all have different CEOs. Both companies face a food market that has been upended by inflation, new weight loss drugs and runaway cocoa costs that have squeezed chocolate companies’ profit margins. More than ever, there’s a strategic rationale for large packaged food companies to increase scale and diversify portfolios.

That logic also drove Mars’ agreement to buy Kellanova for nearly $36 billion in August — until now, the biggest deal of the year. Adding the maker of Pringles and Nutri-Grain bars pushed the owner of M&Ms and Snickers further into snacks, which are growing at a faster clip than confectionery.

Mars’ tie-up with Kellanova has increased the pressure on Mondelez, headed by CEO Dirk Van de Put, to bulk up in order to better compete.

“It’s clear that for confectionery and snacking, you need both to be a powerhouse and compete effectively,” said Arun Sundaram, an analyst at CFRA Research.

Mondelez also has a wide distribution network, Sundaram said. “Their products are everywhere — convenience stores, airports,” he said. “If they did acquire Hershey, they would immediately expand distribution.”

Representatives for Pennsylvania-based Hershey and Mondelez said they don’t comment on market rumors.

Mondelez on Dec. 11 approved a stock buyback of as much as $9 billion, and said it’s committed to “an acquisition strategy that is focused on bolt-on assets.”

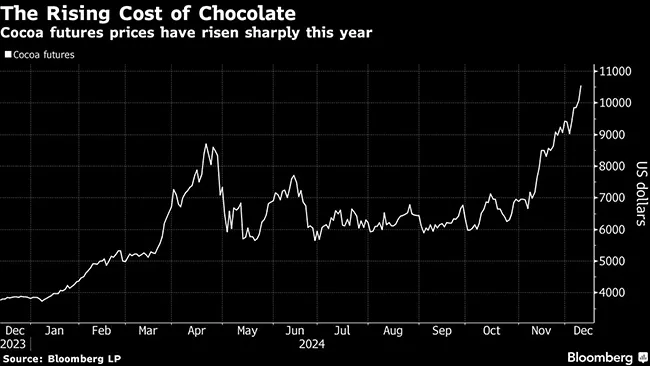

Hershey has been particularly hard hit by the surge in cocoa prices, with the most traded contract surging about 150% this year. Analysts estimate that Hershey’s gross margin will fall to below 42% this year from 45% last year.

Chocolate accounts for more than 88% of the company’s sales, according to Bloomberg Intelligence. On the company’s most recent earnings call, Chief Financial Officer Steve Voskuil said it’s looking at “a pretty significant step-up” in cocoa prices for next year.

Chocolate makes up less than a third of revenue at Mondelez. Its willingness to step deeper into that market may be a bet that cocoa prices will eventually ease. Chief Financial Officer Luca Zaramella said on a late October earnings call that the company expects them to normalize by 2026.

Even if the market stays volatile, greater scale and diversification of markets and suppliers could help the combined companies ride out the ups and downs.

Other potential challenges include a growing consumer preference for healthier foods and the rise of GLP-1 drugs such as Novo Nordisk A/S’s Ozempic and Wegovy, which are used to combat diabetes and help with weight loss.

Lori Heino-Royer of Waabi discusses the latest developments, breakthroughs and key industry partnerships in autonomous trucking. Tune in above or by going to RoadSigns.ttnews.com.

Van de Put has repeatedly said he believes the company is largely insulated. Company data shows “consumers firmly believe snacking plays an important role in active and busy lifestyles,” he said in February, even though they’re seeking out more portion-controlled snacks. In a later interview with Bloomberg TV, he predicted that the impact of GLP-1 drugs on the amount of food Mondelez sells would be between 0.5% and 1%, which he called a “margin of error.”

Hershey CEO Michele Buck has been slightly more cautious. In November, she said the drugs were causing a “mild” and “gradual impact,” but added that users “aren’t eating disproportionately less of our categories.”

By combining, the companies could lower costs, and their geographical footprints are complementary. In addition to Toblerone and Milka bars, Mondelez makes Ritz, Triscuit and Wheat Thins crackers. Only about 30% of its net revenue comes from North America, according to its most recent earnings report.

Hershey has diversified some with its acquisitions of Skinny Pop and Dot’s Pretzels, but it remains primarily a North American chocolate company. The strength of its top brands, including Kisses, Reese’s and KitKat, makes it less vulnerable to the growth of private labels, Sundaram said.

The political landscape could also play a part in the timing of Mondelez’s interest, if the election of Donald Trump makes the Federal Trade Commission more receptive to large deals than it has been in recent years. Still, any deal would likely get careful scrutiny by the agency because of the overlap in the companies’ product portfolios, Bloomberg Intelligence analyst Jennifer Bartashus said.

A combination would give Mondelez 16% of the global confectionery market and 27% of North America’s, according to Euromonitor data cited by Bloomberg Intelligence — higher shares than Mars’ in both instances.

Want more news? Listen to today's daily briefing above or go here for more info

In 2016, the Hershey Trust Co. ultimately blocked Mondelez’s takeover. The body, whose mission centers on preserving the founder’s legacy through institutions like the Milton Hershey School, has recently brought on a new CEO who has signaled openness to major portfolio changes and new board members.

There’s another potential hurdle. Under Pennsylvania law, the state’s attorney general can block a transaction that results in a trust losing its voting control if it’s seen as “unnecessary for the future economic viability” of the company.

Even potential interest from Hershey’s management might not be “strong enough to withstand some of the very same challenges to any deal that were present in 2016,” said Billy Roberts, a senior economist for food and beverage at CoBank ACB, pointing to the Hershey Trust’s mission. “Those responsibilities are still there.”

Written by Deena Shanker, Dasha Afanasieva and Ilena Peng