How Startups are Using Big Data to Manage the Holiday Cargo Rush

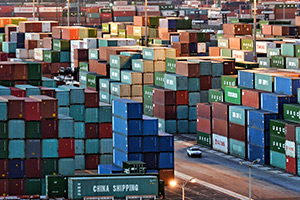

You won’t have to worry about holiday shopping for at least another couple of months, but for freight operators and many of the world’s largest retailers, preparation for the year-end shopping craze has begun. To meet that demand, cargo ships will begin crowding next month to transport inventory from factories to warehouses around the globe.

Despite months of preparation each year, it’s always a scramble in November and December to find some of the season’s most popular products. But several startups have sprung up to help manage the complicated flow of data involved with the movement of goods. Flexport and Cargobase are two such companies that collate data from freight forwarders, which are the travel agents of cargo.

International freight forwarding was a $144 billion market in 2014, according to logistics research firm Transport Intelligence. With the help of technology companies, systems that can churn out almost instant price quotes for importers and exporters are beginning to emerge.

Big-data startups within the freight forwarding industry raised about $1 billion since the beginning of 2014, double the sum of the preceding five years, according to research firm PitchBook Data.

The latest company to attract venture capital is Freightos, a Jerusalem startup that announced a $14 million funding round Sept. 9. The company over the past year began managing internal pricing systems for Sysco, a food distributor, and Marks & Spencer Group, which sells clothing and consumer products. Freightos helps them track prices buried within their carrier contracts and compare those with industry averages.

“This new capital will allow us to take our initial successes with leading forwarders and import-export companies and scale globally,” Freightos CEO Zvi Schreiber said. “At this point, it’s all about growing the data.”

The freight industry carries 90% of global exports, which stood at $19 trillion worth of goods in 2014, according to the World Bank. Without the help of automated pricing, it can take about three days just to receive a quote, according to Freightos.

While such companies as Expedia and Priceline.com have put airline tickets and hotels reservations a few clicks away, the number of moving parts in a standard cargo delivery—ships, trucks, various customs agencies—has precluded much innovation from happening in the past, and the complexity and inefficiencies still could ultimately doom any hope of progress.

“The technology requirements are much greater than consumer travel,” Bob Mylod, former head of worldwide strategy and planning at Priceline, said in an interview last year. “In some ways, we’re talking about a different industry, but the transactional dynamic is the same.” Mylod is the managing partner of Annox Capital, which is an investor in Freightos.

While the upstarts are leading the innovation race, industry giants aren't ignoring the trend. Deutsche Post has invested millions upgrading its freight-forwarding business, though a planned rollout of SAP software was shelved because of a negative impact on earnings. Flexport CEO, Ryan Petersen said the company is using money from a recent $22 million funding round to boost head count. “While we are way ahead of the current market leaders in technology, we are playing catch-up with regards to industry expertise and access to the world’s logistics assets,” he said. “Our gamble is that we can close the gap on expertise and access to assets faster than the incumbents can build the tech.” Bloomberg Beta, the venture capital arm of Bloomberg LP, is a backer of Flexport.

In addition to helping fulfill holiday shoppers’ demands, better tech promises to conserve fuel and reduce waste. At any given moment, cargo ships sail with 24% of their capacity unused, according to Drewry Shipping Consultants, a maritime research organization. Human error by cargo bookers costs the industry $684 million a year, according to Ocean Audit, which examines invoices for such large retailers as Macy’s.

Among Freightos' 40 clients are Ceva Logistics and Hellmann Worldwide Logistics, two global freight-forwarding companies. The big three, however — DHL Supply Chain & Global Forward, Kuehne & Nagel, and DB Schenker Logistics — are not on the list. “The more price points we manage for forwarders, [the] more seaports and airports, the more options we can calculate to get freight efficiently from A to B—even during peak season,” Schreiber said.

But the company isn’t there yet. So expect another holiday season full of lines and unruly parents fighting for this year’s hottest toys.