May Tonnage Growth Slowest in Two Years

By Rip Watson, Senior Reporter

This story appears in the June 29 print edition of Transport Topics.

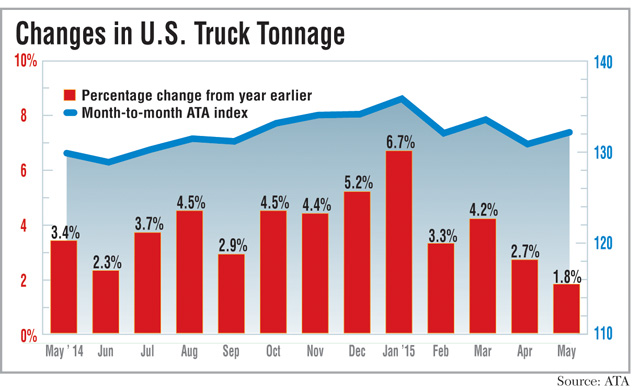

Truck tonnage gained a scant 1.8% in May from a year earlier, the smallest rise in two years, on weaker factory output and bloated inventories, a sign that the economy is relying more on consumer-driven growth than manufacturing.

American Trucking Associations said last week its advanced seasonally adjusted index stood at 132.1, continuing a slowdown since a 6.7% rise in January from the prior year.

Tonnage growth averaged 3.4% year-over-year between February and April, before May’s increase — the smallest since February 2013.

“The good news is that truck tonnage increased in May, but tonnage is certainly not strong at the moment,” ATA Chief Economist Bob Costello said. “Factory output is soft. Inventories are bloated. Levels are high enough to depress freight volumes.”

He added: “The inventory correction should end this summer, and truck freight, helped by better personal consumption, will accelerate.”

However, Costello noted that “new production of oil and gas wells is coming to a standstill. That is very different than the past couple of years.”

This year’s industrial slowdown followed several years of manufacturing growth, fueled largely by energy exploration that dropped off as oil prices fell.

Spending on energy exploration has dropped 49% on an annualized basis, said Noël Perry, senior consultant at FTR Associates.

BB&T Capital Markets analyst Thom Albrecht noted lower first-quarter gross domestic product (0.2%) and industrial production (0.3%) through May, in contrast to the declining GDP and 3.9% growth in industrial production in the 2014 period.

Economist James Meil at ACT Research said he believes exploration activity alone boosted truck tonnage by 20% to 25%, which represents about 1 percentage point of tonnage growth in past years.

ATA said that on a month-to-month basis, tonnage rose 1.1% in May. The index fell 1.4% in April, less than the 3% originally reported, ATA said. The non-seasonally adjusted index, measuring freight actually hauled, was 133.1 last month, up less than 1% sequentially and year-over-year.

“The economy is still stagnant,” said Perry. “We are always looking for clear direction in the market, and we are not getting it. It’s not a good sign. You wouldn’t want to have another month or two of declines.”

Perry said there has been some recent positive economic news from the retail and housing sector while downplaying the consumer’s role in tonnage growth.

“The trucking industry isn’t driven by the consumer,” said Perry, a former Schneider and CSX executive. “It’s driven by manufacturing. The ATA numbers indicate a [trucking] slowdown is coming.”

Albrecht said it’s possible the economy is emerging from its “soft patch” and the associated slowdown in freight and tonnage growth.

He noted improvements such as a pickup in new orders measured by the Institute of Supply Management and strength in some housing markets.

More housing permits than starts imply that the stronger job and wage markets “are helping people actually commit to buying new homes,” Albrecht said.

On the other hand, Albrecht contended the strong dollar shaved 1.25 percentage points off first quarter GDP.

“It’s two steps forward and two steps back in each sector of the economy,” Meil said. “We are starting to see some consumer spend. That was MIA in the first quarter. We are starting to get a better tone in that sector.”

Vehicle sales at levels not seen in a decade are helping, he added.

Meil counterbalanced his view by noting the weakening economies in states such as Texas and North Dakota that rely on exploration and crude production.

Costello also said the economy won’t be saddled in the second half with early 2015 problems related to severe winter weather, inventory buildup and disruptions from West Coast port cargo handling congestion.

“With solid job growth and [slightly] improved wages, spending should pick up accordingly,” Costello said

in the report that gauged second-quarter GDP growth at 2.1%.

Peggy Dorf, a market analyst at load board operator DAT Solutions, said freight demand has been strongest in a band of states stretching from Georgia through Texas. That’s primarily because of increased produce shipments and flatbed freight that is stronger due to seasonal construction activity, with additional help from increased manufacturing in some states and more truckload traffic at ports.

On a nationwide basis, she said, freight volumes are tracking patterns in past years, excluding the surge in 2014 load board activity due to capacity constraints