Staff Reporter

Transportation M&A Gains Momentum in Late 2024

[Stay on top of transportation news: Get TTNews in your inbox.]

The transportation sector saw merger and acquisition activity gain momentum as market conditions stabilized in the second half of 2024, according to experts.

“I would say it was a more muted M&A environment,” Jonathan Britva, managing director at Republic Partners, said. “Definitely one that was more muted than, I think, most of us hoped for. But at the same time, there were some signs that hopefully we’re moving past the challenges of the M&A market over the last couple of years.”

Britva noted that these challenges included higher interest rates, uncertainty and geopolitical concerns. He added that the situation has been especially challenging for more rate-sensitive carriers that are still underperforming.

“Conversations we’re having with our clients, and also with folks in the industry, and potential prospects, are more optimistic than I’ve heard for some time,” Britva said. “So that’s been positive, just more anecdotally.”

Britva suspects there also is growing optimism that freight rates will continue to improve. Higher profitability typically drives M&A activity by improving sellers’ valuations.

Tenney

“The first thing that I would say is that the freight recovery is still recovering,” Tenney Group CEO Spencer Tenney said during a presentation Jan. 30. “We’re definitely coming out of it, but very slowly. I don’t think anybody predicted it would take that long. But when you combine that with what has influenced activity over the last 12 months, a period of the highest interest rate hikes, you have record inflation.”

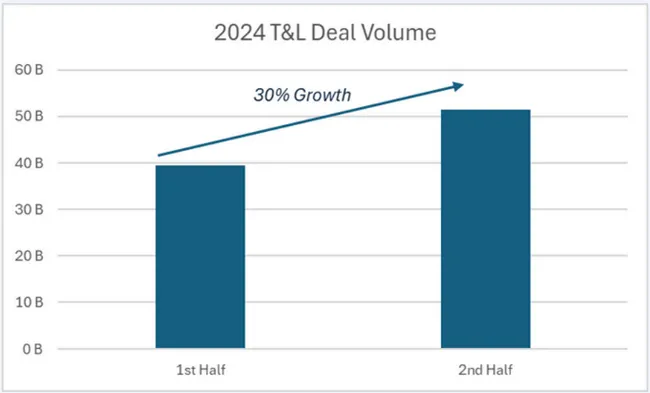

The 2025 Tenney Group Annual Report found acquisition transactions in the transportation and logistics space increased 159% to $90.5 billion from $35 billion in 2023. While both figures were well below the $193 billion in 2022, activity picked up in the second half of 2024. The report uses third-party data from S&P Capital IQ.

“Very light, needless to say, in terms of the first half, but that certainly changed in the second half from our standpoint,” Tenney said. “A matter of fact, 100% of our total completed deals took place in the second half. I think some of that was it took time for [profit-and-losses] to get stabilized enough for buyers and sellers to get alignment on both valuation and structure.”

(2025 Tenney Group Annual Report)

The report found that deals in the first half totaled around $39 billion, but that increased to $51.5 billion in the second half. This came as conditions stabilized enough to make more reasonable profit-and-loss analyses.

In the end, 2024 improved from 2023, “but not by much,” said Lee Clair, a managing partner at Transportation and Logistics Advisors. “And given that was one of the worst, if not the worst years ever, that’s coming off a low base.”

Clair

Clair noted that capital markets stabilizing and a more willing lender market are needed for activity to pick up. This would increase available capital as banks become more willing to offer reasonable financing terms. Clair added that lenders didn’t know how to price in risk in 2023.

“That’s getting better,” Clair said. “Then it becomes an issue of clarity going forward. The second issue then becomes bad earnings, and it’s hard to sell a company off bad earnings since they’re generally sold at a multiple of earnings. However, if things become clear, and as the future becomes clearer that things are going to improve, they can actually create a forecast that holds water. Then there’s a good chance you can start selling companies.”

Clair pointed to the decrease in overall cargo as an important factor as well. The problem was that capacity didn’t decrease as much as volume had fallen. This trend was somewhat obscured by overall economic growth, since that includes services. Clair also noted that deals were most likely to land based on specific company characteristics rather than broader trends.

Stefanovich

“We were down last year about 5% from the previous year,” Left Lane Associates President Peter Stefanovich said. “I think that’s due to the prolonged freight recession. It eliminated parties from trading and selling their businesses, but also people just really put their head down to the grindstone and said we’re going to continue to work until the freight recession is fully over.”

Stefanovich is optimistic the down cycle is ending as he has seen early signs of economic recovery in certain areas. But he also pointed out that tariffs have added new unknowns to the market, generating volatility.

“That’s been the focus of everybody the last week or two weeks,” Stefanovich said. “Once we get past the tariff stuff, call it by Q2, I think there’s going to be a lot more pickup of M&A in general. It’s going to be quite robust, and it’s going to be getting progressively better and better.”

Want more news? Listen to today's daily briefing below or go here for more info: