Bloomberg News

Mondelez’s Takeover of Hershey Would Rank as Top 2024 Deal

[Stay on top of transportation news: Get TTNews in your inbox.]

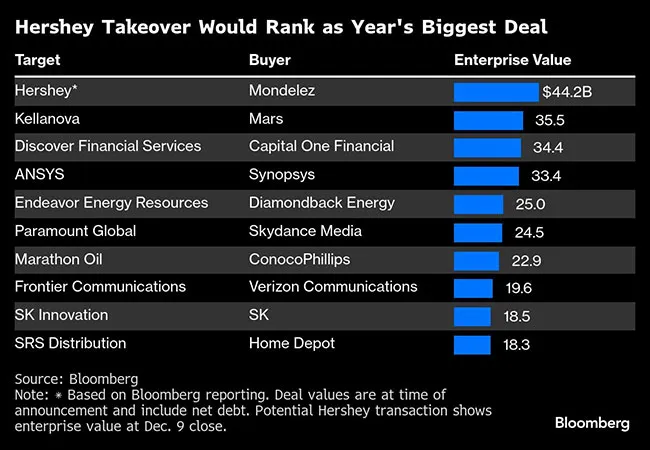

Snack-food giant Mondelez International’s potential takeover of chocolate maker Hershey Co. would rank as the year’s top M&A deal.

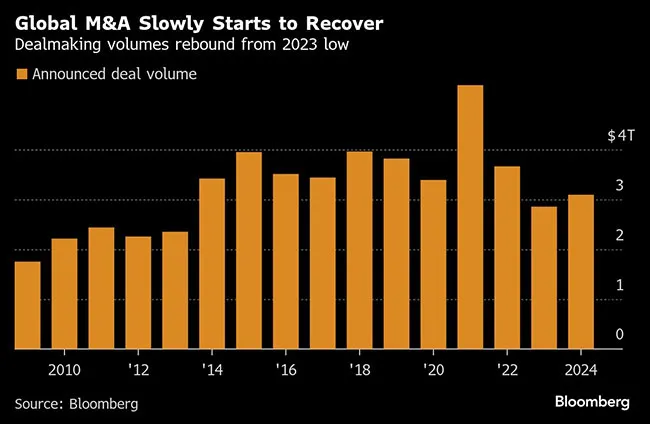

The volume of mergers and acquisitions globally is already up 18% year over year to $3.1 trillion as dealmaking makes a slow recovery from last year’s lows, according to data compiled by Bloomberg. A takeover of Hershey, which was valued at $44 billion including debt Dec. 9, would surpass candy bar maker Mars Inc.’s planned purchase of cereal producer Kellanova as the biggest acquisition of the year if they reach a final agreement.

Hershey signage in Hershey, Pa. (Luke Sharrett/Bloomberg News)

Mondelez ranks No. 65 on the Transport Topics Top 100 list of the largest private carriers in North America and No. 9 among agriculture and food processing carriers.

There have already been more megadeals this year than in 2023, with marquee transactions in the software, energy and media industries. Consumer transactions have accounted for a larger than usual proportion of the pie, approaching almost 20% of total deal volumes this year, according to data compiled by Bloomberg.

Activity is also heating up in financial services, with BlackRock Inc. agreeing recently to buy HPS Investment Partners for $12 billion. Man Group PLC CEO Robyn Grew, who leads the world’s biggest publicly traded hedge fund, said at a Bloomberg conference Tuesday that the firm is open to further acquisitions and sees “cracking opportunity” in the fast-growing credit space. Prudential PLC is also exploring options for its Asian asset management arm Eastspring Investments, Bloomberg News reported Dec. 10.

Want more news? Listen to today's daily briefing below or go here for more info: