New Class 8 Registrations Up 13%; Total US Fleet Size Hits 3.82 Million

By Seth Clevenger, Staff Reporter

This story appears in the May 25 print edition of Transport Topics.

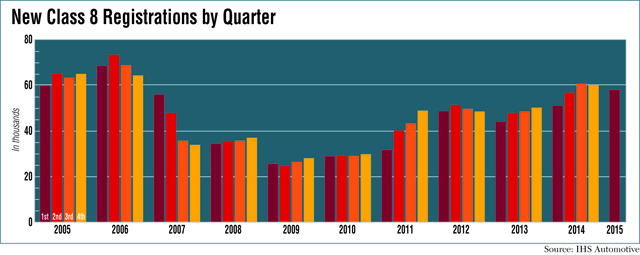

Initial registrations of new Class 8 trucks rose 13% in the first quarter compared with the same period last year but declined sequentially for the second straight quarter, IHS Automotive reported.

Trucking companies registered 57,950 new trucks in the United States from January through March, up from 51,072 a year earlier but down 4% from 60,135 in the final three months of 2014, according to the latest Polk report on commercial vehicles from IHS.

The total population of heavy-duty vehicles registered for highway use continued to expand, rising 4.4% to 3.82 million trucks, the highest level on record, IHS said.

Gary Meteer Sr., director of global commercial vehicle products at IHS, said the registration figures were “good” but not quite on par with expectations.

“When I look at the data, my take-away is the first quarter was OK but wasn’t anything stellar,” he said.

Meteer said new truck registrations have declined for two straight quarters since reaching the recent high-water mark of 60,652 in the third quarter of 2014.

Large fleets helped drive the continued growth in new Class 8 transactions in the second half of 2014, but they were not as active in the first quarter, he said.

Meteer said he had been calling for about 7% year-over-year growth in 2015, but first-quarter figures support a full-year growth projection of about 4% from the 228,697 new registrations recorded in 2014.

Still, any growth would make 2015 the industry’s best year for new truck registrations since 2006.

The total U.S. Class 8 vehicle population has continued to expand, but Meteer said growth has been supported by older trucks remaining in service at the same time that companies invest in new equipment.

“Those used trucks are still being used,” he said. “When someone buys a new truck, they’ve usually got a good used truck and there’s always somebody standing in line to pick it up, and that keeps the vehicles in operation inching their way upward.”

The IHS vehicle population data include some trucks that are registered but aren’t in use as they await resale on the secondary market.

Meteer also sounded a note of caution on the economy.

He said it’s important for U.S. gross domestic product growth to regain some steam after a disappointing 0.2% uptick in the first quarter.

If it doesn’t, it likely will mean that business will “flatten out,” he said.

Meteer said it’s “almost uncanny” how closely the fluctuations in truck registrations align with the corresponding changes in GDP growth.

“If people feel good about the economy, new equipment is going to do well,” he said. “If they don’t feel so good about the economy, they’re going to start hedging their bets.”

Total registrations of new Classes 3-8 trucks increased 11% year-over-year to 163,828 in the first quarter, led by 19% growth in Class 7, according to the IHS report.

Foltz Trucking, a bulk materials hauler based in Detroit Lakes, Minnesota, has been steadily investing in new equipment to attract drivers and take advantage of the improved reliability of newer models, said Ken Foltz, the fleet’s vice president.

“With the driver situation, we feel that you have to have the best equipment out there,” he said. “These guys can go drive for anybody down the street. To be competitive in the driver market, we need to have the latest and greatest.”

In 2014, Foltz brought in 52 new trucks, with about eight representing fleet expansion and the rest replacing older equipment.

This year, the company will take delivery of 50 new trucks that mostly will be for replacement, Foltz said.

The firm operates a fleet of 135 Class 8 tractors.

In a note to investors, J.P. Morgan analyst Ann Duignan said new truck orders have been supported by the relatively old age of equipment and some fleet expansion but added “the pace of orders has clearly slowed” in recent months.

Her firm maintained its North American Class 8 truck production forecast of about 324,500 units in 2015, which would be up 9% from last year.

“We remain mindful of the driver shortage headwind, which continues to weigh on fleet expansion, as well as the potential for capacity constraints to weigh on production,” Duignan said.