Staff Reporter

Paccar Q4 Profit Falls but Leaders Predict Better 2025

[Stay on top of transportation news: Get TTNews in your inbox.]

A slump in North American truck sales at Paccar Inc. dragged on profit at the parent company of Kenworth and Peterbilt in the fourth quarter of 2024, but executives are positive about 2025’s prospects, including in the key truckload segment.

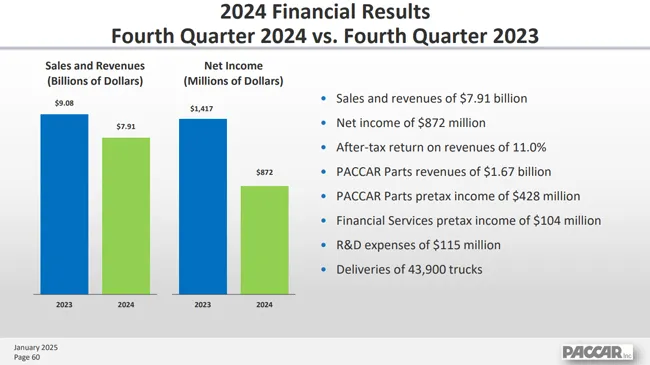

Bellevue, Wash.-based Paccar posted a profit of $872 million or $1.66 per diluted share in the fourth quarter of 2024, down 38.5% compared with $1.42 billion, $2.70, in the same period in 2023.

But the year-over-year slump should be viewed in context. The final quarter of 2023 saw a 54% year-on-year jump in net income on the back of record revenue and a double-digit jump in U.S. and Canadian truck sales.

Paccar reported revenue of $7.91 billion in Q4, down 12.9% compared with $9.08 billion in the same period in 2023.

(Paccar Q4 2024 Earnings Presentation)

Kenworth and Peterbilt sold 22,300 trucks in the U.S. and Canada in the final three months of 2024, down 20.6% compared with 28,100 trucks in the year-ago period.

Data indicates Kenworth and Peterbilt underperformed their peers in the final quarter. Industrywide U.S. Class 8 sales fell 1.46% in Q4, while medium-duty sales in Classes 4-7 nudged 0.6% higher year over year in the three-month period, according to Wards Intelligence data collated by Transport Topics.

Overall, the two truck makers sold 106,400 vehicles in 2024 in the U.S. and Canada, down 2.5% compared with 109,100 trucks in 2023, Paccar said.

RELATED: Paccar Q3 Profit Falls 20.9%, Tops Analyst Expectations

Sales in Europe in Q4 fared nearly as badly as in the core North American market, sliding 17.5% to 12,300 trucks from 14,900 a year earlier. However, for the full-year period, sales in Europe dived 28.2% to 45,400 from 63,200.

The company’s sales in Europe were hurt badly by weak demand in central and eastern Europe, where DAF is especially strong, Chief Financial Officer Harrie Schippers told analysts during a quarterly conference call, adding that deliveries in Poland and Lithuania, for instance, fell 20% year on year.

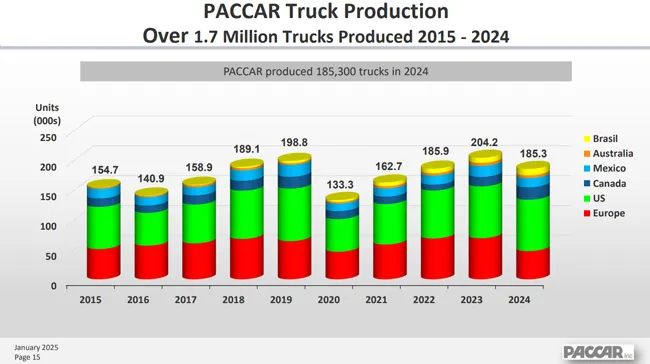

Paccar sold 185,300 vehicles globally in 2024, down 9.3% compared with 204,200 a year earlier.

(Paccar Q4 2024 Earnings Presentation)

Kenworth and Peterbilt achieved an “excellent” U.S. and Canada Class 8 retail sales market share of 30.7% in 2024, Paccar said, compared with 29.5% in 2023.

U.S. Class 8 sales in 2024 fell 9.9% to 240,249 trucks from 266,752 in 2023, according to Wards Intelligence data.

Paccar estimated marketwide U.S. and Canada Class 8 retail sales totaled 268,000 trucks in 2024 and expects about the same in 2025, with a forecast range of 250,000-280,000 trucks.

Paccar Senior Vice President Laura Bloch said vocational truck demand was steady while adding that the less-than-truckload segment also is performing well.

“The heavy influence of vocational was a last year thing,” CEO Preston Feight told analysts during the conference call, adding that Paccar and truck makers in general can expect a more balanced order book in 2025.

Want more news? Listen to today's daily briefing above or go here for more info

Paccar is beginning to see signs of improvement in the truckload segment, Feight said during the Jan. 28 conference call.

Demand for vehicles from the truckload sector is set to improve for three reasons, he said: “Spot rates are starting to improve, some capacity has exited the market and used inventories are quite low.”

Overall, in 2024, the company’s profits fell 9.6% year on year to $4.16 billion or $7.90 per diluted share from $4.6 billion or $8.76 in 2023.

Revenue totaled $33.66 billion in 2024, down 4.2% compared with $35.13 billion in 2023.

Paccar’s capital expenditure rose to $796 million in 2024 from $698 million, while research and development expenses climbed to $453 million from $411 million.

The truck maker estimates it will invest $700 million-$800 million on capital projects in 2025 and $460 million-$500 million on research and development.

“Paccar is investing in its truck factories, including expansions at Kenworth Chillicothe, Ohio, Paccar Mexico, and the DAF electric truck assembly plant in Eindhoven, Netherlands. Investments in Paccar’s global engine business include additional manufacturing and remanufacturing capacity,” Chief Technology Officer John Rich said.

“In addition to the capital and R&D investments, the company expects to invest a total project amount of $600 [million]-$900 million in its battery joint venture, Amplify Cell Technologies.”

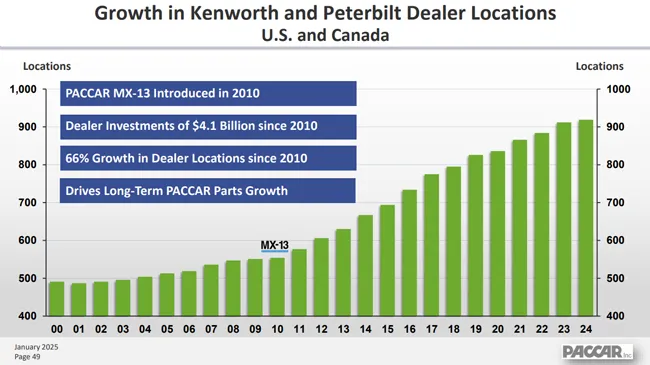

(Paccar Q4 2024 Earnings Presentation)

Construction of Amplify’s battery cell manufacturing plant in Mississippi began in June and is expected to be finished by 2027, when production will also begin, the joint venture with Daimler Trucks & Buses U.S. Holding and Cummins’ Accelera unit said.

Feight said during the call that the Trump administration’s antipathy toward battery-electric vehicles would not change Paccar’s enthusiasm for the joint venture, and the management team would make the same commitments should they be doing so in 2025 with hindsight.

Looking forward, Paccar expects its total truck deliveries to be around 40,000 vehicles in the first quarter of 2025, compared with 43,900 in the final three months of 2024, Feight said.

“We look forward to an excellent year in 2025,” he said. Q1 U.S. Class 8 sales should be flat or a little firmer, while medium-duty sales are expected to normalize, Feight added, noting that Paccar’s order book is mostly full for the first quarter and about half full for the second quarter of the year.