Pepsi Soothes Investors With Sales Growth, Plans for Payouts

PepsiCo Inc. rose in early trading as investors brushed off a lower profit forecast, instead focusing on sales growth in snacks and North American beverages and the company’s plans to return about $8 billion to shareholders this year.

The owner of Doritos and Gatorade was able to push through price increases, boosting revenue at key units in the fourth quarter. PepsiCo also announced deeper cost cuts as it strives to become “leaner, more agile and less bureaucratic,” according to CEO Ramon Laguarta.

As it slashes costs, the company will also boost spending on marketing in a bid to sustain sales growth in North America. PepsiCo is adding drivers and trucks to distribute snacks, while reducing headcount in other areas.

PepsiCo shares rose as much as 2.6% to $115.50 in early trading. The stock had gained 1.9% this year through close Feb. 14, lagging the S&P 500 over that period.

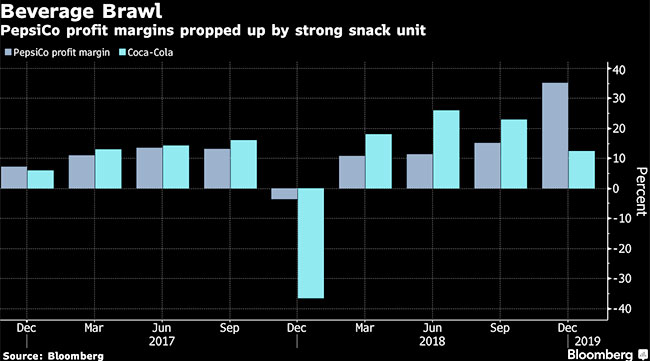

The market’s favorable reaction shows that investors are taking a different view of PepsiCo’s 2019 challenges — which include currency volatility, slowing economic growth and weakening consumer sentiment. Coca-Cola Co. listed many of the same uncertainties in its earnings report Feb. 14.

For this year, PepsiCo forecast a 1% decline in core earnings per share, excluding currency shifts, along with a slowdown in sales growth.

The lower profit outlook illustrates how the cost of boosting sales is becoming more expensive, Bonnie Herzog, an analyst with Wells Fargo, said in a research note after the release of fourth-quarter results.

The company is extending its cost-saving program through 2023, incurring $2.5 billion in charges. PepsiCo said it plans to shutter plants and that 70% of the costs would come from severance and other “employee-related costs.”

Chief Financial Officer Hugh Johnston didn’t specify how many jobs might be cut, adding that the company planned to “boost selling capacity” in North America via more drivers and trucks. Some employee reductions could also result from taking automation programs overseas, he said.

PepsiCo ranks No. 1 on the Transport Topics Top 100 list of the largest private carriers in North America