The Return of Transportation Buyers: Insights Into Customer Spending Behavior

Zembles captures more than $250 billion in annual spending by companies in North America on transportation goods and services, as part of its insights into over $1.6 trillion in annual B2B spending. Zembles provides a prospecting tool that empowers transportation sales professionals to identify companies that resemble their best customers using AI and machine learning. Zembles’ benchmark data, which includes spend behavior, assists sales professionals in understanding their prospective businesses and where they need to strategically target their efforts. This Q&A focuses on the economic state of the transportation industry and delivers insights into spending behavior, including trends across various sub-sectors of the industry.

How would you describe the current economic state of the transportation industry, recognizing there are regional swings and variances by industry?

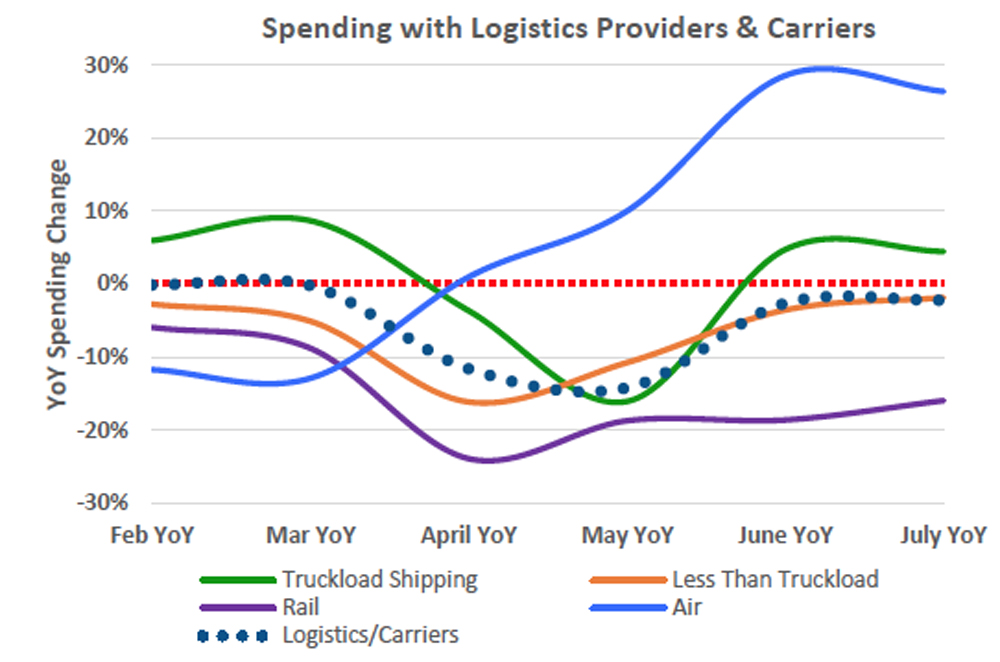

The pandemic clearly impacted businesses across many industries. The good news is that non-payroll spending by businesses appears to be quickly recovering, particularly in the transportation sector. Overall, B2B spending reached a bottom in May and has been increasing steadily since then, from -13.6% in May to -2.6% in July. One area of improvement has been in freight: Spending has increased, driven by air freight and truckload. This trend is not surprising; the distribution of goods and services has skyrocketed because of increased demand in both essential and non-essential materials.

How does the volume break down by sub-sector?

Air freight experienced the largest YoY increase – from -10% to nearly 30% from February to July, YoY. A key driver is the shift of office workers to work-from-home set ups, resulting in an increase in the purchasing of computer equipment and other related materials from online retailers. By contrast, LTL (less than truckload) and rail experienced declines in activity, particularly in April, given that sector’s reliance on manufacturing customers.

We know restaurants are struggling and home-delivery is booming. What surprises are you seeing, though, that those in the industry should pursue as sales opportunities?

The top customer industries since April 2020 have been merchant wholesalers, computer and electronic product manufacturing, general merchandise stores, transportation equipment manufacturing, and non-store retailers. In fact, non-store retailers experienced a 49% transaction increase in July.

Another area of spend increase is truckload shipping YoY from July 2019. This trend is also driven by the transition to work-from home, triggering more computer and electronic product manufacturing.

The data clearly supports the hypothesis that the pandemic has created a meaningful shift in purchasing behavior, particularly in the non-store retailer space and computer and electronic manufacturing – resulting in the increased need for transportation carriers.

>> Download the latest Zembles Transportation Industry Report – Click here <<

How essential has the transportation industry been in supporting the resilience of America's supply chains?

In today’s world, transportation is a necessity. Without transportation, especially with air freight, trucking and railroad, there is no way suppliers can deliver resources in a timely manner. The stresses and demands of the pandemic highlight that criticality.

As transactions are increasingly becoming digital and global, transportation will need to continue to keep up with delivery processes and maintain the integrity of a complex supply chain that spans different regions and geographies. The demand and pressures from the pandemic proved its resilience - it shed new light on the importance of transportation and on the need for more accurate insights into the flow of goods and services through our supply chains.

There are thousands of salespeople in the transportation industry that are out there, selling hard. Yet you say the traditional approach to generating new businesses is fundamentally flawed. What's wrong with it?

The way sales teams approach prospects is inefficient. They invest most of their time chasing companies that do not meet the right criteria. They are not equipped with the right information in terms of industry sector knowledge and company size. We feel for them.

Based on our sales experience, when you buy a list, only 10-20% of the targets are good leads. Additionally, while a prospecting company attempts to employ multiple data sources, the data is typically incomplete and inaccurate. Zembles is unique in that it provides data with insights that identify opportunities that may have been overlooked - yielding better and actionable results. Zembles takes the best of what search engines can deliver – utilizing search history algorithms and data – and the best of what platforms like Netflix and Spotify can do in identifying “lookalike” patterns – and roles them into a tool that we think will transform the way sales professionals do their job.

You enter a target company, say your best customer, and the system employs benchmarking to find a similar company. Now compare to all the time sales professionals waste on lists and chasing companies they have incomplete data on. Our tools do the heavy lifting for you, including analytics, research and insights to provide you qualified options.

You say that without access to a company's current buying behavior, there is no efficient and scalable model for profitable selling? Can you explain your principles of "strategic prospecting"?

With buying behavior, you can see that a customer has rapidly decreased their spending, a bad sign. Zembles lets you know that the customer has experienced a key financial change or event, which could mean they are not in the market to buy your product. It’s not about teaching you how to sell; you know your product more than I do and you are the experts in your field. The focus here is strategic prospecting, how do I increase my efficiency in identifying the right businesses to close more deals. We have two easy steps:1. Going after the RIGHT companies (i.e. similar attributes to your best customer) and 2. Having that spend behavior so you know who to chase because they are active in the market. They are growing. And there is a higher chance they will respond to you. If there is a company that went into bankruptcy, Zembles also has that information. If there is a company that increased their spend in LTL by 50%, Zembles will know that as well.

For more information about Zembles – visit: www.zembles.com

The above article is sponsor-generated content. To learn more about sponsor-generated content, click here.