Trade Strains Boost Ocean Shipping Cargo Rates

[Stay on top of transportation news: Get TTNews in your inbox.]

Global goods trade is showing signs of accelerating after last year’s slump, pushing up shipping rates and giving some supply chain managers flashbacks to the demand spike that disrupted international commerce three years ago.

“This situation will bring back memories of the chaos and skyrocketing ocean freight rates during the pandemic,” said Emily Stausbøll, a senior shipping analyst with Xeneta, an Oslo-based freight analytics platform. “Shippers have learned lessons from COVID-19 and some are bringing their imports forward, ahead of the peak season and the potential for a capacity squeeze.”

Some of the catalysts for the monthlong advance in seaborne freight rates stem more from worry than optimism. They include concerns about port congestion in Asia, labor strikes in North America that threaten to hobble ports or rail services, and heightened trade tensions between the U.S. and China.

Ocean shipping began the year already stretched by Red Sea attacks that forced carriers to send their vessels the longer way around southern Africa rather than through the Suez Canal. A.P. Moller-Maersk A/S, the world’s No. 2 container line, has estimated the industry’s capacity loss at 15%-20% this quarter on routes to northern Europe from Asia.

Maersk ranks No. 5 on the Transport Topics Top 50 global freight companies list.

Perhaps worst for shippers moving cargo to the East Coast is that the International Longshoreman Association (ILA), the union operating all ports on the East and Gulf Coasts, has a contract expiring on Sept 30. Talks are ongoing and wage increase will likely be a sticking point.… pic.twitter.com/koJcIRJqSY — Ryan Petersen (@typesfast) May 20, 2024

Importers and exporters across Asia, the U.S. and Europe typically see shipments increase from July to September as retailers look to restock before back-to-school, Halloween and year-end holiday sales seasons. That spurt of orders looks to be happening now, analysts said, at a time when spare container capacity is limited.

“This early peak season is packing a major punch,” Stephanie Loomis, head of ocean freight for the Americas at Rhenus Logistics, wrote in a LinkedIn post before the Memorial Day weekend. “In speaking with many carriers this week, the comments were all the same: Vessels are all completely full.”

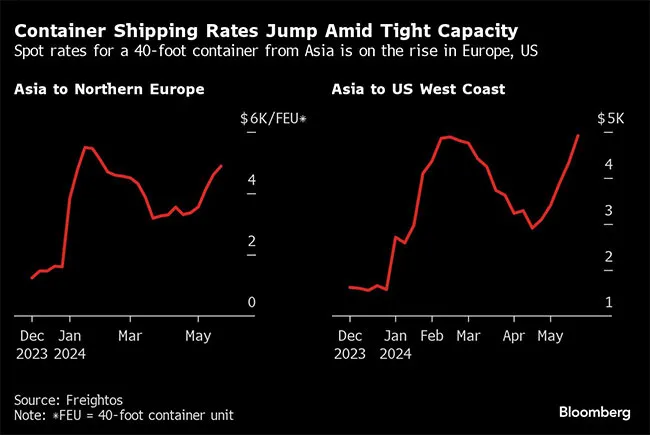

Spot rates for containers reflect the tightness. The cost for a 40-foot container to the West Coast from Asia jumped 13.4% to $4,915 in the week ended May 26, according to Freightos data, the fifth straight weekly advance. That’s triple what it was in late December, but still well below the September 2021 peak of $20,586.

The spot rate for containers to northern Europe from Asia is also climbing, fetching $4,882 last week, more than three times higher than a year ago, according to Freightos.

In a research note last week, Judah Levine, head of research at Freightos, said some carriers have announced more increases for June, meaning “they do not expect conditions to ease in the short term.”

Some of the snarls originate in China, according to an operational note last week from Hapag-Lloyd AG, the world’s fifth-largest container carrier. In the ports of Qingdao, Shanghai and Ningbo, ships are waiting one to four days for a berthing slot because of “vessel bunching” and harsh weather. Wait times are also elevated in Singapore and Malaysia, it said.

Those kinds of delays are making it difficult to keep up with the demand across the Pacific.

Container imports through the top 10 ports in the U.S. rose for a seventh straight month in April from a year earlier, pushing the three-month trailing average gain to 19.1%, according to veteran shipping analyst John McCown. That was the strongest showing since July 2021 — near the peak of the demand surge during the pandemic.

“Underlying economic activity would seem to be the driver of these strong gains,” McCown wrote in a report released on May 25.

Fear and long memories might also be at play. To prevent shortages during the pandemic, companies ordered more products and parts than demand warranted, boosting inventories that have since come down.

In the midst of the latest surge in container rates, the U.S. government announced more tariffs on Chinese imports — potentially adding to the urgency for companies to stock up now, analysts said.

Want more news? Listen to today's daily briefing above or go here for more info

That’s what happened in 2018 and 2019 when the Trump administration imposed tariffs on China. American importers’ complaints about the new import taxes were catalogued in the Federal Reserve’s beige book report on regional business activity.

“Companies worried about new U.S. tariffs are pulling forward their imports to get them into the country before those take hold,” according to a post on X by Ryan Petersen, the founder and CEO of Flexport Inc., a digital freight forwarder in San Francisco. “Probably a big factor.”

He also said that threats of a Canadian rail strike and contract talks for dockworkers in the eastern and southern U.S. are worrying companies that don’t want to get caught short-handed heading in the second half of the year.

“Strike or not, shippers are nervous,” Petersen wrote last week in a separate post on X. “Companies fear they may miss Christmas if cargo doesn’t get into East Coast ports before Sept. 30.”

That’s the expiry date for a labor contract covering East and Gulf coast dockworkers.