Traders Place Bets on Rate Cut From Fed

Bond traders have a decent record when it comes to nailing the Federal Reserve’s path relative to official guidance. So while Chairman Jerome Powell says the policy rate is “in a good place,” history suggests his next move could align with what futures are showing — a rate cut.

Money-market traders have proved skeptical in recent years — and much of the time rightly so — about just how much the central bank might be able to push rates back up toward more historically normal levels. Officials on March 20 scaled back from two to zero the number of rate increases they foresee in 2019.

Futures markets, which already were leaning toward a cut this year, have pushed the probability of easing to about 50%. For next year, a cut is fully priced in. The turnaround in Fed expectations in recent months has been accompanied by a rebound in stocks, which tumbled in December amid concern about the economy and the prospect of rate hikes.

“The Fed got the signal from markets last year as they were crashing and were pretty much devouring the economy,” said Robert Tipp, chief investment strategist at PGIM Fixed Income, which oversees about $716 billion. “A cut this year is possible. This is a good environment for U.S. fixed income,” and the 10-year yield has room to fall, he said.

The central bank held the target range for the federal funds rate at 2.25% to 2.5%, while signaling no change in rates this year and one hike in 2020. Officials also decided to slow the drawdown of the central bank’s bond holdings starting in May, then end it in September.

“The data are not currently sending a signal that we need to move in one direction or another,” Powell said in response to a reporter’s query about the market pricing a cut as most likely.

“We see a favorable outlook for this year,” Powell said, with policymakers expecting growth at around 2%, unemployment under 4% and inflation close to target. “But we are also very mindful of the risks,” including slowing global growth, trade tension and Brexit, he said.

Gautam Khanna, senior portfolio manager at Insight Investment Management, aligns more with Powell and doesn’t share the bond market’s gloomy view on the economy.

The Federal Reserve left its key interest rate unchanged Wednesday and projected no rate hikes in 2019. https://t.co/pDyTmpqH59 — Chicago Sun-Times (@Suntimes) March 20, 2019

“I don’t buy into that,” he said. While he said he’s “surprised by the market reaction,” he’s also wary of taking an opposing stance at this point, and is neutral duration in portfolios.

With Treasury rates out to around five years now below the fed funds rate, the bond rally March 20 raises questions about where value is in the curve, in Khanna’s view.

The 10-year Treasury yield dipped below 2.5% March 21, its lowest since January 2018. TD Securities strategists including Michael Hanson lowered their forecasts for yields after the Fed decision, to 2.6% for the 10-year at year-end, from 2.85% previously.

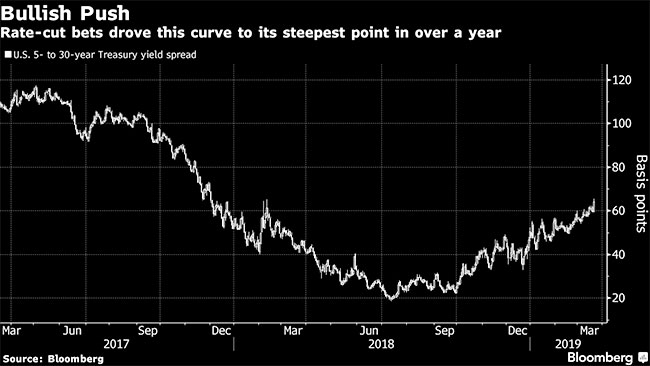

In another sign of building expectations for rate cuts, the spread between 5- and 30-year yields touched 66 basis points March 20, the widest in more than a year.

“Markets are not necessarily telling you now the Fed is flat-out wrong, but they are saying that the risks are skewed to a cut,” said Blake Gwinn, a strategist at NatWest Markets. “I don’t disagree with market pricing.”