Staff Reporter

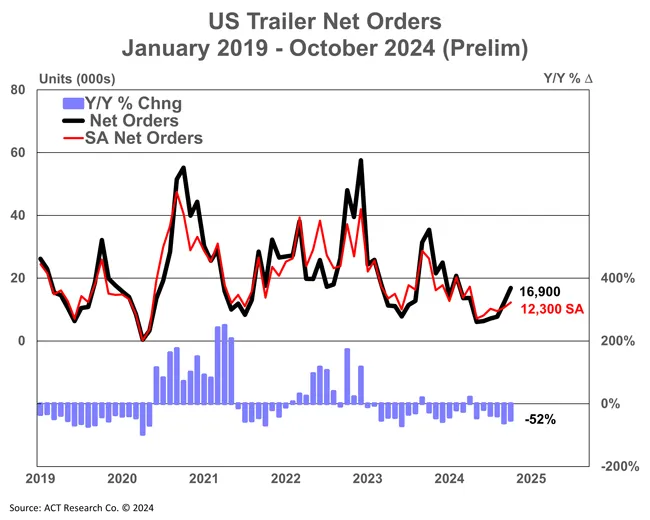

October Trailer Orders Drop 52% From Last Year

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders in October continued a trend of unfavorable year-over-year comparisons, but posted sequential growth for the month, ACT Research reported.

Preliminary net data showed orders fell 52% year over year to 16,900 units, but that total represented a 4,800-order increase over the previous month. Seasonally adjusted results lower the total for the month to 12,300 units.

The only year-over-year increase this year was a 37% rise in April, but that bright spot came after six months of unfavorable year-over-year comparisons and has now been followed by six more.

“Since we’re still in the early stages of the traditional start to the order season, this month’s [sequential] uptick was expected,” said Jennifer McNealy, director of commercial vehicle market research at ACT. “It’s also no surprise that the data is significantly below the October 2023 intake, given the soft demand recorded throughout this year.”

(ACT Research)

Year-to-date, trailer orders are down 37.5% to 118,300 units compared with year-ago levels, which McNealy attributed to weaker fundamentals across the for-hire truck market, low used equipment valuations and already-filled dealer inventories. She noted that these trends are impeding stronger activity as the industry heads into 2025.

“Despite the sequential order improvement, October data continue to bear witness to our expectations of weaker trailer demand relative to recent performance,” McNealy said. “An order uptick showcasing demand — or the lack thereof — depends not just on the first two months of the new order cycle, but at least on order volumes through January 2025.”

McNealy has heard industry anecdotes that are suggesting the lack of optimism is continuing. She noted that lingering weak carrier profitability suggests little support for trailer orders heading into next year, despite positive momentum in the economy.

“The month of October was extremely slow,” said Dan Taylor, director of sales at Western Trailers. “We heard a lot of, ‘I’m waiting to see what the election does,’ which didn’t do us a whole lot of good for orders. But one nice thing that did come after the election was over [is that] our customers, true to their word, came back around and started ordering trailers.”

Want more news? Listen to today's daily briefing above or go here for more info

Taylor is optimistic that the industry is beginning to feel better about where the business environment is headed. He also suspects that specialty equipment businesses like his might be in a good position relative to the downstream impacts of the overall freight market.

“Our general freight customers tell me they’re busy, they’re keeping all their equipment busy, they just aren’t making a whole great deal of money,” Taylor said. “Nobody is making a whole lot of money. I also wonder if some of it is a little bit of the Covid hangover, when everybody made really good money [and] everything was clipping along in the freight market.”

“October proved to be a month of anticipation as fleets indicated decision-making was moving into November,” said Chris Hammond, executive vice president of sales at Great Dane. “A lot of fleets were waiting to see what the election would bring before finalizing some plans for 2025. We still see rates and profitability as a headwind for our for-hire fleets. We are hopeful that the trucking economy begins to recover soon, allowing for fleets to update their older equipment and even add some capacity back after an extended reduction in capacity.”