Senior Reporter

Trailer Orders Top 21,000; Fleets Inquire About 2017

This story appears in the March 28 print edition of Transport Topics.

Trailer orders in February topped 21,000 as backlogs of unbuilt units remained high and some customers began to inquire about slots in 2017, analysts said.

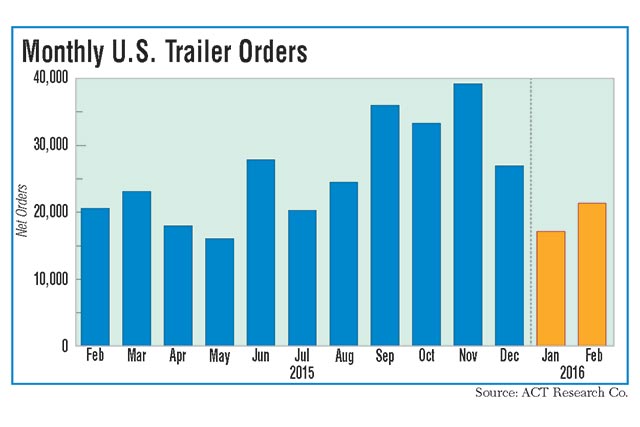

U.S. net trailer orders climbed to 21,377, up 4% year-over-year from 20,624, and 25% above a weak January total of 17,157, ACT Research Co. said.

The orders flowed in, even though the average backlog was seven months and about 8½ months for vans and refrigerated trailers, said Frank Maly, ACT’s director of commercial vehicle transportation analysis.

“It looks like it is going to be a real solid year for the industry, given the backlogs we have right now. One of the thoughts is fleets are certainly being careful about dramatically expanding their investment commitments, but they are not really backing away from what they have on the boards, either,” Maly told Transport Topics.

The research company FTR pegged orders at 21,300, up 2% year-over-year and 21% from January.

“It would appear the trailer market has stabilized for now at a high level,” Don Ake, FTR’s vice president of commercial vehicles, said in a statement.

Ake told TT that refrigerated vans are performing the best of any segment: “These OEMS are doing great.”

Ake said refrigerated fleets are accelerating some of their replacement demand, due to new food-safety and age-of-equipment regulations, and are continuing to add drop-and-hook operations. The market for refrigerated products also is widespread and increasing.

Maly agreed, saying there are “more refrigerated delivery points and more frequent deliveries.”

Utility Trailer Manufacturing Co., the market leader in sales of refrigerated vans, “enjoyed a strong February,” surpassing the month-over-month and year-over-year figures FTR reported, said Larry Roland, Utility’s director of marketing.

“We are seeing an easing in the March numbers so far, much like last year at this time, considering normal ordering cycles and the current lengthy backlogs,” Roland said.

David Giesen, vice president of sales at Stoughton Trailers, summed up the month with: “Order volume seemed pretty normal. Backlogs are still extremely healthy.

“The normal level does fluctuate by month, and January through March tends to have a wide range for normal,” Giesen said.

Glenn Harney, chief sales officer at Hyundai Translead, said orders were up about 19% from January to February.

The ongoing growth has meant Hyundai must “plan better, and lead times have stretched out on average about two weeks longer than normal,” Harney said.

Charles Willmott, chief sales officer at the Strick Group, said requests for new quotes picked up significantly in February compared with the previous two months.

“Customers are already requesting pricing for 2017 production,” he said.

Other trailer makers said their customers were inquiring more about future production slots, so far, rather than pricing.

David Gilliland, vice president of national accounts at Great Dane Trailers, said refrigerated orders continued to be strong while van orders were steady, “with most of the fleet business already in house.”

Overall, flatbed orders were in line with the industry’s order level, Gilliland noted.

“I would not be surprised for 2016 to be a kind of reset year for platform trailers,” said Alan Briley, president of Fontaine Trailer’s commercial platform business. Fontaine is a unit of Marmon Highway Technologies, a Berkshire Hathaway company.

The flatbed industry rode the back of manufacturing during the recovery from the 2008-2009 recession, he said. “There has been a lot of steel and aluminum hauled . . . a lot of metal . . . and when manufacturing goes back the other way, the way that it is right now, that gives us reason to be concerned.

The energy sector business is nonexistent, he said. “I like the cheap fuel at the pump stuff, but it sure does hit our business hard,” Briley said.

Orders were up month-over-month from a very weak January, he said, and dealers are still working through excess inventory.

Prices for used flatbeds have fallen significantly in the past six months, he said, adding that Fontaine does not typically deal in used equipment. “When used trailers are half the price, I expect that is going to eat into new trailer production for us, for the foreseeable future.”

He said flatbed production in 2016 is forecast to come in at about 22,000 units, compared with 30,000 a year earlier.

“Historically, 22,000 is a really good year for flatbeds, so you have to put it in perspective,” Briley said. “We will be fine, it just will not be like it was.”

FTR’s Ake said the flatbed segment has tracked Class 8 tractor demand most closely.