Senior Reporter

Truck Sales Plunge 31.4%

This story appears in the Feb. 27 print edition of Transport Topics.

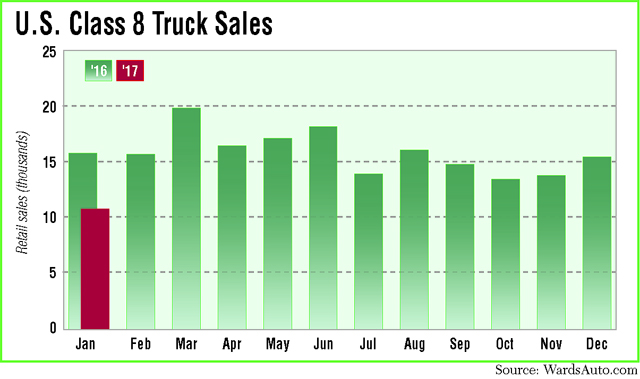

U.S. retail sales of Class 8 vehicles in January — typically a skimpy point in any year — squeaked past 10,000 units, the lowest in nearly six years, and a 31.4% fall year-over-year, WardsAuto.com reported.

Sales were 10,944, compared with 15,949 in the 2016 period, Ward’s said, as all truck makers but Volvo Trucks North America reported fewer sales. February 2011 saw sales reach 9,712 trucks.

“January was below expectations and not very good. But if I had to bet money, I would bet that’s the bottom,” of the current sales cycle, Don Ake, vice president of commercial vehicles at research firm FTR told Transport Topics. “The fact that we bottomed out is good. We were in a free fall, and certain people were panicking.”

The stage is set for a slow, moderate recovery, Ake said. FTR’s freight forecast for 2017 is for 2% growth.

Fleets typically buy most heavily in December given budget needs, discounted prices and accelerated depreciation considerations. Then the “hangover comes in January,” said Steve Tam, vice president at ACT Research Co.

“We expected to see this, and it came to fruition,” he said.

At the same time, truck makers said they anticipated that inventories finally would come into balance and replacement needs primarily would drive demand in what could still be a soft year.

Sales for VTNA — a unit of Volvo Group — increased 8.6% to 1,178 units, good for a 10.8% market share and up from a 6.8% share a year earlier.

The company remains cautious about the months ahead.

“We anticipate an overall softer Class 8 market this year compared with 2016, with replacement demand serving as the primary driver,” said Magnus Koeck, VTNA’s vice president of marketing and brand management.

Mack Trucks, also a unit of Volvo Group, posted sales of 1,070 trucks, down 9.4% from a year earlier but good for a 9.8% share.

“With manufacturing levels remaining relatively flat, there has simply continued to be less freight to move requiring fewer trucks. It does appear, however, that we have worked through most of the inventory glut affecting the overall economy in 2016, suggesting an uptick in manufacturing activity moving forward,” said John Walsh, Mack vice president of global marketing and brand management.

Freightliner — a unit of Daimler Trucks North America — was the market leader, selling 4,077 trucks, down 41% from a year earlier but earning a 37.3% share.

DTNA “is off to a solid start into this year,” said Markus Pfeifer, DTNA’s director of marketing research and planning.

“Our inventories are in good shape, and we do see some positive momentum in our current order intake across all product lines, distinctively in our vocational models, which is certainly driven by an improved business sentiment in light of expected infrastructure spending measures.”

Pfeiffer added, “Our recently launched Freightliner New Cascadia and our Western Star brand, driven by the growth of Western Star’s 4700 model in the municipal and construction applications, are expected to be driving factors for the 2017 performance.”

Western Star’s sales slumped 22.9% to 272 trucks compared with a year earlier, good for a 2.5% share.

International Trucks, a unit of Navistar Inc., also pinned its hopes to market acceptance of its new truck models.

“North American industry conditions remain tough and continue to impact our heavy-truck sales,” said Jeff Sass, Navistar’s senior vice president of sales and marketing. “While we ended January slightly higher than our plan in retail sales, we’re still not where we want to be. However, we are really excited about our LT Series, and our customers are already seeing the benefit these trucks can bring to their fleet.”

International saw sales fall 50.4% to 1,293 trucks, third-highest total of all brands in the month and an 11.8% share.

Peterbilt Motors Co. sold 1,862 trucks, down 12.3% year-over-year, and earned a 17% share, the second highest.

Kenworth Truck Co. posted a decline of 29.4% from the 2015 period on sales of 1,188 trucks for a 10.9% share.

Peterbilt and Kenworth are units of Paccar Inc. Neither truck maker responded to a request for comment.

Meanwhile, the Equipment Leasing & Finance Foundation’s February 2017 Monthly Confidence Index found 73.1% of respondents believed U.S. economic conditions will get better over the next six months, an increase from 61.3% in January. Also, 26.9% believed the economy will stay the same over the next six months, a decrease from 38.7% the previous month. None believed economic conditions will worsen.