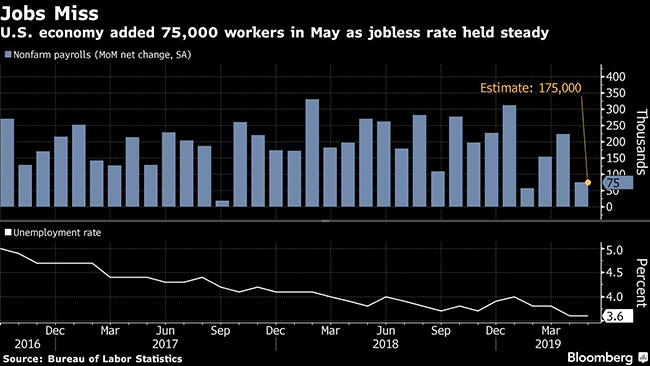

US Payrolls, Wages Cool as Trade War Weighs on Economy

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. employers added the fewest workers in three months and wage gains cooled, suggesting broader economic weakness and boosting expectations for a Federal Reserve interest-rate cut as President Donald Trump’s trade policies weigh on growth.

Nonfarm payrolls rose 75,000 in May after a downwardly revised 224,000 advance the prior month, according to a Labor Department report June 7. The increase missed all estimates in Bloomberg’s survey calling for 175,000. The jobless rate held at a 49-year low of 3.6% while average hourly earnings climbed 3.1% from a year earlier, less than projected.

The dollar and Treasury yields fell as the data signaled the labor market — a pillar of strength for an economy headed for a record expansion — was facing new pressures even before Trump threatened tariffs on Mexican goods in addition to proposed higher levies on Chinese imports. Retail sales, factory output and home purchases have shown the economy struggling this quarter after better-than-expected growth in the first three months of the year.

“It definitely looks like we’ve downshifted in the pace of job growth,” said Michael Feroli, chief U.S. economist for JPMorgan Chase & Co. “Overall it’s a disheartening report particularly since you may have some trade effects there, but a lot of the trade tensions escalated” since the reference period for the Labor Department’s surveys in the middle of the month, he said.

Stocks jumped as traders focused on the interest-rate implications of the report. Fed funds futures showed a quarter-point cut almost fully priced in for July.

Fed policy makers have described the economy as solid, though recent remarks from Chairman Jerome Powell signaled openness to lower rates if needed. St. Louis Fed President James Bullard, who votes on policy this year, this week became the first official to indicate likely support for a rate cut; others suggested they’re waiting for more data.

As the world’s largest economy nears its longest-ever expansion in July, the employment report may amplify rhetoric that Fed rate cuts are needed to support growth.

Revisions subtracted 75,000 jobs from the prior two months, bringing the three-month average to 151,000.

Payroll changes by industry showed broad weakness. Manufacturing growth slowed to 3,000 jobs, as forecast, while construction employment expanded by 4,000, down from the prior month. Professional and business services added 33,000, about half the prior month’s number.

Retail jobs fell by 7,600 for a fourth-straight drop while transportation and warehousing and nondurable goods also slipped. Government payrolls contracted by 15,000, highlighted by drops in state and local education.

Kevin Hassett, the departing chairman of Trump’s Council of Economic Advisers, said on CNBC that the report was disappointing but wage gains mean the economic outlook is still solid. Flooding in the central U.S. may have reduced the May payroll number by 40,000 jobs, Hassett said on Bloomberg Television.

The Labor Department report, which sometimes can mention special factors that affected jobs or survey responses, didn’t cite any such as weather for the latest month. The number of people not at work due to bad weather was 72,000 in May, a figure roughly in line with the same month in prior years. It tends to spike during major storms or natural disasters.

Average hourly earnings rose 0.2% from the prior month, missing estimates. That indicates the tight labor market may offer limited support for consumer spending.

The participation rate, or share of working-age people in the labor force, held at 62.8%. The average workweek for all private employees was unchanged at 34.4 hours.