Staff Reporter

July Used Class 8 Truck Sales Jump 17% From 2023

[Stay on top of transportation news: Get TTNews in your inbox.]

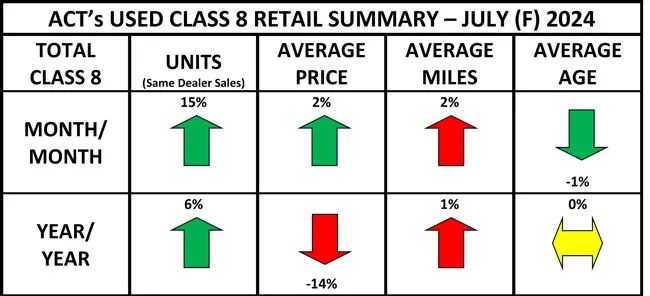

The used Class 8 truck market showed signs of life in July, with sales climbing nearly 17% compared to the same month last year, according to ACT Research.

While prices remained below last year’s levels, they ticked up slightly from June, suggesting the market may be stabilizing. ACT Vice President Steve Tam sees reason for cautious optimism.

“Prices are expected to remain stable at or around this lower level through 2024, transitioning to [year-over-year] growth in early 2025,” Tam said. “For the time being at least, retail prices seem to be appreciating for trucks 6 years old and younger. There is probably still some validity to the assumption that these units are potential substitutes for new trucks.”

Tam added that some used truck buyers may be refreshing their fleets with younger pre-owned equipment. He noted the market is seeing price declines for trucks seven years and older, possibly suggesting credit availability and costs are negatively impacting demand for older equipment.

(Act Research)

In specific numbers, used Class 8 truck sales rose 16.9% year over year to 22,800 units in July, a 10.1% increase from June’s 20,700 units.

The average retail sale price, while down 14% year over year to $55,785, showed a 2.3% uptick from June. Average mileage increased slightly, up 0.9% year over year to 429,000 miles and 1.7% from the previous month.

Smith

“July, believe it or not, was pretty good company-wise for us,” said Charles Smith, regional business development and marketing manager at Mission Financial Services. “We saw 30% growth … from last year, as well as a big increase in financing. Going into August it slowed. It was lower from July.”

Smith said the increase in business started in late June and continued for over a month. He noted business typically slows in summer, so a strong July is unusual. It usually picks up in August or September.

“Now it’s like the opposite,” Smith said. “It started pretty good, then it kind of bottomed out. Again, I don’t know if the election has anything to do with it, if people are holding onto their money, they’re not making rash decisions until they see how the economy is going to be. I’m just not certain what cards they’re playing right now.”

Transtex CEO Mathieu Boivin discusses the environmental sustainability of auxiliary power units. Tune in above or by going to RoadSigns.ttnews.com.

Smith said it’s not just a matter of affordability, since companies may be uncertain about the market’s direction, making it difficult to invest for future business. He noted much of the recent growth came from owner-operators.

Rob Slavin, senior pricing analyst at Ritchie Bros., said that Q1 and Q2 set back-to-back sales records for RBA’s transportation sector, and July’s performance — which is usually a down time — was only slightly below the pace set in the first half of the year. Overall, more than 7,600 pieces of transportation equipment were sold in July across all four of the company’s platforms.

Slavin said those sold units included 2,500 tractors, about 1,000 fewer than the average during the first six months of 2024. Freightliner was the most frequently sold manufacturer in July. Sleeper pricing ranged from stable to improving, while day cabs also saw improvements from Q2.

“This improvement in July is good news for sellers,” Slavin said. “But due to quantity of equipment in the market, I would still call this a ‘buyers market,’ a dramatic reversal from the same time in 2021-2022. While July’s pricing improvement help, there [is] still plenty of room for improvement in the transportation sector.”

Overall, more than 7,600 pieces of transportation equipment were sold in July across all the Ritchie Bros. platforms. (Ritchie Bros.)

Slavin cited spot rates and diesel pricing as areas for potential improvement. He has seen owner-operators and small to medium fleets exiting the market. He expects new truck prices to drop as dealers appear oversupplied due to canceled orders.

Want more news? Listen to today's daily briefing above or go here for more info

“It is a confluence of variables — inflation sticking around, unknown timing to interest rate reductions and freight that is still lagging,” said Paul Rosa, senior vice president of procurement and fleet planning at Penske. “Add in weak consumer confidence and the picture is unclear. These variables spinning are causing a fog, to paint a picture.”

Rosa noted there is demand and activity wants to pick up, but uncertainty remains in the market. He has seen more pre-buys as the industry prepares for upcoming nitrogen oxides emissions regulations.

Rosa explained that starting in January 2025, several states including Oregon, Washington, Massachusetts, New Jersey and New York will implement the Advanced Clean Truck rule, which California adopted in January 2024. Additionally, Oregon and Massachusetts will implement a Low NOx rule. Due to these upcoming regulations, pre-buys in these states have already begun this year.