Staff Reporter

June Used Class 8 Retail Sales Fall 3.7% Year on Year

[Stay on top of transportation news: Get TTNews in your inbox.]

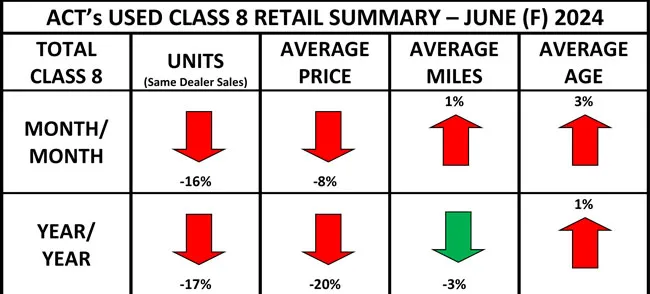

Used Class 8 truck sales totaled 20,700 in June, according to the latest ACT Research data, down 3.7% from 21,500 vehicles in the year-ago period and 9.2% lower than May’s 22,800.

“A lack of traction in freight and freight rate improvement, coupled with still-high interest rates, remain the largest hurdles to better used truck sales performance,” ACT Vice President Steve Tam said.

The average retail sales price for used Class 8 trucks in June was $54,345, down 7.6% compared with $58,815 in May and 20.5% from $68,354 in June 2023.

“We signaled the price drop last month, based on the fact that freight growth remains somewhat elusive,” said Tam. “Prices are expected to remain stable at this lower level through 2024, now transitioning to [year-over-year] growth in early 2025.”

Tam’s expectations for a year-on-year upturn slipped slightly from the end of the fourth quarter of 2024 into 2025 over the past month.

Tam

The average retail mileage for Class 8 trucks sold in June was 422,000, up 1.2% from 417,000 in May, but down 1.85% from 433,000 in the same month in 2023, ACT said.

Same-dealer Class 8 retail truck sales fell for a fourth consecutive month in June, dropping 16% in a month that typically sees a 5% increase, according to ACT.

Wholesale activity, meanwhile, increased 3.6% in June compared with May, and as is typical in the final month of a quarter, auction sales swelled 42% compared with May, said Tam.

Auction prices decreased moderately in June, Chris Visser, director of specialty vehicles at J.D. Power, said in a blog post July 18.

ACT's Used Class 8 Retail Summary

Auction prices for model year 2021 Class 8 sleepers averaged $43,669 in June, down 6.7% compared with May’s average. The month-on-month decline for model year 2020 sleepers was slightly larger at 7.7% to $37,962 and slightly smaller for model year 2019 trucks at 6.4% to $26,578.

Visser

However, the average auction price for model year 2018 sleepers slumped 42.4% compared with May to $16,755. “The unusual drop in model-year 2018 selling prices is due to a return to a more normal mix of make, model and specs after an anomalous May,” said Visser.

June prices for 4- to 6-year-old sleepers dipped 2.3% compared with May, ending a three-month run of essentially unchanged values, Visser said, which leaves values for this age group about 8% below the strong pre-pandemic period of 2018 in nominal figures, or about 24% lower if adjusted for inflation.

In the coming months, Visser expects minimal to moderate depreciation as the price stability in an oversupplied market suggests a market floor has been found.

Inventory in the used commercial vehicle market at the moment is the highest in six years, according to Commercial Truck Trader, with the number of trucks available for sale increasing 37.2% over the past 12 months.

“There are several reasons why so many medium- and heavy-duty trucks are currently listed with improved value for shoppers. Mainly, it comes down to new and private businesses expanding their fleets and trading in older models, industry downsizing, and buyer hesitancy due to the current conditions of the freight market,” CTT’s Ryan Miller wrote in a July 26 blog.

Want more news? Listen to today's daily briefing below or go here for more info: