Used-Truck Transactions Up, But Constrained by Inventory

This story appears in the March 9 print edition of Transport Topics.

Used-truck transactions rose about 4% last year, but sales volumes were constrained by the scarcity of desirable units reaching the secondary market, IHS Automotive said.

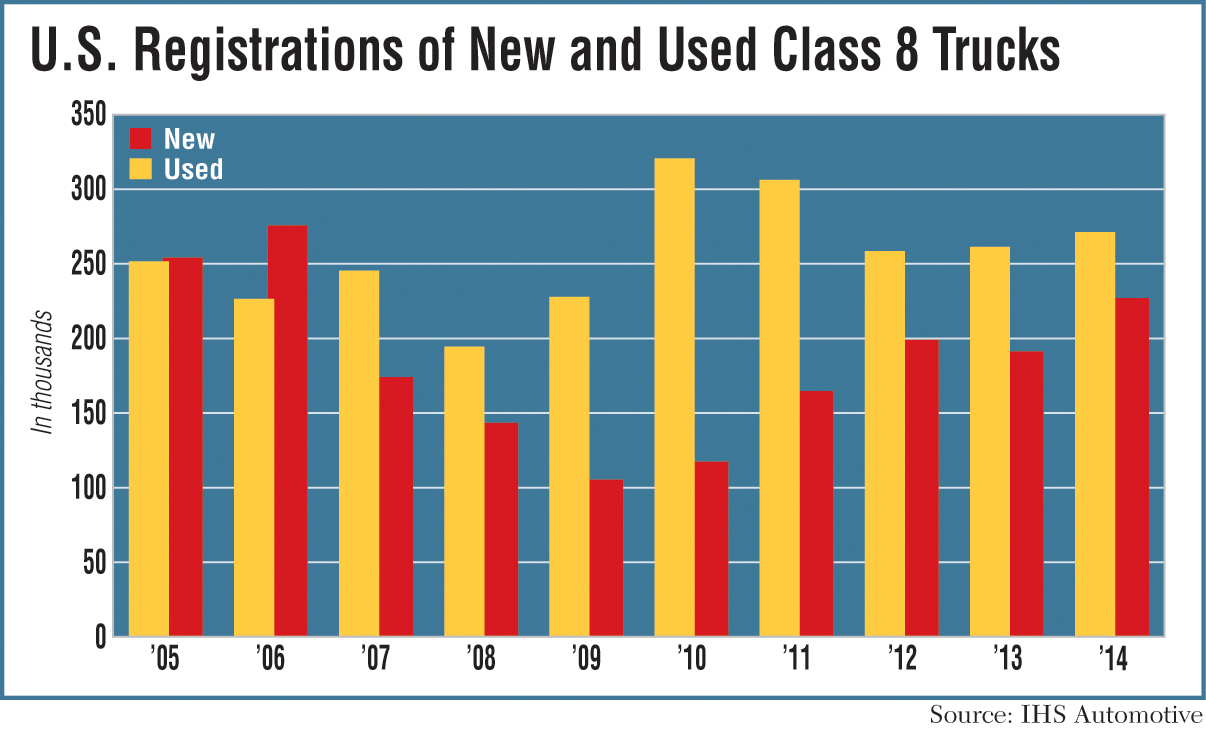

Used Class 8 registration changes in the United States increased to 270,597 in 2014 from 260,703 in the previous year, according to IHS’ latest Polk report on commercial vehicles. Meanwhile, average used-truck prices rose in January after easing late last year.

Despite growth in freight demand and the overall economy the past few years, 2014 used-truck volumes remained below the levels seen in 2010 and 2011, when used registration changes reached 319,980 and 305,516 units, respectively.

Gary Meteer Sr., director of global commercial vehicle products at IHS, said the used market is still feeling the effects of the industry’s down years for new truck sales from 2008 to 2011.

“Those are the trucks that are coming back into the marketplace now as used trucks, and there just aren’t as many of them,” he said. “You’ve got a really shallow well of trucks that are available to be traded out and come back into the used market.”

Given the scarcity of late-model, low-mileage trucks, they’ve been commanding high prices, Meteer added.

“People are asking a lot of money for them,” he said. “They’re worth a lot because there just aren’t that many.”

Meteer predicted the number of used trucks that change hands this year will be “at best, flat.”

“When you have as long a drought as we had, it takes a long time for that inventory to build back up,” he said.

IHS’ used-truck data count transactions that include both an owner’s name and address change, so as not to include vehicles that change hands as a result of the sale of a company.

Relief for the used-truck inventory shortages could arrive in the form of increased trade-ins corresponding with rising sales of new trucks. In the new-truck market, transactions surged 19% last year to 226,228 units.

However, fleet expansion could partially mitigate that benefit, said Steve Clough, president of used-truck dealer Arrow Truck Sales, which is part of the Volvo Group.

“With the new-truck order board being so big, the question really is how much the new-truck buyers are expanding their fleets versus maintaining them and trading in,” he said.

In some cases, large fleets are keeping some of their lower-mileage trucks and moving them down to shorter routes rather than replacing them.

“They aren’t trading back as many as they are buying,” Clough said.

That being said, there is bound to be some improvement in used-truck availability, given the strength of new orders, he added. It’s just a question of when and how much.

“It might take a couple more years before you see the supply really get to the place where it’s completely in balance,” Clough said.

He predicted that the market would reach equilibrium when 2014 truck models, generally built during 2013, begin to reach the used market in significant numbers. That should begin to happen when they are 3 or 4 years old.

Steve Tam, vice president at ACT Research, shared a similar timeframe.

He said the industry may see a “modicum” of inventory relief this year with increased trade-ins, but he predicted that dealers and used-truck buyers will take longer for a more meaningful increase in the supply.

“As we get into 2016 and more so in 2017, we should start to see things loosen up quite a bit,” Tam said.

Meanwhile, average sales prices for used trucks escalated in January, reversing a trend of lower prices late in 2014.

In fact, the American Truck Dealers said the average retail price for a used Class 8 sleeper tractor climbed to $62,246 in January, the highest level on record.

“That’s kind of a surprise because the market had been cooling in the fourth quarter of last year,” said ATD analyst Chris Visser.

January’s price compared with $56,866 in December and $56,391 in January 2014.

Despite the gain, Visser predicted that prices will resume a gradual decline in the months ahead, as trade-ins lead to some improvement in used-truck supplies.

ACT reported that the average price for all types of used Class 8 trucks sold via retail, wholesale and auction channels was $48,225 during January, up from $47,685 in December and $44,975 in January 2014.