Used-Truck Transactions Rise 4% in 1Q

This story appears in the June 1 print edition of Transport Topics.

Used-truck transactions grew nearly 4% in the first quarter, and average pricing has continued to escalate in recent months as newer, more valuable models have become available, according to recent industry reports.

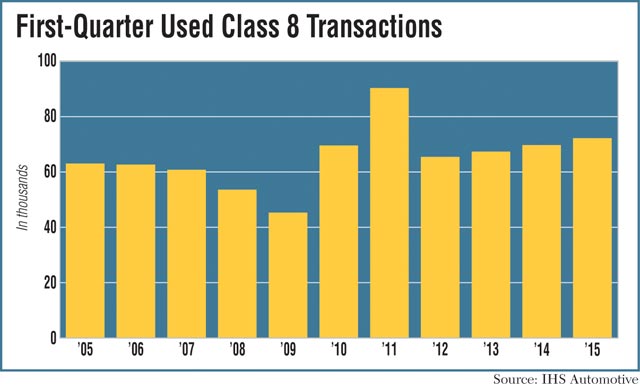

Used Class 8 registration changes in the United States increased to 72,113 in the first quarter, up from 69,619 in the same period last year, IHS Automotive said.

The period also marked the industry’s highest first-quarter volume since 2011 and the second-best in the past decade, the firm said in its latest Polk report on commercial vehicle registrations.

IHS?counts a registration change as a used-truck transaction when both the owner and address change.

“When a clean 4- or 5-year-old truck comes out, people are snapping at it,” said Gary Meteer Sr., director of global commercial vehicle products at IHS.

American Truck Dealers and ACT Research both reported record average prices for used trucks sold in April, driven by a growing number of newer, lower-mileage units reaching the secondary market.

Total used transactions for Classes 3-8 commercial trucks during the first quarter increased 8% to 189,344 units, IHS reported.

The average retail price for a used Class 8 sleeper tractor sold in April climbed to a record $63,325, up from $60,730 in March and $59,980 in April 2014, according to American Truck Dealers.

“We keep breaking the record on this universal average because there’s a continued increase in the number of late-model trucks entering the market,” ATD analyst Chris Visser said.

That growth in the supply of used trucks has been supported by more vehicle trade-ins as new-truck purchases continue to increase, he said.

Visser said 2013 models, which were generally built during 2012, are beginning to show up in greater numbers on the used market.

“Fleets have gotten back to shorter trade cycles, so there are quite a few more 3-year-old trucks,” he said.

That trend has helped to bring down average mileage, which stood at 481,164 for used-trucks sold in April, down from 484,315 in March and 506,999 in April 2014.

“Average mileage continues to fall hand-in-hand with the influx of newer trucks to the market,” Visser said.

Average age has also decreased, to 72 months in April, compared with 74 months in March and 77 months a year ago, ATD said.

ACT Research reported that average prices for all types of used Class 8 trucks — sold via retail, wholesale and auction channels — climbed to an all-time high of $49,821 in April

compared with $48,635 in March and $46,699 a year earlier.

ACT Vice President Steve Tam agreed that an increase in late-model, lower-mileage trucks on the used market has pushed average pricing higher.

“It is the composition of what’s becoming available — a little bit newer, a little bit lower miles,” he said.

ACT said average mileage stood at 516,600 in April, virtually flat from the previous month but down significantly from 542,400 in April 2014.

Even with newer trucks on the market, the balance between supply and demand hasn’t changed dramatically, Tam said.

The supply of late-model aerodynamic sleeper tractors is adequate, he added, but day cabs and vocational and specialized trucks are harder to find.